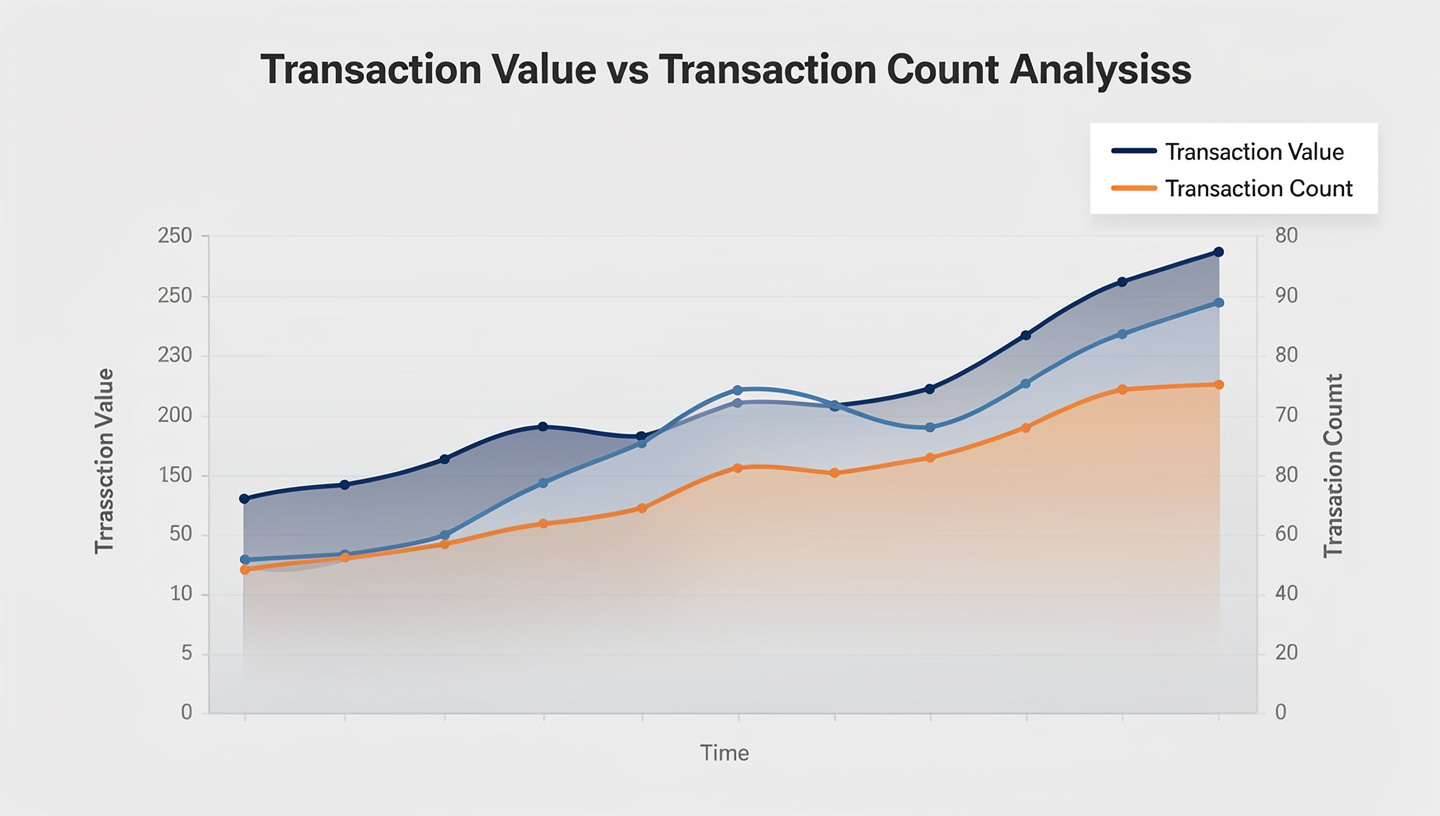

The blockchain industry is saturated with metrics, dashboards, and real-time charts that promise insight but often deliver noise. Transaction counts rise, prices fall. Transaction volumes spike, networks stagnate. Analysts point to activity metrics without understanding the economic substance embedded within them.

This confusion stems from a fundamental analytical error: treating all transactions as equal.

A blockchain is not merely a ledger of actions; it is an economic system that records the transfer of value. Some transactions represent trivial behavior—dust movements, automated arbitrage, internal contract calls. Others represent decisive capital allocation by institutions, whales, or long-term holders. To analyze blockchain networks without separating transaction count from transaction value is to confuse motion with meaning.

This article establishes a rigorous framework for understanding Transaction Value vs. Transaction Count Analysis—why the distinction matters, how to interpret divergences between them, and how this lens reveals the true economic health of blockchain networks beyond surface-level activity metrics.

Defining the Metrics: Similar Data, Fundamentally Different Signals

Transaction Count: Measuring Activity, Not Importance

Transaction count measures the number of individual transactions processed on a blockchain over a given period. It is frequently used as a proxy for “usage” or “adoption.”

However, transaction count is agnostic to economic weight. A transaction transferring $0.01 and one transferring $100 million are counted identically.

Transaction count primarily captures:

- User interaction frequency

- Automation intensity (bots, arbitrage, MEV)

- Contract-level operational activity

- Fee market congestion

It does not inherently measure economic conviction.

Transaction Value: Measuring Capital Commitment

Transaction value, typically denominated in USD or native asset terms, measures the aggregate economic value transferred across the network.

This metric captures:

- Capital movement intensity

- Institutional or whale participation

- Settlement-layer relevance

- Economic gravity of the network

Transaction value answers a more important question: How much real economic weight is being settled on this blockchain?

The Core Analytical Insight: Activity Does Not Equal Economic Significance

A high transaction count with low transaction value indicates fragmented, low-conviction activity. Conversely, high transaction value with relatively low transaction count indicates concentrated, high-conviction capital flows.

This distinction mirrors traditional finance:

- Retail payment systems process millions of low-value transactions

- Interbank settlement systems process fewer but vastly larger transfers

Both are active—but only one moves systemic capital.

Four Structural Regimes of Transaction Behavior

By analyzing transaction count and transaction value together, blockchain networks can be classified into four distinct regimes.

1. High Transaction Count, Low Transaction Value

Behavioral Signal: Retail micro-activity, gamification, or spam

Common in:

- NFT mint phases

- Airdrop farming periods

- Low-fee chains with aggressive incentive programs

Characteristics:

- Inflated “usage” metrics

- Weak fee sustainability

- Minimal long-term capital commitment

This regime often precedes metric collapse once incentives disappear.

2. High Transaction Count, High Transaction Value

Behavioral Signal: Broad adoption with real economic participation

Seen in:

- Mature DeFi ecosystems

- Stablecoin settlement hubs

- High-liquidity Layer 1s during growth cycles

Characteristics:

- Strong fee markets

- Diverse user base

- Organic demand for block space

This is the healthiest network state.

3. Low Transaction Count, High Transaction Value

Behavioral Signal: Institutional-grade settlement layer

Common in:

- Bitcoin during consolidation phases

- Ethereum during large capital rotations

- Layer 1s used for treasury movements

Characteristics:

- Capital efficiency

- High average transaction value

- Strong monetary premium

This regime indicates trust, not hype.

4. Low Transaction Count, Low Transaction Value

Behavioral Signal: Network decay or irrelevance

Characteristics:

- Declining economic activity

- Weak developer engagement

- Minimal fee generation

This regime rarely reverses without structural change.

Average Transaction Value (ATV): The Missing Metric

Most dashboards display transaction count and volume separately, but the average transaction value (ATV) provides far more insight.Average Transaction Value=Transaction CountTotal Transaction Value

ATV acts as a proxy for:

- User sophistication

- Capital concentration

- Network trust level

A rising ATV during flat or declining transaction count often signals institutional entry. A falling ATV during rising transaction count often signals retail speculation or incentive gaming.

Case Study: Why Bitcoin’s “Low Activity” Is Misunderstood

Bitcoin is frequently criticized for having lower transaction counts compared to newer chains. This critique misunderstands Bitcoin’s role.

Bitcoin is not optimized for:

- High-frequency micro-transactions

- Contract-heavy automation

It is optimized for:

- Large-value settlement

- Long-term capital preservation

- Monetary finality

Bitcoin’s consistently high average transaction value reflects economic seriousness, not stagnation. It behaves more like a global settlement network than an application platform.

Transaction count analysis alone fails to capture this distinction.

DeFi and the Illusion of Activity

In DeFi-heavy ecosystems, transaction counts are often inflated by:

- Automated market makers rebalancing

- Liquidation bots

- Arbitrage loops

- Internal contract calls

While these inflate usage metrics, they do not necessarily represent new capital entering the system. Transaction value analysis filters out this noise by highlighting net value movement, not operational churn.

A DeFi protocol with rising transaction count but stagnant transaction value is likely experiencing activity recycling, not growth.

Fee Markets: Where Transaction Value Dominates

Transaction fees are more strongly correlated with transaction value concentration than raw transaction count.

Large-value transactions are:

- Less price-sensitive to fees

- More willing to pay for security and finality

This is why high-value settlement chains can sustain fee markets even with lower throughput.

A blockchain that maximizes transaction count at the expense of transaction value often struggles to generate sustainable fee revenue once subsidies disappear.

Transaction Value as a Proxy for Trust

Capital is conservative by nature. Large value does not move without confidence in:

- Network security

- Consensus stability

- Governance predictability

When transaction value grows independently of transaction count, it signals trust accumulation. This is the same dynamic that transformed SWIFT, Fedwire, and TARGET2 into systemic infrastructure.

Blockchains aspiring to monetary relevance must prioritize value settlement, not activity theater.

Implications for Investors and Analysts

For serious on-chain analysis:

- Transaction count measures behavioral noise

- Transaction value measures economic intent

Ignoring this distinction leads to:

- Overvaluing incentive-driven ecosystems

- Undervaluing settlement-oriented networks

- Misreading adoption curves

The market repeatedly rewards chains that settle value, not those that merely process interactions.

A Forward-Looking Thesis: The Inevitable Convergence

Over time, successful blockchain networks converge toward:

- Fewer but more valuable transactions

- Higher average transaction value

- Fee markets driven by economic urgency

This is not a limitation—it is a sign of maturation.

Just as the internet evolved from page views to payments, blockchains evolve from clicks to capital.

Measure What Matters

Transaction count tells you how often a network is used.

Transaction value tells you why it is used.

One measures motion.

The other measures meaning.

In an industry obsessed with dashboards and surface-level metrics, Transaction Value vs. Transaction Count Analysis provides a structural lens grounded in economic reality. It distinguishes speculation from settlement, noise from signal, and activity from adoption.

Blockchains that endure will not be those with the most transactions—but those trusted to move the most value.

Capital, unlike narratives, does not lie.