In traditional finance, yield is a consequence of risk, time preference, or productive activity. In crypto, yield often appears out of thin air—minted, streamed, and distributed through token emissions.

That illusion has fueled multiple market cycles.

High APYs attract capital. Capital legitimizes protocols. Protocols justify higher valuations. Valuations validate the yield.

Until they don’t.

The core problem is structural: most crypto yield is not generated—it is subsidized. Tokens are printed to bootstrap liquidity, incentivize usage, and manufacture growth metrics. This is not inherently bad. It is a powerful coordination mechanism. But it carries a mathematical certainty that many participants ignore:

Emission-based yield decays over time, and eventually converges toward the organic revenue of the system—often close to zero.

This article explains why that happens, how it manifests across DeFi ecosystems, and what long-term capital allocators should internalize if they want to survive beyond the hype phase.

If you admire the disciplined capital allocation mindset of Warren Buffett, this piece is written in that spirit—applied to token economics instead of equities.

No buzzwords. No motivational fluff. Just mechanics.

1. What Token Emissions Actually Are

Token emissions are newly minted or pre-allocated tokens distributed to users, liquidity providers, validators, or developers.

They serve four main purposes:

- Bootstrap liquidity

- Incentivize early adoption

- Reward network participation

- Simulate yield before real revenue exists

From a systems perspective, emissions are marketing spend denominated in native tokens.

From a financial perspective, emissions are dilution.

Every emitted token increases circulating supply. Unless matched by proportional demand, price pressure is inevitable.

Protocols rarely frame emissions this way because “marketing spend” doesn’t sound as exciting as “300% APY.”

2. The Mathematical Certainty of Yield Decay

Let’s simplify.

Assume:

- A protocol emits $10 million worth of tokens per month.

- Total value locked (TVL) is $100 million.

That implies a nominal 120% annualized yield.

Now fast-forward six months:

- TVL grows to $400 million (attracted by the yield).

- Emissions remain $10 million per month.

Annualized yield collapses to 30%.

TVL grows again. Yield compresses again.

This is not a market anomaly. It is basic arithmetic.

Even worse, most protocols increase emissions early to accelerate growth, then reduce them later to appear “sustainable.” This front-loads rewards and back-loads dilution.

Early participants extract value. Late participants absorb depreciation.

This pattern repeats across nearly every yield-driven crypto cycle.

3. Emissions vs. Real Yield: A Critical Distinction

There are only two sources of yield:

A. Subsidized Yield (Emissions)

- Comes from token inflation

- Requires no economic activity

- Ends when emissions stop

- Transfers value from future holders to present participants

B. Organic Yield (Revenue)

- Comes from fees, spreads, or real usage

- Requires sustained demand

- Can persist indefinitely

- Scales with actual adoption

Most DeFi yield is Type A disguised as Type B.

Protocols often report “APR” without separating:

- Trading fees

- Borrowing interest

- Liquidation penalties

from - Token incentives

This obscures economic reality.

If 80% of your yield comes from emissions, you are not earning income. You are harvesting dilution.

4. Why Emissions Are Necessary (But Dangerous)

Without emissions, most protocols would never reach critical mass.

Liquidity attracts traders. Traders generate fees. Fees justify liquidity.

This chicken-and-egg problem requires an external subsidy.

Token emissions solve it elegantly.

But they also create three systemic pathologies:

1. Mercenary Capital

Liquidity arrives for yield, not belief. When incentives drop, capital leaves.

2. Reflexive Overvaluation

High APYs inflate TVL, which inflates perceived protocol success, which inflates token price.

3. Delayed Price Discovery

Emission rewards mask underlying weakness until incentives taper.

By the time organic revenue is tested, speculative participants are already gone.

5. Historical Pattern: Every Cycle Rhymes

From early Bitcoin mining rewards on Bitcoin, to DeFi liquidity mining on Ethereum, the arc is consistent:

- High emissions attract capital

- Capital inflates metrics

- Metrics justify valuation

- Emissions taper

- Yield collapses

- Price follows

Later iterations merely disguise this better.

“Vote-locked tokens.”

“Gauge wars.”

“Real yield narratives.”

Same structure. New vocabulary.

6. The Illusion of Sustainable APY

Protocols often advertise:

- “Protocol-owned liquidity”

- “Fee-sharing”

- “Real yield”

These mechanisms help—but they rarely offset emission decay at scale.

Why?

Because fee generation in crypto is extremely competitive.

Unless a protocol has:

- Durable network effects

- Structural monopolies

- Regulatory moats

its margins compress over time.

Decentralized exchanges compete on fees. Lending markets compete on rates. Bridges compete on speed.

This race to zero mirrors traditional markets—but without mature demand curves.

7. Emission Schedules: The Hidden Risk Curve

Every serious protocol has an emission schedule.

Most users never read it.

They should.

Key variables:

- Initial inflation rate

- Halving or taper structure

- Team and investor unlocks

- Vesting cliffs

These define future supply shocks.

Yield today is paid by supply tomorrow.

If you don’t model that, you are trading blind.

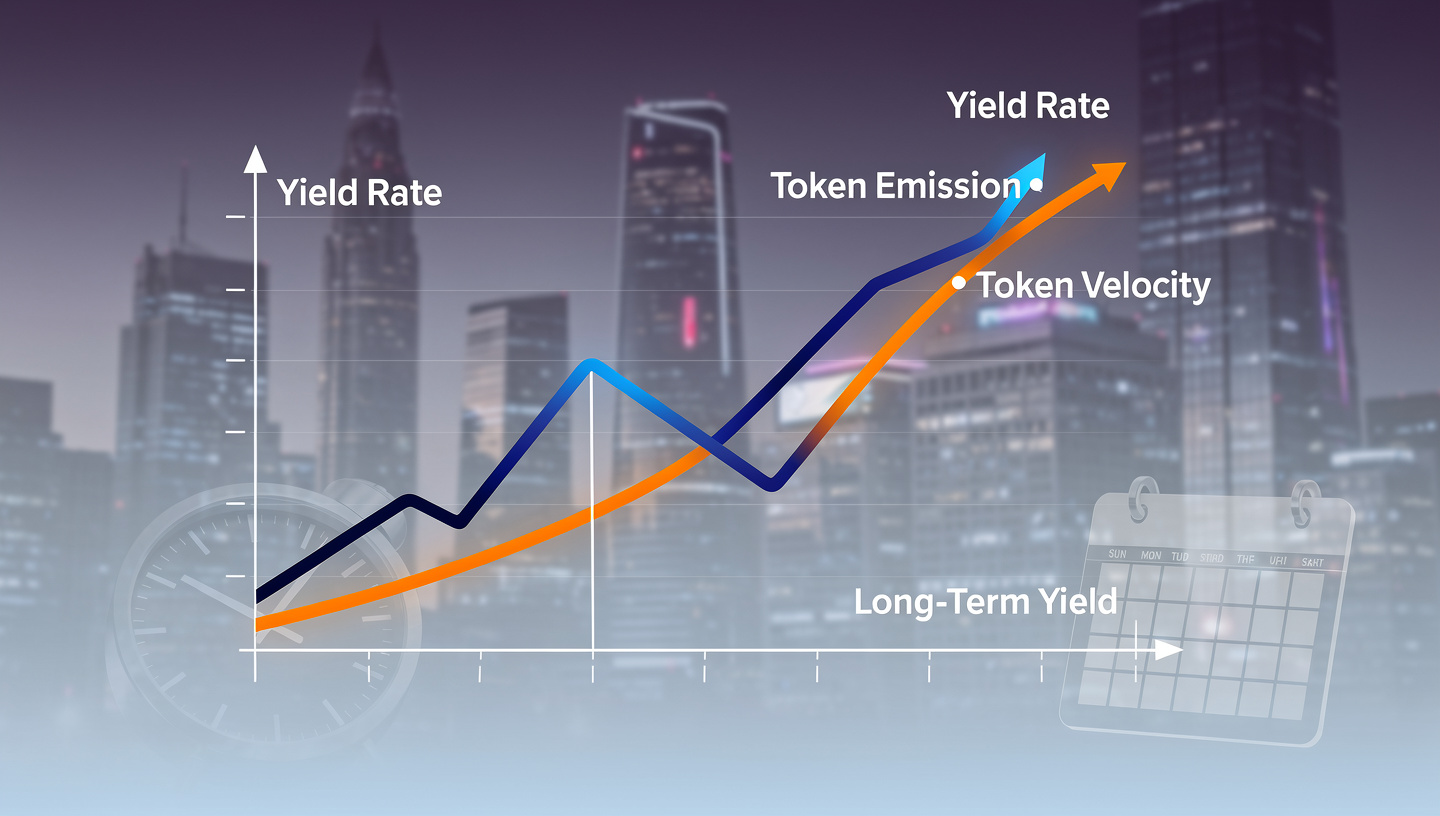

8. Long-Term Yield Always Converges to Economic Surplus

In classical economics, returns trend toward equilibrium.

Crypto does not escape this.

Long-term yield converges to:

Protocol revenue minus operational costs, divided by capital deployed.

Everything else is temporary distortion.

If a protocol produces $5 million per year in fees and supports $500 million in TVL, baseline yield is 1%.

No emission mechanism changes that.

It only redistributes timing.

9. Why Retail Keeps Falling for It

Three reasons:

1. Annualized Framing

“300% APY” sounds enormous even if it lasts two weeks.

2. Token Denomination

Rewards paid in volatile tokens obscure real returns.

3. Recency Bias

Recent gains override structural analysis.

This is not stupidity. It is human psychology interacting with reflexive markets.

10. The Institutional Perspective

Professional allocators treat emission yield as:

- Customer acquisition cost

- Liquidity bootstrapping expense

- Short-term incentive

Not income.

They underwrite protocols based on:

- Fee durability

- Competitive positioning

- Developer velocity

- Regulatory exposure

Yield is secondary.

This is why sophisticated capital rotates early and exits quietly.

11. Case Archetypes (Without Naming Names)

You’ve seen this movie:

Phase 1: Launch

- Triple-digit APYs

- Rapid TVL growth

- Social media excitement

Phase 2: Plateau

- Emissions taper

- Yields compress

- Price stagnates

Phase 3: Reality

- Liquidity leaves

- Token unlocks hit

- Narrative collapses

The chart always looks different.

The structure never does.

12. Token Emissions Are Not Evil

They are tools.

Used correctly, they:

- Accelerate network effects

- Reward early risk-takers

- Enable experimentation

Used poorly, they:

- Mask unsustainable economics

- Attract extractive capital

- Destroy long-term trust

The difference lies in governance discipline and revenue trajectory.

13. A Practical Framework for Evaluating Yield

Before allocating capital, answer these questions:

1. What percentage of yield comes from emissions?

If over 50%, assume decay.

2. What is the emission runway?

Months, not years, matter.

3. Is protocol revenue growing faster than supply?

If not, dilution dominates.

4. Who controls emissions?

Autonomous contracts or discretionary governance?

5. What happens when incentives drop?

If TVL collapses, you have your answer.

14. Thinking Like an Owner, Not a Farmer

Yield farming encourages transactional behavior.

Long-term success requires ownership thinking.

Owners ask:

- Does this protocol produce cash flow?

- Is demand structural or speculative?

- Can competitors replicate this easily?

- Who absorbs dilution?

Farmers ask:

- What’s the APY?

Only one of these mindsets compounds.

15. The Endgame: Low Yields, High Survivorship

As crypto matures, emission-driven growth will fade.

Survivors will resemble traditional financial infrastructure:

- Low yields

- High volume

- Thin margins

- Strong moats

Speculation will move elsewhere.

Capital will consolidate.

This is not pessimism. It is normalization.

Closing: The Discipline of Waiting

Token emissions compress time.

They pull future value into the present.

They create the sensation of abundance.

But markets eventually reconcile.

If you want longevity in crypto, treat emission yield as temporary noise layered on top of economic signal.

Strip it away.

Analyze what remains.

That residue—actual revenue, actual users, actual differentiation—is the only yield that matters over decades.

Everything else is just printed persuasion.