At some point, someone decided that opacity was the root of civilization’s failures.

Corruption hid in shadows. Inequality thrived in private ledgers. Power consolidated behind closed doors. The diagnosis seemed obvious, almost elegant: expose everything. Replace trust with math. Replace institutions with code. Record every transaction, every contract, every economic interaction on an immutable public substrate.

Transparency would fix it.

That assumption—quietly embedded into the architecture of blockchains—has become one of the most consequential design choices of the 21st century. And it may also be its most dangerous.

This article is not about price cycles, memecoins, or market narratives. It is about a deeper trajectory: what happens when a civilization builds itself atop systems where everything is visible, forever—and what kind of society emerges when privacy becomes an anomaly rather than a default.

This is science fiction in the strict sense: extrapolation from existing technical reality.

And the reality is already here.

1. Transparency Was Supposed to Be a Feature

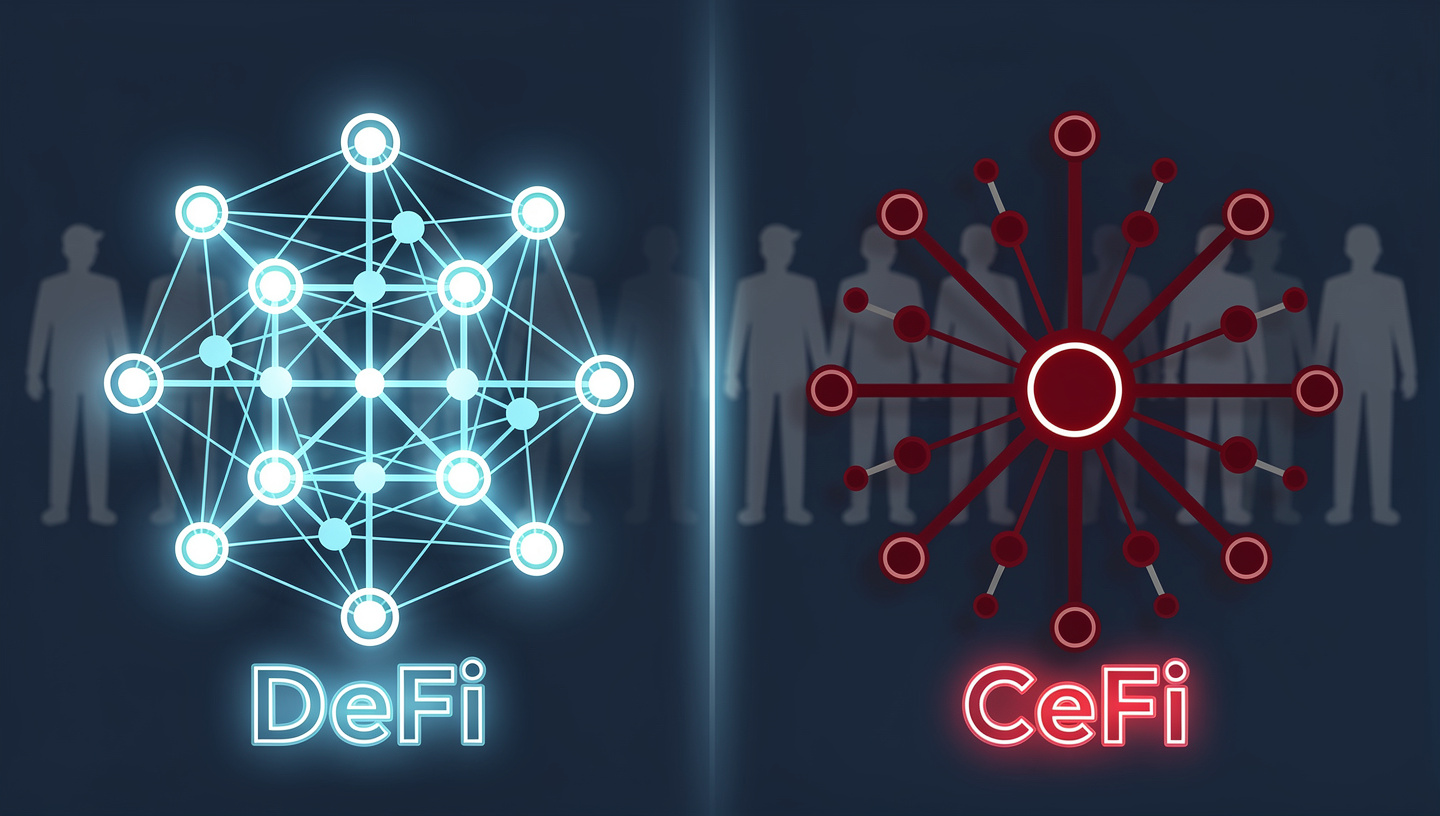

Public blockchains were engineered around radical openness. Anyone can inspect balances. Anyone can trace transactions. Anyone can verify the rules.

This architecture solved a real problem: how to coordinate value exchange among strangers without centralized intermediaries.

It worked.

But embedded in that success is a philosophical gamble: that maximal transparency produces maximal fairness.

The crypto movement inherited this idea from two sources:

- Cryptographic engineering culture, which values verifiability over discretion.

- A reactionary stance against traditional finance, whose opacity enabled systemic abuse.

The logic chain looked clean:

- Hidden systems enable corruption.

- Transparent systems expose wrongdoing.

- Therefore, transparent systems produce better societies.

What was missed is that transparency is not neutral. It changes behavior. It reshapes incentives. It alters power gradients.

And when transparency becomes total, it stops being a safeguard and starts becoming infrastructure for control.

2. The Ledger That Never Forgets

Blockchains do not forget.

Every transaction is permanent. Every wallet interaction becomes part of a public archaeological record. Even when addresses are pseudonymous, linkage analysis steadily collapses anonymity over time.

Once a wallet is associated with a real identity—through an exchange KYC process, an NFT purchase, a DAO vote, or a leaked dataset—its entire historical footprint becomes attributable.

There is no statute of limitations.

A payment made years ago.

A political donation.

An experimental DeFi interaction.

An embarrassing NFT.

All persist indefinitely.

In traditional systems, memory decays. Banks close accounts. Records are purged. Data fragments. Human institutions forget.

Blockchains remember perfectly.

This creates a new condition: economic permanence.

In such a world, reputation becomes algorithmic. Past behavior becomes permanently queryable. Financial history becomes identity.

This is not a marginal change. It is a structural transformation of how trust is computed.

3. Surveillance Capitalism, On-Chain Edition

The transparent ledger did not remain a neutral public utility for long.

Entire industries formed around blockchain analytics.

Companies like Chainalysis built sophisticated tooling to map wallets, cluster entities, infer relationships, and predict behavior. Governments adopted these platforms. Corporations integrated them. Venture capital funded their expansion.

What began as open verification quietly evolved into continuous financial surveillance.

This is not speculative. It is operational.

Every on-chain action becomes a data point. Every smart contract interaction feeds models. Every wallet movement trains classifiers.

The result is a new form of surveillance capitalism—except this time, the raw material is not social media activity or browsing behavior.

It is money itself.

And unlike Web2 data, blockchain data is:

- Global

- Immutable

- Permissionless

- Correlatable across platforms

Once harvested, it cannot be revoked.

4. When Code Becomes Law, and Law Becomes Code

Smart contracts formalize rules as executable logic.

That alone is transformative.

But the deeper shift lies in how governance migrates from institutions to protocols.

In traditional systems, law is interpretive. Judges weigh context. Regulators exercise discretion. Exceptions exist.

In smart contract systems, execution is automatic.

If conditions are met, outcomes occur.

No appeals.

No nuance.

No mercy.

This rigidity is celebrated as “trustlessness.” Yet what it really produces is procedural absolutism.

As these systems scale, they begin to resemble automated legal frameworks—except without human oversight.

Now imagine combining this with perfect transparency.

Every rule is visible.

Every violation is detectable.

Every actor is traceable.

You no longer need police in the conventional sense.

You need monitoring software.

5. The Soft Emergence of Algorithmic Social Credit

No central authority announced a blockchain-based social credit system.

It emerged organically.

Lenders began scoring wallets. DAOs filtered contributors based on transaction history. Protocols adjusted rates based on on-chain reputation. Airdrops excluded addresses deemed “unproductive.” Employers quietly reviewed wallet activity.

None of this required coordination.

It arose naturally from incentives.

If financial history is public, it becomes useful.

If it becomes useful, it becomes decisive.

Over time, your wallet stops being merely a financial tool. It becomes a behavioral profile.

Did you participate in risky protocols?

Did you flip NFTs too aggressively?

Did you interact with sanctioned addresses?

Did you vote the “wrong” way in governance?

These signals accumulate.

Access to opportunity becomes conditional.

This is not speculative futurism. It is already happening in fragments across DeFi, DAO tooling, and compliance infrastructure.

The only missing piece is scale.

6. Privacy Coins Were a Warning, Not a Solution

Privacy-preserving cryptocurrencies attempted to counter this trajectory by obfuscating transaction details.

They were marginalized.

Exchanges delisted them. Regulators scrutinized them. Institutional capital avoided them.

The market delivered a verdict: radical privacy is incompatible with compliance.

But the deeper issue is philosophical. You cannot bolt privacy onto a system designed for transparency. You must architect for it from first principles.

Most blockchains did not.

They optimized for auditability, not human dignity.

7. Identity Collapse: When Wallets Become Selves

In early crypto culture, wallets were tools.

Over time, they became identities.

ENS domains, NFT avatars, DAO memberships, on-chain credentials—these layered social meaning atop addresses.

Eventually, the abstraction collapses.

Your wallet becomes you.

This has profound implications:

- Financial mistakes become permanent character traits.

- Early experimentation becomes lifelong baggage.

- Economic behavior becomes moralized.

A teenager’s speculative trade can shadow them decades later. A politically sensitive donation can resurface in future negotiations. A failed startup attempt becomes part of an immutable personal record.

Human development assumes the ability to outgrow past selves.

Perfect ledgers deny that possibility.

8. Even the Architects Are Uneasy

Some of crypto’s most influential figures have publicly wrestled with these implications.

Vitalik Buterin has repeatedly emphasized the need for privacy-preserving primitives, warning that fully transparent systems risk enabling authoritarian dynamics. Under the umbrella of the Ethereum Foundation, research into zero-knowledge proofs and selective disclosure continues—but these remain complex, under-adopted, and often peripheral to mainstream usage.

The core infrastructure is already deployed.

Retrofitting privacy is far harder than designing for it from inception.

9. Transparency Favors the Powerful

A critical asymmetry defines the transparent future:

Individuals are exposed. Institutions are abstracted.

A single person’s wallet history is legible. A multinational organization operates through layered entities, custodians, shell structures, and legal jurisdictions.

Transparency flows downward.

This mirrors existing power structures—but with cryptographic reinforcement.

The wealthy diversify addresses. They employ professional opsec. They use intermediaries. They access private liquidity venues.

Everyone else operates in the open.

Perfect transparency does not equalize power.

It sharpens it.

10. The Behavioral Compression of Society

When actions are permanently recorded and continuously evaluated, people adapt.

They become conservative.

They avoid experimentation.

They minimize deviation.

They optimize for reputational safety.

Innovation slows.

Dissent softens.

Risk-taking declines.

This is not speculative psychology. It is observed behavior in monitored environments.

A society under constant visibility converges toward norm compliance.

Crypto promised permissionless creativity.

Perfect transparency produces behavioral compression.

11. Programmable Money Enables Programmable Morality

Once money becomes programmable, so does access.

Smart contracts already enforce geographic restrictions, blacklist addresses, and gate participation based on arbitrary criteria.

Extend this logic:

- Carbon-heavy purchases incur penalties.

- Unapproved speech triggers financial friction.

- Noncompliant wallets face higher transaction fees.

- Certain assets become inaccessible based on social metrics.

No central tyrant is required.

Just code.

And once such mechanisms exist, they will be used—because they are efficient.

12. This Is Not Dystopia. This Is Optimization.

The most unsettling aspect of this trajectory is that it does not require malice.

Every step is rational.

- Transparency reduces fraud.

- Analytics improve risk management.

- Reputation systems increase trust.

- Automation lowers costs.

Each layer improves efficiency.

Together, they produce something else entirely: a society where economic participation is continuously evaluated, algorithmically mediated, and permanently recorded.

Not oppression.

Optimization.

That is what makes it dangerous.

13. The Missing Primitive: Selective Forgetting

Human systems rely on forgetting.

Statutes expire. Records are sealed. People reinvent themselves.

Blockchains do not forget.

If crypto is to mature into civilizational infrastructure, it must develop primitives for:

- Selective disclosure

- Temporal data expiry

- Contextual identity

- Revocable history

Without these, it will encode a world where every action is forever.

And forever is not humane.

14. A Future Still Being Compiled

Crypto is still young.

Its social consequences are only beginning to surface.

What started as a rebellion against opaque institutions is quietly assembling the most transparent economic substrate in history. Whether that substrate becomes a foundation for empowerment or an architecture of soft control depends on choices being made right now—mostly by engineers, protocol designers, and governance frameworks few people ever see.

Perfect transparency sounds virtuous.

In practice, it is coercive.

The tyranny is not loud. It does not arrive with armies or decrees.

It emerges from dashboards, compliance APIs, and reputation scores.

It compiles itself into existence.

Final Thought

Civilizations are shaped less by ideology than by infrastructure.

Blockchains are infrastructure.

And infrastructure, once deployed at scale, becomes destiny.

Crypto still has time to decide whether it is building tools for free individuals—or designing the operating system of a permanently audited society.

The ledger is already running.

The question is what kind of humanity it will remember.