Power failed long before legitimacy did.

Modern governance collapsed not because armies marched or currencies hyperinflated, but because decision systems could no longer scale with complexity. Democracies optimized for participation. Corporations optimized for profit. Bureaucracies optimized for procedure. None optimized for truth under load.

By the late 21st century, every institution suffered from the same structural defect: humans were still selecting humans to rule systems too large for human cognition.

That was the real crisis.

Crypto did not emerge to fix money. It emerged to fix coordination.

And from that quiet objective came the most radical experiment in political history: leadership selected not by voters, not by shareholders, not by inheritance—but by algorithms operating on transparent, verifiable state.

This article examines that future: a cryptographic civilization where authority is computed, not campaigned for. Where legitimacy is derived from provable contribution. Where governance is executed by smart contracts. And where the concept of “leader” becomes a dynamic role assigned by code.

This is not a story. It is a technical extrapolation.

The Hidden Flaw in Human Governance

Every governance system built by humans inherits three fatal constraints:

- Information asymmetry – leaders never see the full system state.

- Incentive distortion – power attracts those most willing to abuse it.

- Temporal mismatch – election cycles and quarterly reports conflict with long-term stability.

Traditional democracy attempts to solve this with representation. Corporations solve it with hierarchy. Authoritarian regimes solve it with force.

None solve it at scale.

As global systems became more interconnected—finance, climate, logistics, energy—decision-making bottlenecked around biological cognition. A single regulatory change could ripple through millions of contracts. A single policy error could destabilize continents.

Leadership stopped being about vision.

It became about throughput.

Crypto Was Never About Money

Public blockchains first reached mainstream awareness through Bitcoin, attributed to the pseudonymous Satoshi Nakamoto. Most observers framed it as a financial rebellion.

They misunderstood.

Bitcoin proved something far more important than peer-to-peer value transfer:

It demonstrated that large populations could reach consensus without centralized authority.

That discovery triggered a cascade.

Smart contract platforms—most notably Ethereum, architected by Vitalik Buterin—expanded this primitive into programmable governance. Suddenly, rules themselves could live on-chain. Organizations could exist as code. Capital could be autonomous.

Crypto became an operating system for collective action.

Once that clicked, leadership was the obvious next abstraction.

From Elections to Execution

The core innovation was simple:

Replace subjective selection with objective computation.

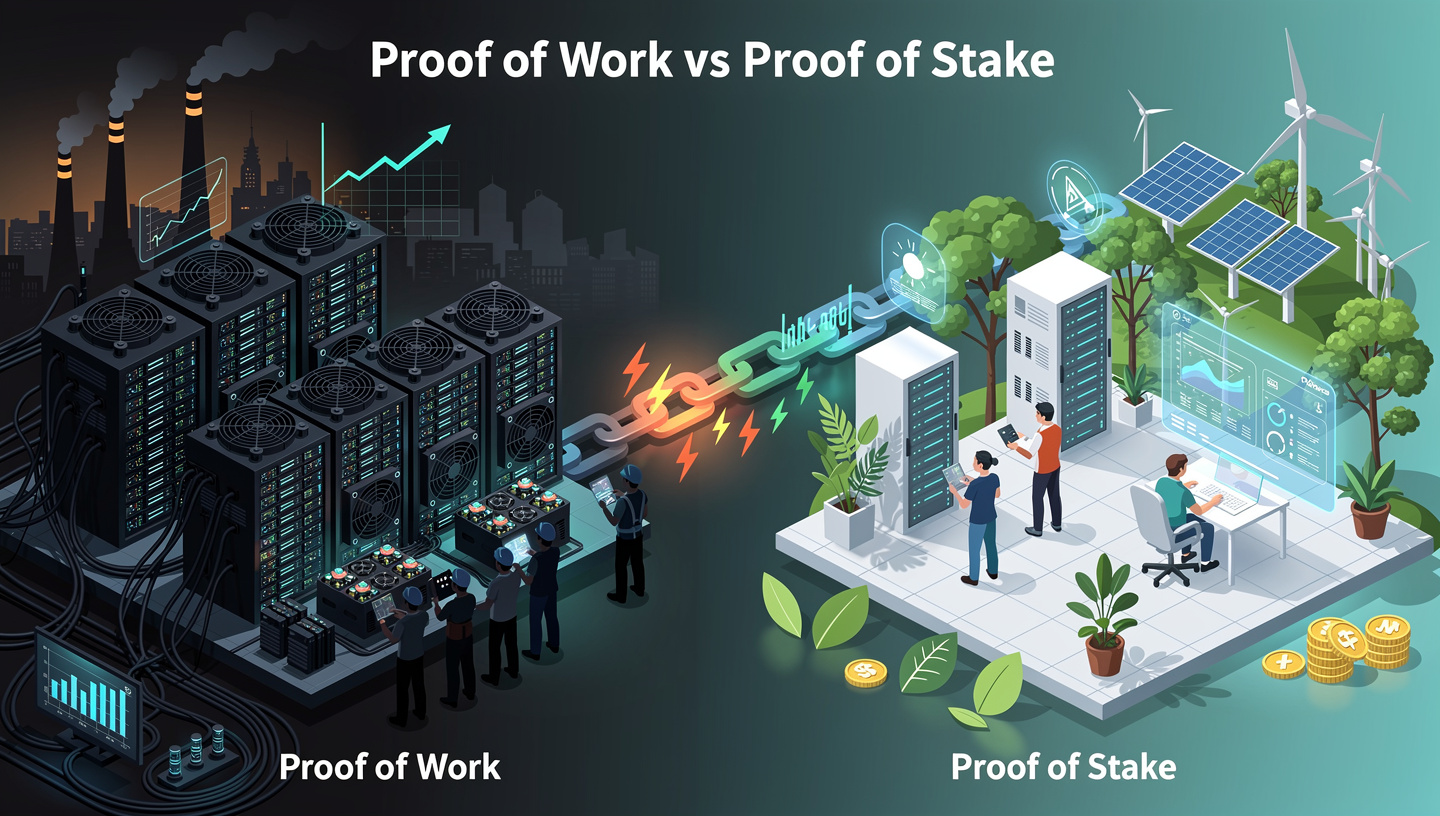

Instead of voting for leaders, systems began assigning leadership functions algorithmically based on real-time performance metrics encoded on-chain.

This did not mean machines ruling humans.

It meant removing discretion from roles that required mechanical consistency.

Treasury management. Infrastructure maintenance. Dispute arbitration. Resource allocation. Policy execution.

Each became a smart contract module governed by measurable inputs:

- Contribution history

- Reputation scores

- Stake-weighted responsibility

- Predictive reliability models

- Cryptographic identity proofs

Authority became granular. Temporary. Revocable.

There was no president.

There were executors.

Proof-of-Competence: The End of Charisma

Charisma was an evolutionary hack. It allowed small tribes to rally behind confident voices.

It is catastrophically inefficient in planetary systems.

Algorithmic governance replaced charisma with Proof-of-Competence (PoC)—a composite signal derived from:

- Historical accuracy of decisions

- Economic alignment (skin in the game)

- Peer-validated expertise

- Outcome-based reputation decay

Every action left a cryptographic trace.

Every mistake reduced future authority weight.

Every successful intervention increased it.

Leadership became a floating property of the network.

Not a title.

The Rise of Dynamic Authority Graphs

Rather than hierarchical pyramids, societies adopted authority graphs—living maps of responsibility flowing across nodes.

At any moment:

- You might be a healthcare coordinator.

- Three hours later, a logistics validator.

- Tomorrow, nothing.

Roles were ephemeral.

The graph recalculated continuously, redistributing control based on current system needs and individual performance.

No campaigns. No lobbying.

Just math.

DAOs Were Only the Prototype

Early Decentralized Autonomous Organizations (DAOs) were clumsy. Governance tokens were hoarded. Voting participation was low. Whales dominated outcomes.

But they introduced two irreversible concepts:

- Transparent treasuries

- Executable governance

Over time, DAO frameworks evolved into multi-layer governance stacks:

- Local micro-DAOs for neighborhoods

- Sector DAOs for energy, transport, education

- Meta-DAOs coordinating planetary-scale policy

Each layer interfaced through cryptographic APIs.

Policy became composable.

Leadership became modular.

Identity Without Nations

Passports failed when borders lost relevance.

Crypto-native identity replaced nationality with verifiable credentials bound to wallets:

- Education proofs

- Skill attestations

- Medical clearances

- Employment history

Your “citizenship” was your cryptographic footprint.

Participation in governance depended on demonstrated contribution, not birthplace.

Statelessness became normal.

Competence became portable.

The Algorithmic Social Contract

Classic social contracts are implicit.

This one was explicit, executable, and auditable.

Every participant agreed to:

- Transparent rules

- Deterministic enforcement

- Cryptographic accountability

In return, the system guaranteed:

- Property rights enforced by code

- Access to shared infrastructure

- Dispute resolution through algorithmic courts

- Universal participation based on merit

There was no supreme authority.

Only protocols.

Conflict Resolution Without Judges

Human courts failed because outcomes depended on interpretation.

Smart contract arbitration replaced them with multi-stage resolution pipelines:

- Automated evidence ingestion

- Precedent matching via machine reasoning

- Stake-weighted jury selection

- Slashing for malicious voting

Justice became probabilistic but incorruptible.

Appeals existed—but every layer required increased stake and reputation risk.

Frivolous litigation vanished.

Truth gained economic gravity.

Economic Policy as Live Code

Monetary policy used to be debated in rooms behind closed doors.

In algorithmic societies, it was open-source.

Interest rates, issuance schedules, fiscal stimulus—everything executed through contracts reacting to real-time economic telemetry:

- Velocity of money

- Employment signals

- Supply chain stress

- Energy availability

There were no emergency meetings.

There were parameter updates.

The Psychological Cost

Humans struggled with this transition.

Not because it was unfair—but because it was impersonal.

There was no one to blame.

No leader to idolize.

Failure became collective.

Success became anonymous.

Ego had no API.

The new generation adapted quickly. They grew up inside systems where authority flowed like bandwidth. Where leadership was something you earned for minutes or hours, not decades.

Power stopped being an identity.

It became a task.

The Collapse of Political Theater

Without elections, politics lost its performative core.

No speeches.

No debates.

No manufactured outrage cycles.

Media pivoted from personalities to protocol changes. Citizens followed governance updates like software releases.

Drama gave way to dashboards.

What Emerged Was Not Utopia

Inequality persisted—expressed now in reputation gradients rather than wealth alone.

Black markets formed around identity leasing.

Some attempted to game reputation systems.

Every governance model has attack vectors.

But the system corrected itself faster than any human institution ever had.

Bugs were patched.

Exploits were slashed.

Forks occurred.

Civilizations became upgradable.

Why This Was Inevitable

Once coordination costs dropped below a threshold, centralized leadership became economically irrational.

Algorithms do not tire.

They do not seek legacy.

They do not form dynasties.

They simply execute.

Crypto provided the substrate.

Smart contracts provided the logic.

Reputation systems provided the signal.

The rest followed mechanically.

Leadership After Leaders

The algorithm did not replace humanity.

It removed the illusion that humanity was ever good at managing complexity through hierarchy.

In this future, leadership is not a throne.

It is a transient state granted by provable alignment with system objectives.

You do not become a leader.

You are selected—continuously—by transparent computation.

And when your performance decays, authority evaporates.

Silently.

Instantly.

Final Observation

The most radical consequence of crypto was not financial sovereignty.

It was the end of permanent power.

When governance becomes software, authority becomes fluid.

And when authority becomes fluid, civilization stops orbiting individuals.

It begins orbiting outcomes.

That is the algorithm that chose leaders.

Not once.

But every second thereafter.