For centuries, economic exchange has been structured around discrete transactions. Salaries are paid biweekly or monthly. Subscriptions renew on fixed billing dates. Loans amortize according to rigid schedules. Invoices are settled in lump sums. The temporal granularity of money has been coarse because the infrastructure supporting it has been coarse.

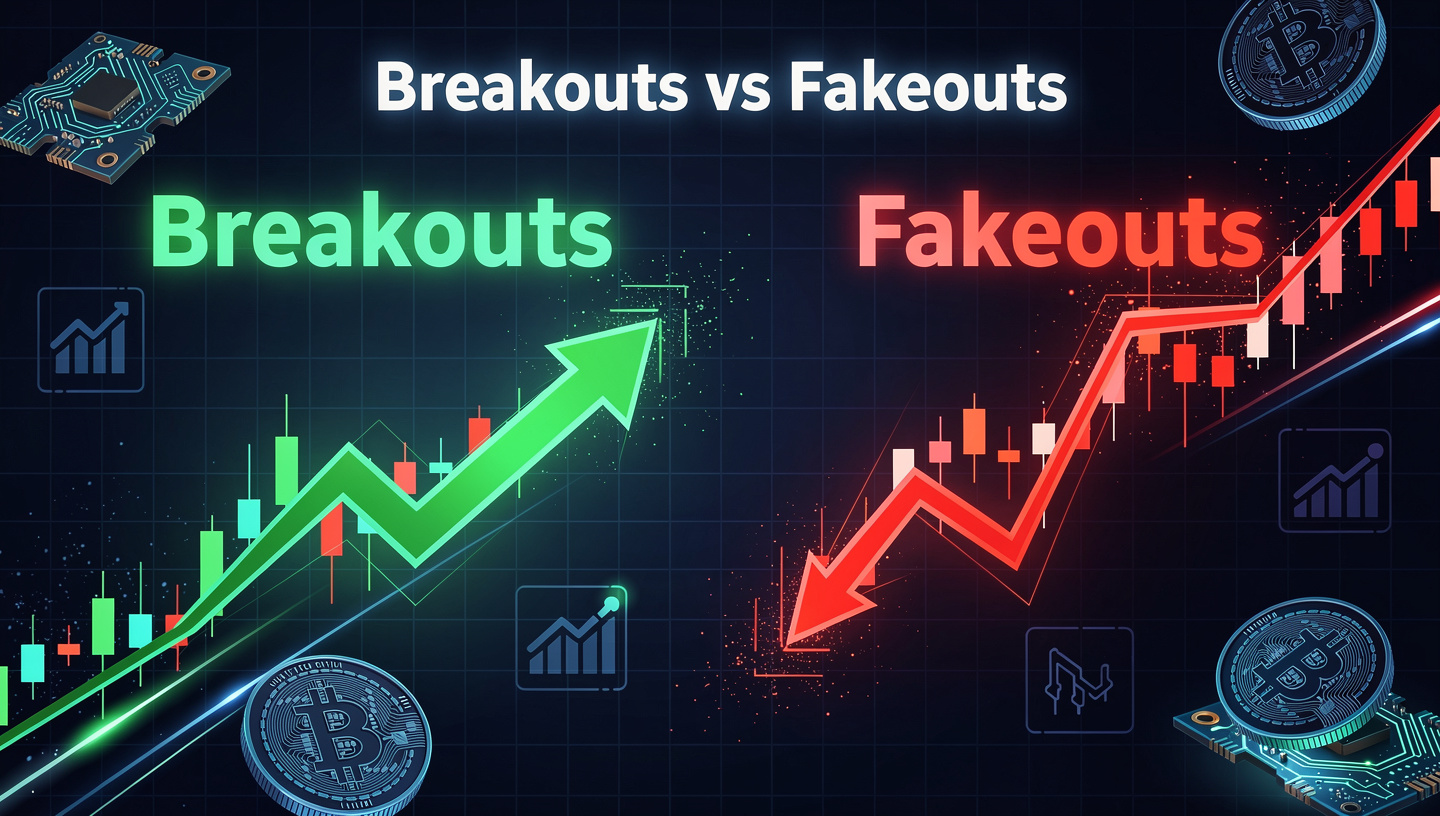

Blockchain-based systems introduce a fundamental shift: the ability to transfer value continuously, programmatically, and with deterministic settlement. Instead of batching economic activity into periodic events, digital assets enable value to flow as a function of time. This model—commonly referred to as streaming money—reconceptualizes payments as real-time processes rather than episodic transfers.

Streaming money is not merely a novel payment mechanism. It is an architectural shift in financial design. It redefines compensation, capital allocation, subscription economics, treasury management, and decentralized governance. This article examines streaming money as a default payment model: its technical foundations, economic implications, implementation patterns, security considerations, and long-term systemic impact.

Defining Streaming Money

Streaming money refers to the continuous transfer of digital assets over time, typically implemented via smart contracts on programmable blockchains. Instead of sending a fixed amount in a single transaction, the sender authorizes a stream that releases value incrementally—per second, per block, or according to any definable time unit.

In practical terms:

- A salary can accrue every second.

- A subscription fee can flow continuously rather than renew monthly.

- A grant can vest and distribute linearly over time.

- A loan repayment can amortize in real time.

This model is enabled primarily by smart contract platforms such as Ethereum and layer-2 scaling networks. Protocols like Superfluid and Sablier pioneered generalized streaming primitives.

The core conceptual shift is this: money becomes a function of time rather than a static asset held in discrete balances.

Technical Architecture of Streaming Payments

1. Smart Contracts as Escrow Engines

At its simplest, a streaming payment contract:

- Locks a specified principal amount.

- Defines a start time and end time (or a rate).

- Computes accrued value in real time.

- Allows the recipient to withdraw up to the currently accrued amount.

This structure ensures:

- Deterministic release schedule.

- Non-custodial control.

- On-chain verifiability.

More advanced implementations support dynamic rate adjustments, conditional triggers, governance-controlled streams, and composability with DeFi protocols.

2. Continuous Settlement Models

There are two dominant design approaches:

A. Escrow-Based Streaming

- The full principal is deposited upfront.

- The contract releases funds linearly.

- High security; capital inefficient.

B. Real-Time Balance Streaming

- No full pre-funding required.

- Balances update continuously via accounting deltas.

- Requires sophisticated liquidity management and settlement layers.

Superfluid introduced “Constant Flow Agreements” that modify balances over time without requiring discrete transfers for each micro-payment.

3. Integration with Scaling Solutions

Gas costs are prohibitive for per-second state updates on base layers. Therefore, streaming systems often rely on:

- Layer-2 rollups

- State channels

- Off-chain indexing layers

- Netting mechanisms

The scalability of streaming money depends heavily on efficient state compression and batch settlement techniques.

Economic Implications of Continuous Payments

1. Time-Weighted Capital Efficiency

Traditional payments create idle capital between billing cycles. Employers hold payroll until payday. Subscribers prepay for future service consumption. Streaming redistributes liquidity in real time.

Implications include:

- Improved working capital dynamics

- Reduced float advantages

- Increased liquidity turnover velocity

- More precise financial forecasting

For organizations, treasury management transitions from batch planning to continuous flow modeling.

2. Real-Time Labor Compensation

Salary streaming eliminates the need for payday cycles. Workers accumulate earnings continuously and can withdraw at any time.

Benefits include:

- Reduced financial stress.

- Lower reliance on payday lending.

- Improved global contractor payments.

- Transparent vesting structures.

This model is particularly relevant in decentralized autonomous organizations (DAOs), where contributor compensation is often token-based and time-bound.

3. Subscription Re-Engineering

Traditional subscription systems charge users upfront for full billing periods. Streaming enables:

- Pay-per-second usage.

- Instant cancellation without overpayment.

- Micro-access monetization.

- Dynamic pricing models.

This fundamentally changes SaaS economics and digital content monetization.

Streaming Money in DeFi Ecosystems

Streaming primitives integrate deeply into decentralized finance (DeFi).

Yield Streaming

Interest earned on capital can itself be streamed to recipients. Instead of distributing yield periodically, protocols can forward yield continuously.

Vesting and Token Distribution

Token allocations often vest linearly over time. Streaming mechanisms:

- Prevent large cliff unlock events.

- Reduce volatility.

- Align long-term incentives.

- Improve governance stability.

Real-Time Treasury Allocations

DAOs can stream budget allocations to contributors or sub-DAOs. Governance can modify stream rates rather than initiate lump transfers.

This reduces:

- Governance overhead.

- Capital misallocation.

- Risk of immediate treasury drain.

Comparative Analysis: Streaming vs. Traditional Payment Models

| Dimension | Traditional Model | Streaming Model |

|---|---|---|

| Settlement Frequency | Periodic | Continuous |

| Capital Lock-Up | High | Reduced |

| Cancellation | Discrete billing cycles | Immediate |

| Accounting | Event-based | Time-based |

| Liquidity Dynamics | Batch | Real-time |

| Trust Assumptions | Intermediary-based | Smart contract-enforced |

The structural change is profound: time becomes programmable capital.

Regulatory and Compliance Considerations

Streaming money intersects with existing regulatory frameworks in complex ways.

1. Wage and Labor Law

Continuous compensation must align with:

- Minimum wage compliance.

- Overtime calculations.

- Tax withholding rules.

- Jurisdictional payroll reporting.

Hybrid models may require periodic reporting layers layered on top of continuous accrual.

2. Securities and Token Law

When streams involve tokenized equity or yield-bearing instruments, regulatory scrutiny increases.

Authorities such as the U.S. Securities and Exchange Commission have emphasized that distribution structure does not negate underlying asset classification.

3. Accounting Standards

Streaming revenue recognition may require adaptation under GAAP and IFRS. Real-time accrual models can improve precision but complicate reporting.

Security and Risk Vectors

Smart Contract Risk

Bugs in streaming contracts can result in:

- Over-withdrawals

- Underflows or overflow errors

- Frozen funds

- Governance exploits

Auditing and formal verification are mandatory for institutional-grade deployments.

Liquidity Insolvency Risk

If streams are not fully pre-funded, insolvency risk emerges. Real-time systems must monitor collateralization and enforce automated stop conditions.

Oracle Dependency

Conditional streams based on external data introduce oracle risk. Manipulation of price feeds or event triggers can distort payment flows.

Advanced Use Cases

1. Infrastructure Billing

Cloud providers could bill compute usage per second. Instead of monthly invoices, resource consumption is paid continuously.

2. Micro-Task Economies

Streaming enables task-based compensation that accrues in near real time. This aligns with decentralized labor platforms.

3. Capital Leasing

Equipment financing or asset leasing can operate as continuous micro-rent rather than fixed monthly payments.

4. Cross-Border Remittances

Continuous remittance streams reduce the need for high-fee lump transfers and can stabilize recipient income.

Macroeconomic Consequences

If streaming becomes default infrastructure:

- The concept of payday disappears.

- Salary becomes a continuous flow variable.

- Financial stress tied to billing cycles declines.

- Working capital structures compress.

Money velocity may increase. Liquidity mismatches may decrease. Cash flow volatility becomes smoother at micro scales but potentially more complex at macro levels.

The shift parallels the transition from batch computing to real-time processing in distributed systems.

Implementation Blueprint for Enterprises

- Blockchain Selection

- Smart contract maturity

- Gas economics

- Layer-2 integration

- Compliance Architecture

- Tax integration

- Reporting abstraction layer

- Jurisdiction mapping

- Treasury Integration

- Automated rebalancing

- Stablecoin liquidity pools

- Hedging mechanisms

- Security Framework

- Formal audits

- Continuous monitoring

- Rate-limiting controls

- User Experience Design

- Real-time dashboards

- Withdrawal flexibility

- Clear accrual metrics

Obstacles to Mass Adoption

- Volatility of crypto assets.

- Regulatory fragmentation.

- Enterprise conservatism.

- Gas fee unpredictability.

- Limited wallet UX maturity.

Stablecoins mitigate volatility but introduce counterparty risks depending on issuer design.

Stablecoins as Streaming Primitives

Streaming money depends heavily on stable value units. Stablecoins provide price predictability essential for payroll and subscriptions.

Major stablecoin ecosystems operate on programmable chains. However, issuer risk, reserve transparency, and regulatory oversight vary significantly.

Central bank digital currencies (CBDCs) could theoretically support streaming features natively, though most current pilots prioritize batch transfer compatibility.

Design Principles for Streaming-Native Systems

- Time as a First-Class Variable

- Payment logic must integrate temporal granularity at protocol level.

- Composable Accounting

- Streams should integrate seamlessly with DeFi primitives.

- Revocability and Safety Controls

- Emergency stops and governance override mechanisms.

- Transparent State

- Real-time visibility into accrued balances.

- Capital Efficiency

- Avoid excessive pre-funding where solvency guarantees exist.

Strategic Outlook: Streaming as Infrastructure Layer

Streaming money is not a feature. It is an infrastructural layer.

As programmable finance matures:

- Payroll platforms will default to streaming.

- SaaS billing will become usage-native.

- Token vesting will standardize continuous distribution.

- Treasury management systems will operate on real-time liquidity curves.

The conceptual boundary between payment and process dissolves.

Conclusion

Streaming money redefines economic coordination by aligning value transfer with the passage of time. Enabled by smart contracts and programmable digital assets, it transforms discrete payment events into continuous financial flows.

Its adoption demands secure infrastructure, regulatory clarity, stable value units, and scalable settlement layers. The benefits—capital efficiency, transparency, liquidity optimization, and frictionless compensation—are structurally significant.

As blockchain systems mature, streaming money is positioned not as an experimental feature but as a default model for digital-native economies. The question is not whether continuous payments are technically feasible—they already are. The relevant question is how quickly financial institutions, enterprises, and decentralized networks will redesign their systems around time-based capital flow as a foundational principle.