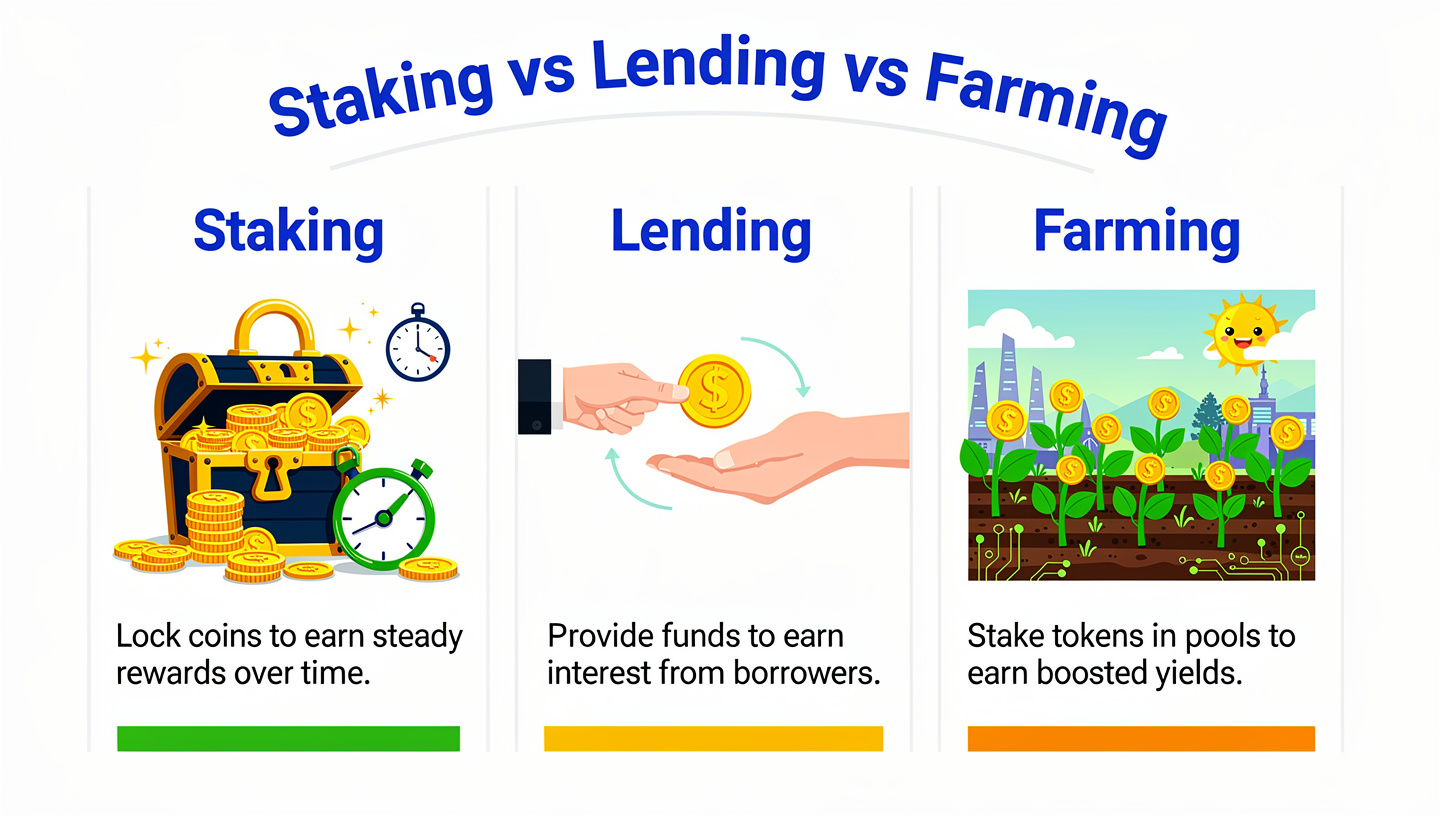

In the fast-moving world of decentralized finance (DeFi), three concepts are often mentioned together — yet frequently misunderstood:

- Staking

- Crypto Lending

- Yield Farming

All three involve putting crypto assets to work instead of letting them sit idle. All three promise returns. And all three come with risks that inexperienced users often underestimate.

But they are not the same thing, and confusing them can be an expensive mistake.

This guide will walk through:

- What each method actually is

- How they generate returns

- Realistic risks to understand

- Who each method is best suited for

- Common myths and mistakes to avoid

By the end, you should be able to evaluate these strategies clearly — and decide whether any of them align with your risk tolerance and goals.

Let’s begin.

Part 1: What Is Staking?

The core idea

Staking exists primarily on proof-of-stake (PoS) blockchains such as Ethereum, Solana, Cardano, and others.

In proof-of-stake networks:

- Validators secure the network.

- Validators must “lock up” tokens as collateral.

- In return, they receive rewards.

When everyday users “stake,” they are essentially delegating their tokens to validators.

You are helping secure the network — and being compensated for your contribution.

How staking generates rewards

Rewards typically come from:

- Newly issued tokens (inflation)

- Transaction fees

- Protocol incentives

Returns are usually expressed as APY (annual percentage yield).

In many cases, staking rewards are:

- Predictable

- More stable than other DeFi opportunities

- Suitable for long-term holders

But staking is not risk-free.

Key risks of staking

- Price volatility If the token price drops significantly, rewards may not compensate for losses.

- Lock-up periods Some staking mechanisms require funds to remain locked for days or weeks.

- Slashing risk If your validator behaves maliciously or incorrectly, part of your stake can be penalized.

- Smart contract vulnerabilities When staking through DeFi platforms rather than natively, you take on contract risk.

When staking makes sense

Staking is best suited for:

- Long-term token holders

- People seeking relatively passive returns

- Users comfortable with moderate risk and lower complexity

If you believe in the blockchain for years — staking can be a logical extension of holding.

Part 2: What Is Crypto Lending?

The basic premise

Crypto lending mirrors traditional banking:

- You deposit cryptocurrency.

- Someone else borrows it.

- You earn interest.

There are two main models:

- Centralized lending platforms

- Decentralized lending protocols

Both rely on borrowers posting collateral.

Where returns come from

Unlike staking, lending returns come from borrowers paying interest.

Typical reasons people borrow:

- Trading leverage

- Short selling

- Accessing liquidity without selling assets

- Arbitrage strategies

Interest rates fluctuate based on supply and demand.

Types of lending platforms

Centralized Platforms

Examples historically included:

- BlockFi

- Celsius

- Voyager

These companies acted like banks — custodying deposits and promising returns.

However, several collapsed because of poor risk management — teaching the industry a painful lesson:

Centralized does not automatically mean safer.

Decentralized Platforms

Protocols such as:

- Aave

- Compound

operate using smart contracts.

Here:

- Collateral levels are automated

- Liquidation triggers are coded

- Users maintain more control

But smart contracts come with vulnerabilities.

Key risks of crypto lending

- Counterparty risk (centralized lending)

Company failure can lead to loss of deposits. - Smart contract risk (DeFi lending)

Bugs or exploits can drain funds. - Liquidation risk

Borrowers may be liquidated if collateral drops in value — impacting market conditions. - Variable interest rates

Returns are unpredictable.

When lending makes sense

Crypto lending fits users who:

- Prefer predictable interest-style returns

- Are comfortable with market and platform risk

- Want liquidity without trading frequently

It is more “financial market driven” than staking.

Part 3: What Is Yield Farming?

The concept

Yield farming is the most complex — and potentially the most lucrative — of the three.

At its core:

Yield farming is the process of moving capital across DeFi protocols to maximize returns.

This often involves:

- Supplying liquidity to decentralized exchanges

- Earning trading fees + token incentives

- Re-deploying rewards into new pools

Farmers constantly chase the best yields.

Where returns come from

Yield comes from multiple layers:

- Liquidity provider fees

- Governance token rewards

- Incentive programs

- Compounding strategies

This stacking effect can produce very high APYs — especially early in a protocol’s lifecycle.

But high returns always reflect higher risk.

Key risks in yield farming

- Impermanent loss When you provide liquidity to AMMs (like Uniswap), price changes between assets can reduce value.

- Smart contract exploits Complex protocols mean larger attack surfaces.

- Rug pulls and scams Some projects disappear after attracting deposits.

- Unsustainable yields Many rewards are inflationary and temporary.

- High transaction fees Especially on congested networks.

When yield farming makes sense

Yield farming is appropriate only for:

- Advanced users

- High-risk investors

- Those actively monitoring markets

It is more like active portfolio management than passive income.

Comparing Them Directly

1. Complexity

| Strategy | Complexity | Explanation |

|---|---|---|

| Staking | Low | Mostly “set and forget” |

| Lending | Medium | Requires understanding interest dynamics |

| Yield Farming | High | Requires constant monitoring and knowledge of DeFi |

2. Risk Profile

| Strategy | Risk Level | Main Risks |

|---|---|---|

| Staking | Lower | Price volatility, slashing |

| Lending | Medium | Counterparty, liquidation, contract risk |

| Yield Farming | High | Impermanent loss, exploits, scams |

3. Return Potential

| Strategy | Typical Rewards |

|---|---|

| Staking | Modest but stable |

| Lending | Moderate and variable |

| Yield Farming | Potentially high but inconsistent |

Common Myths You Should Ignore

Myth 1: “Staking, lending, and farming are guaranteed income.”

Nothing in crypto is guaranteed. Returns are probabilistic, not fixed promises.

Myth 2: “Higher APY means better investment.”

Often high yields signal:

- High risk

- High inflation

- Unsustainable incentives

Myth 3: “Decentralized means safe.”

DeFi removes intermediaries — but introduces code risk.

Security shifts, not disappears.

How to Decide Which Strategy Fits You

Ask yourself:

- What is my risk tolerance?

- Do I understand the mechanics?

- Am I willing to monitor positions?

- What timeframe am I investing for?

Practical guidance

- If you are a long-term holder → Staking

- If you prefer interest-style returns → Lending

- If you enjoy complexity and risk → Yield Farming

None is inherently “best.”

The right strategy aligns with your objectives.

Final Thoughts

Staking, lending, and yield farming all grew out of one simple idea:

Money should be able to work while you sleep.

However, every opportunity carries risk. The market rewards those who understand mechanics — not those chasing the highest number on the screen.

Start small. Learn gradually. Diversify strategies. Protect capital first.