In investing, anything that advertises itself as easy deserves immediate suspicion.

Markets do not give away free lunches. They never have. They never will.

Yet crypto, in its short history, has developed an unusual habit: presenting yield as something mechanical—stake tokens, click a button, receive rewards. No factories. No sales teams. No operating margins. Just protocol math producing income.

That framing is misleading.

Because behind every staking reward sits a system of penalties, probabilities, and operational dependencies. And buried inside those mechanics is one of crypto’s least discussed but most financially meaningful risks:

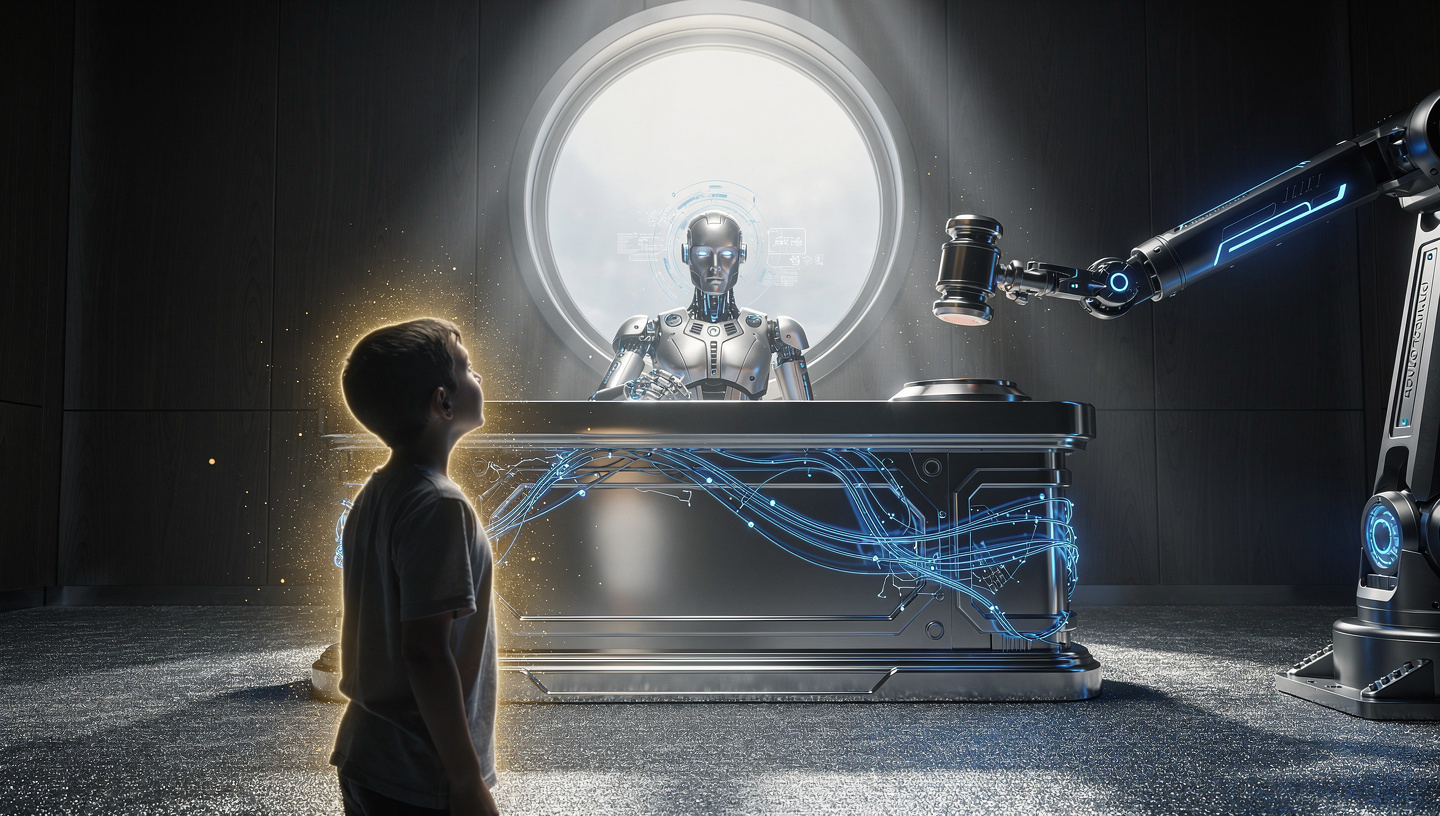

Slashing.

Slashing is not volatility.

It is not market risk.

It is not a temporary drawdown.

It is permanent capital loss imposed directly by the protocol.

No recovery rally fixes it. No “HODL” strategy reverses it. When slashing occurs, your principal is gone.

For investors chasing passive yield in Proof-of-Stake networks, slashing functions as a silent tax—quiet, technical, poorly understood, and often ignored until it becomes expensive.

This article explains exactly what slashing is, how it works across major networks, why it exists, how it actually happens in practice, and why most retail participants systematically underestimate its impact on long-term returns.

What Is Slashing in Crypto?

Slashing is a protocol-enforced penalty applied to validators and their delegators when certain rules are violated.

In Proof-of-Stake (PoS) blockchains, validators replace miners. They lock tokens (stake) as collateral and participate in block production and consensus. The system assumes validators will behave honestly because their stake is at risk.

If a validator:

- Acts maliciously

- Breaks consensus rules

- Goes offline excessively

- Signs conflicting blocks

- Fails to perform required duties

…the protocol automatically destroys or confiscates part of their stake.

That penalty is called slashing.

Importantly:

Slashing affects both validators and anyone who delegated stake to them.

You do not need to personally misbehave to get slashed. Your funds are economically tied to your validator’s behavior.

This is the first misconception retail stakers make.

Why Slashing Exists (And Why It Must Exist)

Without slashing, Proof-of-Stake collapses.

PoS relies on economic incentives rather than energy expenditure. Validators must have something meaningful to lose, otherwise:

- Double signing becomes rational

- Downtime carries no cost

- Network attacks become cheap

Slashing introduces credible punishment. It ensures that dishonest or careless validators face losses larger than any potential gain.

From a protocol design perspective, slashing is essential.

From an investor perspective, slashing introduces non-market risk into yield strategies.

Traditional finance rarely exposes passive investors to operational penalties at the protocol level. Crypto does.

Types of Slashing Events

Not all slashing is equal. Networks differentiate between minor infractions and serious violations.

1. Downtime Slashing

Occurs when validators fail to stay online.

Common causes:

- Server outages

- Network instability

- Cloud provider failures

- Poor monitoring

- Power interruptions

Penalties are usually small but cumulative.

On Cosmos-based chains, repeated downtime can lead to:

- Gradual stake erosion

- Forced unbonding

- Validator jailing

Retail delegators often ignore this risk because it feels operational rather than financial. That is a mistake.

2. Double Signing

One of the most severe violations.

A validator signs two conflicting blocks at the same height. This threatens consensus integrity and can enable chain forks or attacks.

Penalties here are heavy:

- Immediate slashing (often 5–100% depending on chain)

- Permanent validator removal

- Reputation destruction

Double signing often results from:

- Misconfigured failover systems

- Running multiple validator instances

- Poor key management

It does not require malicious intent.

3. Governance or Consensus Violations

Some networks penalize:

- Invalid block proposals

- Incorrect voting

- Failure to follow protocol upgrades

These are rarer but becoming more common as chains grow complex.

Slashing Percentages Across Major Networks

Slashing parameters vary widely.

Here are approximate ranges (subject to change):

Ethereum

- No classic slashing for delegators directly

- Validators lose ETH for double proposals or surround votes

- Penalties scale with number of offenders

- Worst-case losses can exceed 50% during correlated failures

Ethereum also enforces inactivity leaks, slowly draining stake during prolonged outages.

Cosmos Hub

- Downtime: ~0.01%

- Double signing: ~5%

- Validators jailed after infractions

Delegators share losses proportionally.

Polkadot

- Slashing severity depends on offense and validator group size

- Can range from small fractions to substantial stake reductions

Solana

- Uses a different mechanism, but validators still face penalties via reduced rewards and stake deactivation

Each ecosystem encodes risk differently, but the principle remains:

Your yield is conditional on perfect validator behavior.

Why Slashing Is Systematically Underestimated

Retail participants underestimate slashing risk for four structural reasons.

1. Interfaces Hide It

Wallets display:

- APY

- Rewards

- Compound options

They rarely show:

- Historical slashing rates

- Validator incident records

- Infrastructure redundancy

- Operator competence

Yield is visible. Risk is buried.

2. Early Success Creates False Confidence

Many stakers go months or years without experiencing slashing. This builds psychological complacency.

But slashing behaves like insurance events:

Rare, until they aren’t.

3. Delegation Feels Passive

People mentally classify staking alongside savings accounts.

It isn’t.

Delegation is an implicit partnership with a technical operator running distributed infrastructure.

You are underwriting their operational risk.

4. Correlated Failures Are Ignored

Major slashing events often occur during:

- Network upgrades

- Client bugs

- Cloud outages

When they happen, they affect many validators simultaneously, amplifying losses.

This is not diversified risk.

Slashing vs Market Volatility: A Critical Distinction

Price volatility is reversible.

Slashing is not.

If ETH drops 30%, you still own the same amount of ETH.

If you are slashed 10%, your ETH count is permanently reduced.

Future price appreciation compounds on a smaller base.

This makes slashing mathematically more damaging than most drawdowns.

Investors routinely obsess over price charts while ignoring protocol penalties. That is backward.

Real-World Slashing Incidents

Slashing is not theoretical.

Examples include:

- Ethereum validators slashed due to Prysm and Lighthouse bugs

- Cosmos validators slashed during chain halts

- Polkadot validators penalized after misconfigured setups

- Large staking providers suffering correlated downtime events

In several cases, professional operators with millions under management were affected.

Retail delegators paid the price.

The True Yield Equation

Most people calculate staking returns like this:

APY – inflation = real yield

That formula is incomplete.

The real equation is:

(Rewards – Slashing – Opportunity Cost – Lockup Risk – Validator Risk) × Time

Slashing enters directly as a negative cash flow.

Even a single 5% slashing event can erase multiple years of rewards.

Custodial Staking vs Self-Delegation

Centralized exchanges often advertise “no slashing risk.”

What they actually mean is:

They absorb slashing losses internally.

You still pay indirectly via:

- Lower APY

- Wider spreads

- Custody risk

Nothing disappears. Risk is simply redistributed.

Self-delegation gives transparency but shifts responsibility to you.

There is no free structure.

How Serious Investors Manage Slashing Risk

Professionals do not chase headline APY.

They optimize for:

Validator Quality

- Multi-client setups

- Geographic redundancy

- Independent infrastructure

- Public incident history

Stake Diversification

Delegating across multiple validators reduces correlated risk.

Conservative Networks

Some chains prioritize stability over yield.

Lower APY often reflects lower operational complexity.

Monitoring

Serious stakers use:

- Alerting systems

- Validator dashboards

- Governance tracking

Passive does not mean unattended.

The Philosophical Problem With “Easy Yield”

In traditional investing, yield comes from:

- Productive businesses

- Credit risk

- Asset utilization

In crypto, staking yield comes from protocol inflation and transaction fees.

It is not created value. It is redistribution.

Slashing exists to prevent abuse of that redistribution mechanism.

When investors treat staking like interest-bearing savings, they misunderstand the system.

They are participating in a security model, not depositing money.

Slashing Is the Cost of Trustless Finance

Crypto removes intermediaries.

In exchange, it exposes participants directly to system mechanics.

Slashing is one of those mechanics.

It is the price paid for decentralized consensus.

You cannot remove it without breaking the model.

But you can understand it.

And understanding changes behavior.

Final Thoughts: Capital Preservation Comes First

Warren Buffett often emphasizes one rule:

Never lose money.

Crypto does not offer that luxury.

But it does offer informed choice.

Staking is not risk-free yield. It is a contract with distributed infrastructure operated by humans, software, and incentives.

Slashing is the clause most people don’t read.

If you pursue staking rewards without studying validator quality, network design, and penalty structures, you are speculating on operational competence.

Yield without risk analysis is not investing.

It is gambling dressed in spreadsheets.

Slashing is how the house reminds you.