Every chart you’ve ever opened is a probability field. Every trade you’ve ever considered is a wager on asymmetry. And every account that survives long-term—whether trading stocks, futures, or crypto—does so for one reason only: the trader learned how to structure risk before chasing profit.

Not indicators.

Not secret setups.

Not prediction.

Structure.

Risk-to-reward is that structure.

It is the quiet mathematics beneath every professional trade. It’s what separates speculation from strategy, gambling from systems, and temporary luck from durable edge. Yet in crypto, it’s routinely ignored, misunderstood, or reduced to a buzzword.

This article fixes that.

You’ll learn what risk-to-reward actually means, how professionals apply it in volatile crypto markets, why most traders misuse it, and how to engineer it into every position you take—regardless of timeframe, asset, or strategy.

No fluff. No motivational filler. Just applied trading logic.

What Risk-to-Reward Really Means (Beyond the Textbook Definition)

At its core, risk-to-reward (often written R:R) is simple:

How much you’re willing to lose versus how much you expect to gain on a trade.

If you risk $100 to make $300, that’s a 1:3 risk-to-reward.

But that surface definition hides what matters:

Risk-to-reward is not about profits.

It’s about survivability.

It answers one fundamental question:

How wrong can you be and still grow your account?

That’s it.

A trader with a 1:1 ratio must be right more than 50% of the time just to break even (after fees and slippage, even higher).

A trader with a 1:3 ratio can be wrong two-thirds of the time and still remain profitable.

This is why professional systems obsess over R:R long before entries.

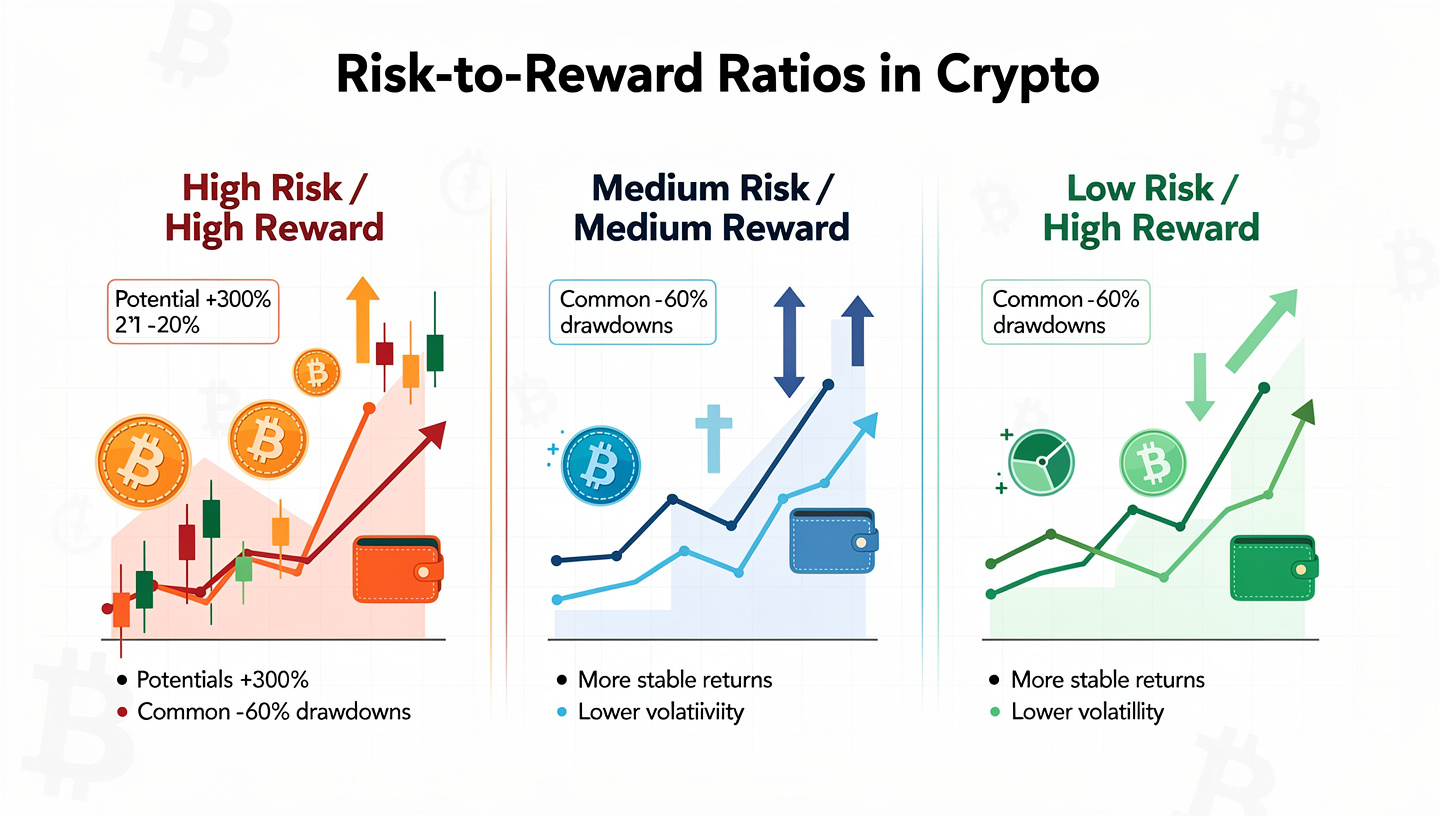

Why Crypto Makes Risk-to-Reward Non-Negotiable

Traditional markets move in increments. Crypto moves in avalanches.

A mid-cap token can drop 20% in minutes. A funding cascade can erase weeks of price action in an hour. Liquidity vacuums appear without warning.

This volatility creates two simultaneous realities:

- Massive opportunity

- Massive downside

Without disciplined risk-to-reward, volatility becomes destructive.

With it, volatility becomes leverage.

Crypto doesn’t punish bad predictions—it punishes poor risk structuring.

Whether you trade Bitcoin, Ethereum, or smaller altcoins, the principle is identical: you must define loss before imagining gain.

The Mathematical Backbone: Expectancy

Professional traders don’t think in wins and losses.

They think in expectancy.

The formula is:

Expectancy = (Win Rate × Average Win) − (Loss Rate × Average Loss)

Risk-to-reward directly controls the second half of that equation.

Example:

- Win rate: 40%

- Risk per trade: $100

- Reward per trade: $300

Over 10 trades:

- 4 wins = +$1,200

- 6 losses = −$600

Net result: +$600

You lost more trades than you won. You still made money.

That is the power of asymmetric risk.

Most retail traders do the opposite:

- Small wins

- Large losses

- No structural edge

They rely on being “right.” Professionals rely on math.

The Hidden Trap: High Win Rates With Terrible R:R

One of crypto’s most common illusions is the high win-rate strategy.

Scalpers brag about 80–90% accuracy. Signal groups advertise “daily wins.” Beginners chase setups that feel safe.

Here’s the problem:

If you make $20 repeatedly but lose $300 occasionally, your account will eventually collapse.

This is called negative skew.

It looks good until it doesn’t.

Crypto graveyards are full of traders who were “usually right.”

Risk-to-Reward vs Position Sizing (They Are Not the Same)

Risk-to-reward defines trade structure.

Position sizing defines capital exposure.

They work together—but they are different tools.

Example:

- Account: $10,000

- Risk per trade: 1% ($100)

- Stop loss distance: 5%

Your position size becomes $2,000.

Now apply R:R:

- Target at 15% = $300 profit

- Stop at 5% = $100 loss

That’s 1:3.

Without position sizing, R:R is theoretical.

Without R:R, position sizing is blind.

Both must exist simultaneously.

Why Most Crypto Traders Fail at Risk-to-Reward

Not because they don’t understand it.

Because they violate it emotionally.

Common failure modes:

1. Moving stops after entry

Loss avoidance masquerading as strategy.

2. Taking profits early

Fear converting 1:3 trades into 1:0.7 outcomes.

3. Letting losers run

Hope overriding predefined risk.

4. Entering without targets

Improvisation disguised as flexibility.

Each one destroys expectancy.

Each one is psychological—not technical.

Fixed R:R vs Dynamic R:R

There are two legitimate approaches.

Fixed Risk-to-Reward

Example: Always trade 1:2 or 1:3.

Used by systematic traders.

Pros:

- Simplicity

- Easy backtesting

- Consistent expectancy

Cons:

- Doesn’t adapt to structure

Dynamic Risk-to-Reward

Targets based on:

- Support/resistance

- Market structure

- Liquidity zones

- Volatility bands

Pros:

- Market-aware

- Higher-quality setups

Cons:

- Requires skill

- Harder to automate

Most discretionary crypto traders use dynamic R:R. Most algorithmic systems use fixed.

Both work—if applied correctly.

R:R in Trending Markets vs Ranging Markets

Context matters.

Trending Conditions

Aim for higher reward multiples (1:3 to 1:6).

Why?

Trends expand. Pullbacks are shallow. Momentum carries price.

This is where accounts grow.

Ranging Conditions

Lower R:R (1:1 to 1:2) with higher win rates.

Why?

Price oscillates. Breakouts fail. Targets compress.

Trying to force 1:4 trades inside ranges leads to death by chop.

Good traders adjust R:R based on regime.

Bad traders force the same template everywhere.

Risk-to-Reward on Different Timeframes

R:R is timeframe agnostic—but its expression changes.

Scalping (1–5 min charts)

- Smaller R:R (1:1 to 1:2)

- Higher frequency

- Tight stops

- Spread and fees matter

Intraday

- 1:2 to 1:3 common

- Structure-based entries

- Partial scaling

Swing Trading

- 1:3 to 1:8 possible

- Wider stops

- Lower trade frequency

Longer timeframes allow larger asymmetry.

Shorter timeframes require precision.

Exchanges Don’t Save You From Bad R:R

Whether you trade on Binance or Coinbase, the mechanics are identical.

The platform does not fix poor trade design.

Order types don’t replace discipline.

Indicators don’t override math.

Risk-to-reward lives entirely in your execution.

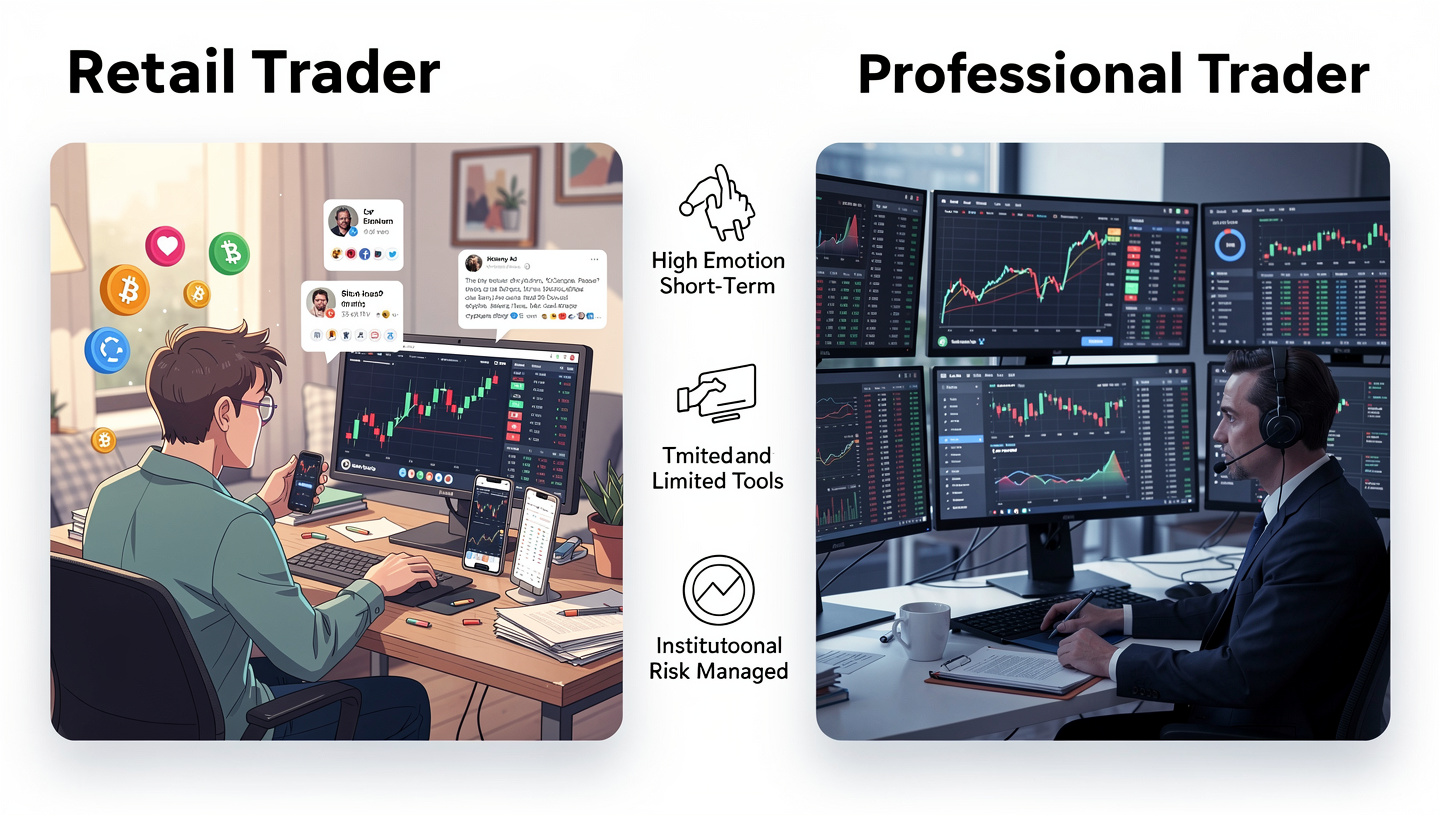

The Institutional Perspective

Large funds don’t care about single trades.

They care about distributions.

They run thousands of samples, optimize expectancy curves, and accept drawdowns as operational cost.

Retail traders do the opposite:

They emotionally overweight individual outcomes.

The professional mindset:

One trade is noise.

One hundred trades is signal.

R:R exists to stabilize that signal.

Risk-to-Reward and Leverage (A Dangerous Combination)

Leverage magnifies R:R—but also accelerates liquidation.

In crypto futures, a 1:3 setup at 10x leverage becomes brutal if stops are misplaced.

Key rule:

Leverage does not improve R:R. It only amplifies consequences.

If your spot R:R is poor, leverage will destroy you faster.

Common R:R Myths in Crypto

Myth 1: Higher R:R is always better

False. Extremely high R:R often comes with very low probability.

Myth 2: You need at least 1:3

False. Many profitable systems operate at 1:1.5 with 70%+ win rates.

Myth 3: Risk-to-reward guarantees profits

False. It guarantees structure, not outcome.

A Practical Framework You Can Use

Before every trade, answer these four questions:

- Where is invalidation? (Stop loss)

- Where is logical profit? (Target)

- What is the multiple? (R:R)

- Does this align with market context?

If any answer is unclear, don’t trade.

This single habit eliminates most losses.

The Psychological Edge

Risk-to-reward removes decision-making after entry.

It converts trading from reaction to execution.

You stop negotiating with price.

You stop improvising.

You stop hoping.

You operate.

This is why elite performers—whether engineers, athletes, or market operators—build systems instead of relying on impulse. The same mentality that drives figures like Elon Musk toward first-principles thinking applies directly to trading: deconstruct the problem, engineer constraints, and let the framework do the work.

Final Thoughts

Crypto is not forgiving.

It doesn’t reward enthusiasm.

It doesn’t care about conviction.

It doesn’t compensate effort.

It rewards structure.

Risk-to-reward is not a trading tip. It is the foundation of capital survival.

If you internalize nothing else, internalize this:

You don’t make money by predicting markets.

You make money by controlling downside and letting upside breathe.

Every professional account is built on that truth.

Everything else is noise.