Crypto markets do not move because people tweet. They move because capital reallocates. Tweets merely reflect the psychological exhaust of capital already in motion. Yet much of crypto “research” today mistakes social chatter for causality, confusing narrative amplification with narrative formation. This is not a semantic error—it is a strategic one.

A crypto narrative is not a slogan, a meme, or a trending hashtag. It is a coordinated belief system that manifests in on-chain behavior, liquidity deployment, leverage expression, and time-weighted capital commitment. Narratives leave fingerprints in data long before they dominate social feeds. The serious researcher does not ask, “What is being talked about?” but rather, “Where is capital behaving differently, and why?”

This article establishes a rigorous framework for identifying, validating, and timing crypto narratives using verifiable data signals, not sentiment proxies. The goal is not prediction by hype, but understanding by structure.

What a Crypto Narrative Actually Is (And Is Not)

A narrative, in market terms, is a shared expectation about future value creation that influences present allocation decisions. In crypto, narratives typically cluster around:

- Technological primitives (e.g., Layer 2s, restaking, modular blockchains)

- Financial abstractions (e.g., real yield, delta-neutral strategies)

- Coordination mechanisms (e.g., DAOs, governance tokens)

- Regulatory or macro alignments (e.g., ETFs, stablecoin legitimacy)

What a narrative is not:

- A viral thread

- A founder interview

- A short-term pump explanation

- A retroactive justification for price action

Tweets are distribution channels, not discovery engines. By the time a narrative trends on social media, it is usually late-stage consensus, not early-stage emergence.

The Narrative Lifecycle: From Data Anomaly to Public Consensus

Every crypto narrative progresses through identifiable phases. Data allows us to observe each phase with increasing clarity.

1. Latent Phase: Structural Anomalies

At this stage, there is no narrative language yet—only statistical irregularities:

- Unusual growth in contract deployments

- Sustained increases in active addresses within a niche

- Capital concentration in previously illiquid protocols

- Shifts in gas usage patterns unrelated to price

These anomalies are rarely discussed publicly because they lack a unifying story. This is where data-first research has maximum edge.

2. Expressive Phase: Capital Commits Before Words Appear

Here, we observe:

- TVL growth outpacing price

- Open interest expansion without corresponding volatility

- Repeated funding neutrality despite directional price bias

- Stablecoin inflows into specific protocol ecosystems

Capital is positioning, but language is still fragmented. Influencers are not yet aligned. This is where narratives are forming, not yet marketed.

3. Linguistic Phase: Narrative Codification

Only now do keywords emerge:

- Terminology stabilizes (“restaking,” “points,” “modular”)

- Research dashboards appear

- Medium-form analysis proliferates

Price often accelerates here, but risk asymmetry begins to deteriorate.

4. Reflexive Phase: Tweets Chase Performance

Social dominance spikes. Metrics look “obvious.” Retail participation increases. Narrative research becomes redundant because the market has already priced consensus expectations.

Most losses occur when participants mistake Phase 4 for Phase 2.

Data Sources That Actually Reveal Narratives

On-Chain Data: Behavior, Not Belief

On-chain metrics are valuable not because they are transparent, but because they record irreversible economic decisions.

Key indicators:

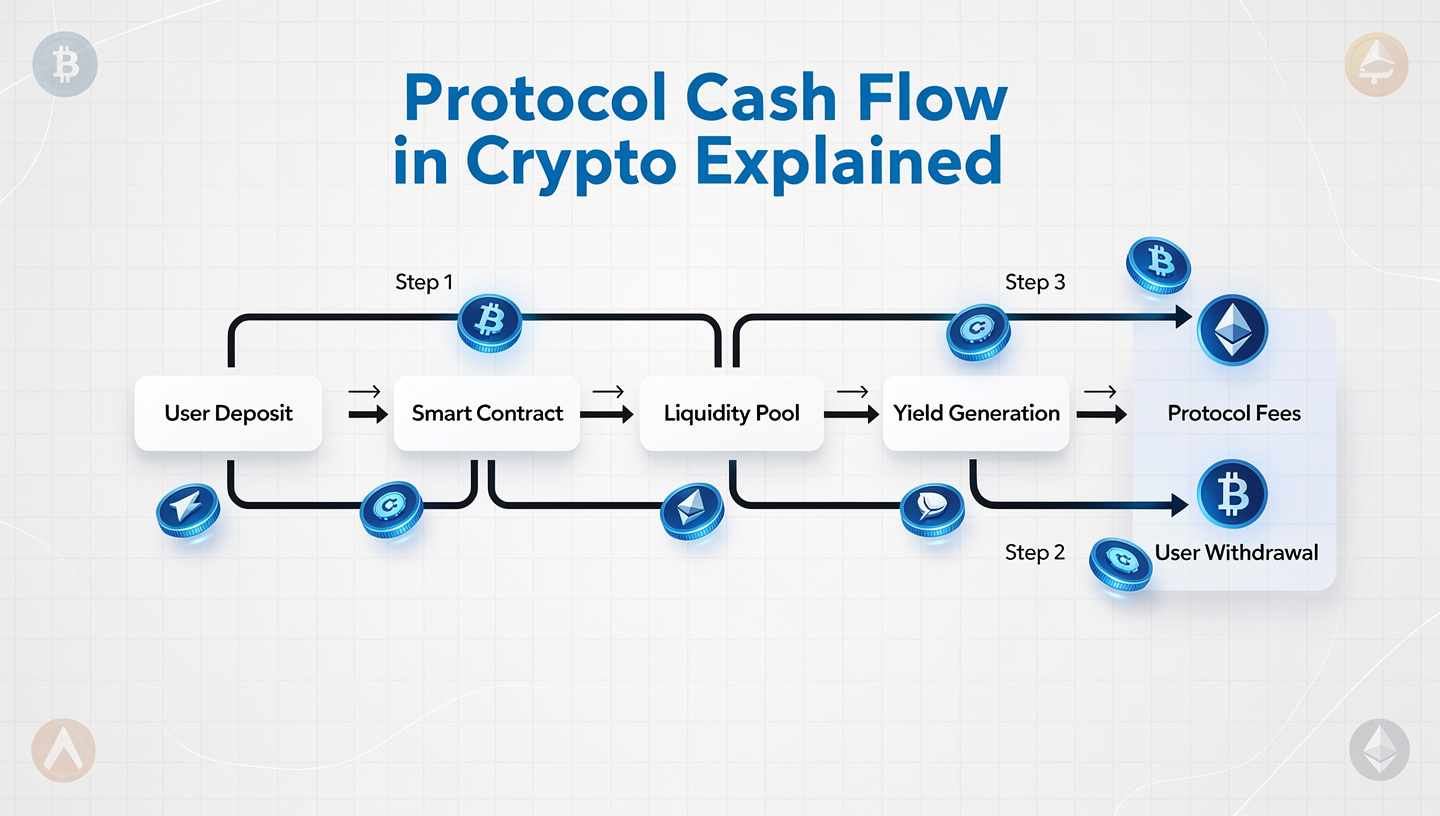

- Net capital flows into smart contracts (not TVL snapshots)

- Wallet cohort behavior (new vs. old capital)

- Time-weighted holding patterns

- Protocol revenue composition

Narratives require persistence. A one-week spike is noise. A three-month behavioral shift is signal.

Derivatives Markets: Where Conviction Is Quantified

Spot markets show interest. Derivatives show belief under risk.

Relevant metrics include:

- Open interest growth relative to spot volume

- Funding rate stability during directional moves

- Basis expansion across maturities

- Liquidation asymmetry

A narrative is gaining strength when leverage aligns with spot accumulation, not against it.

Liquidity Topology: Where Capital Chooses to Rest

Liquidity does not scatter randomly. It clusters around perceived future relevance.

Signals include:

- Deepening order books in specific token classes

- Narrowing spreads without volatility expansion

- Stablecoin parking behavior on certain chains

- Cross-chain bridge imbalances

Liquidity reveals preference, not opinion.

Why Social Metrics Fail as Primary Research Tools

Social metrics are often treated as leading indicators. In practice, they are lagging confirmations with high reflexivity risk.

Key limitations:

- Bots distort volume

- Engagement rewards extremity, not accuracy

- Visibility correlates with price, not insight

- Algorithms amplify momentum, not novelty

Most importantly, social data cannot distinguish between:

- Capital reallocating because of a narrative

- Capital reallocating after performance validates a narrative

Data-first research avoids this confusion entirely.

Building a Data-Driven Narrative Research Framework

A robust framework asks structured questions in sequence:

- Where is capital behaving differently from historical norms?

- Is the behavior persistent across market regimes?

- Does usage precede price, or price precede usage?

- Is leverage confirming or contradicting spot flows?

- Is liquidity deepening before volatility expands?

If the answers align, a narrative exists—whether or not anyone is talking about it.

Case Pattern: Identifying Narratives Without Naming Them

Effective research often avoids labels until late.

For example:

- Observe rising transaction complexity, not “DeFi 2.0”

- Track validator revenue shifts, not “infrastructure narratives”

- Monitor stablecoin velocity changes, not “payment adoption”

Naming prematurely biases analysis. Let the data speak first. Language can follow.

The Intellectual Discipline Crypto Still Lacks

Crypto does not suffer from lack of information. It suffers from lack of epistemic discipline.

Most market participants ask:

“What is the next narrative?”

A better question is:

“What structural behavior is emerging that does not yet require a narrative to exist?”

By the time a narrative is obvious, the opportunity has shifted from discovery to distribution.

Data Is the Only Honest Narrative Detector

Tweets are cheap. Capital is not.

A real crypto narrative is written in:

- Transactions, not threads

- Liquidity, not likes

- Open interest, not opinions

Researching narratives using data is not about being early for the sake of ego. It is about respecting markets as systems of incentives, not stages for performance.

Those who learn to read data will understand narratives before they are named.

Those who read tweets will understand them after they are exhausted.

As in all capital markets, truth moves quietly first.