Crypto markets are saturated with narratives that sound sophisticated but collapse under basic financial scrutiny. Token velocity. Community growth. Total Value Locked. Social engagement. Governance participation. These metrics are discussed endlessly, yet most fail to answer the only question that has ever mattered in capital markets:

Where does the cash come from, and who controls it?

Blockchains did not abolish economic gravity. They did not repeal the laws of capital formation. They did not render cash flow obsolete. They merely changed how cash flow is generated, distributed, enforced, and verified. In that sense, crypto protocols are not alien economic organisms. They are businesses—radically transparent, algorithmically governed, and globally accessible—but businesses nonetheless.

Protocol cash flow is the difference between a network that compounds value and one that merely redistributes speculation. It is the distinction between a system that can sustain security, development, and incentives autonomously, and one that must constantly rely on inflation, narrative momentum, or external capital injections to survive.

This article explains protocol cash flow in crypto from first principles, stripping away buzzwords and focusing on measurable, on-chain economic reality. We will define what protocol cash flow actually is, how it differs from traditional corporate cash flow, how it is generated, how it leaks, how it is manipulated, and why it should sit at the center of any serious crypto valuation framework.

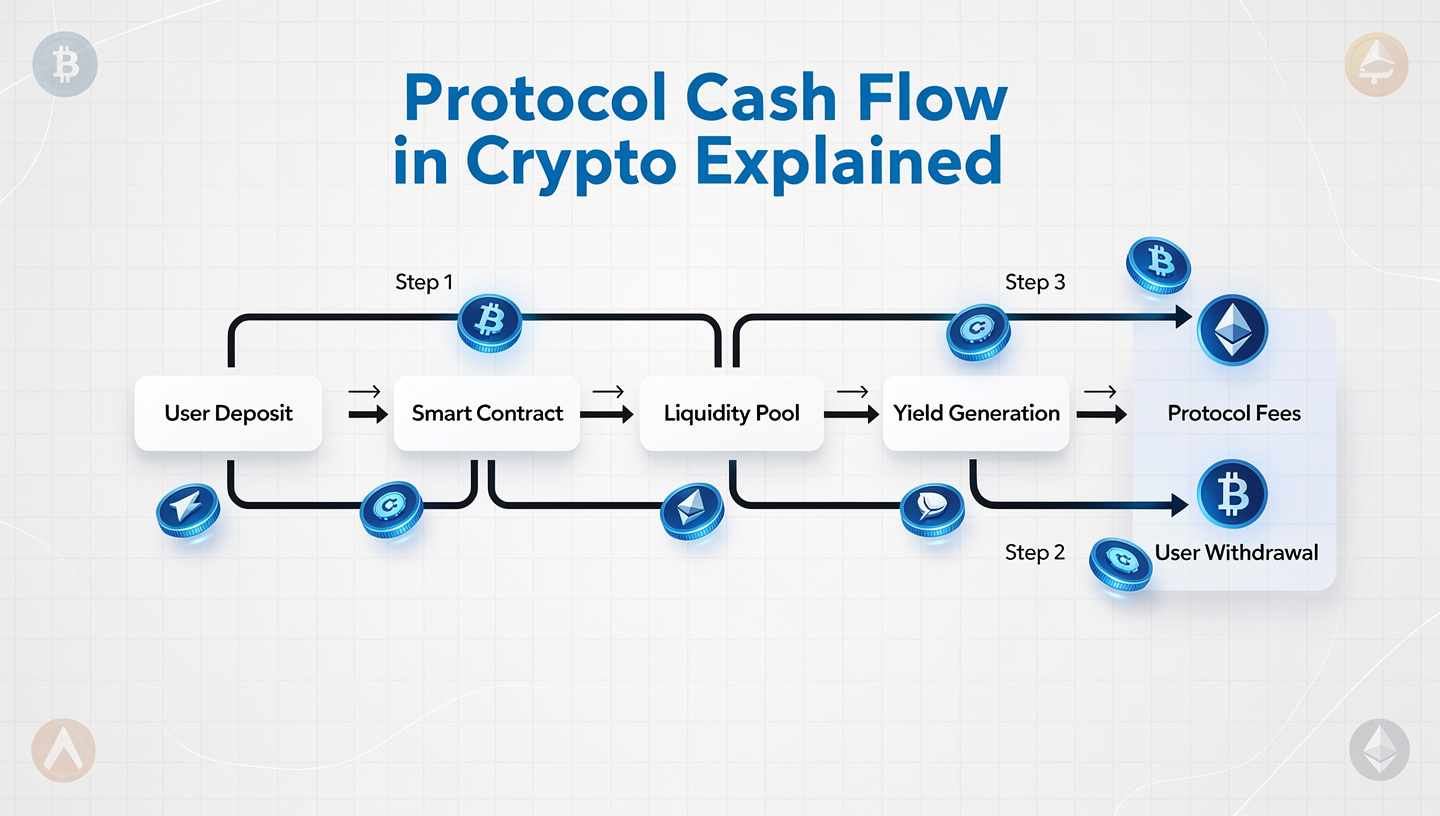

1. What Is Protocol Cash Flow?

Protocol cash flow refers to net economic value captured by a blockchain protocol as a result of user activity, expressed in base assets (ETH, stablecoins, BTC, or native tokens with real purchasing power).

More precisely:

Protocol Cash Flow = Gross Protocol Revenue − Operating Economic Costs

This is not a metaphor. This is not a loose analogy. It is a directly observable on-chain phenomenon.

1.1 Protocol Revenue vs Token Price Appreciation

One of the most persistent analytical errors in crypto is the conflation of token price movement with economic productivity.

Token price appreciation reflects:

- Market expectations

- Liquidity conditions

- Narrative cycles

- Speculative leverage

Protocol cash flow reflects:

- Actual user demand

- Willingness to pay

- Economic utility

- Competitive positioning

A protocol can generate substantial cash flow while its token underperforms, and conversely, a token can appreciate dramatically while the protocol produces little or no sustainable revenue. These two dimensions are orthogonal.

1.2 What Counts as Revenue?

Protocol revenue typically includes:

- Transaction fees

- Swap fees (DEXs)

- Borrowing interest (lending protocols)

- Liquidation penalties

- MEV capture mechanisms

- Subscription or service fees (oracles, data availability layers)

- Sequencer fees (Layer 2s)

Importantly, not all fees equal revenue. Fees paid to validators, liquidity providers, or miners do not necessarily accrue to the protocol treasury or token holders.

2. Gross Revenue vs Protocol Cash Flow: A Critical Distinction

Many analytics dashboards prominently display “protocol revenue” without clarifying what portion of that revenue is actually retained.

This distinction is foundational.

2.1 Gross Revenue

Gross revenue represents total fees paid by users interacting with the protocol.

Example:

- Users pay $100 million in swap fees on a DEX over a year.

This figure is economically meaningless on its own.

2.2 Economic Costs

Protocols incur economic costs, including:

- Validator or sequencer compensation

- Liquidity incentives

- MEV rebates

- Oracle payments

- Security budgets

- Token emissions used to subsidize activity

These costs are often hidden behind euphemisms like “incentives” or “growth spending.”

2.3 Net Protocol Cash Flow

Only after subtracting these costs do we arrive at net protocol cash flow—the portion of economic value that can be:

- Retained by the protocol treasury

- Distributed to token holders

- Used for buybacks or burns

- Reinvested in security and development

Protocols with high gross revenue but negative net cash flow are not profitable systems; they are subsidized ones.

3. How Crypto Protocols Generate Cash Flow

Different protocol categories generate cash flow through structurally distinct mechanisms.

3.1 Layer 1 Blockchains

Layer 1 cash flow primarily comes from:

- Transaction fees

- MEV capture (direct or indirect)

- Priority fees during congestion

Key observation:

Most Layer 1s do not retain fees. Fees are often paid to validators, meaning the protocol itself captures little value unless:

- A portion is burned

- A portion flows to a treasury

- The token supply is reduced via fee destruction

Ethereum’s post-EIP-1559 model is a canonical example of partial value capture through fee burning.

3.2 DeFi Protocols

DeFi protocols often have clearer revenue streams:

- DEXs earn swap fees

- Lending protocols earn interest spreads

- Derivatives protocols earn trading fees

However, revenue sustainability depends on:

- Organic usage vs incentivized volume

- Market cycle sensitivity

- Competitive fee compression

3.3 Layer 2 Networks

Layer 2s introduce a more traditional business model:

- Users pay sequencer fees

- Costs are paid to the base layer (data availability)

- The spread represents potential protocol margin

This makes L2s structurally closer to infrastructure companies than to commodities.

4. Token Emissions: The Silent Cash Flow Killer

One of the most misunderstood elements in crypto cash flow analysis is token emissions.

4.1 Emissions Are Not Free

Issuing tokens to incentivize users or validators is an economic cost, even if no fiat changes hands. Emissions dilute existing holders and represent a transfer of value.

Any protocol that generates $50 million in fees but emits $200 million worth of tokens is net negative cash flow.

4.2 Inflation-Funded Revenue Illusions

Many protocols appear profitable only because:

- Token prices are elevated

- Emissions are priced optimistically

- Sell pressure is temporarily absorbed

This is not sustainable. Inflation is not revenue. It is deferred taxation.

5. Cash Flow Distribution: Who Actually Gets Paid?

Capturing cash flow is meaningless unless we understand who benefits.

5.1 Protocol Treasury

Some protocols route net revenue to a treasury, creating:

- Long-term sustainability

- Strategic optionality

- Balance sheet strength

Treasury-controlled cash flow enables protocols to survive bear markets without external fundraising.

5.2 Token Holder Alignment

Other protocols distribute cash flow via:

- Buybacks

- Burns

- Staking rewards sourced from real fees

This creates a direct link between usage and token value, aligning incentives.

5.3 The Governance Trap

In some cases, cash flow is controlled by governance but never distributed or productively deployed, leading to capital inefficiency and political stagnation.

6. Measuring Protocol Cash Flow On-Chain

One of crypto’s advantages is radical transparency.

Key metrics include:

- Fee revenue by asset

- Net inflows to treasury addresses

- Emission-adjusted profitability

- Fee-to-emission ratios

- Cash flow consistency across cycles

The most credible protocols exhibit:

- Stable or growing fee bases

- Declining reliance on emissions

- Positive net cash flow during market downturns

7. Why Protocol Cash Flow Determines Long-Term Survival

Speculation can bootstrap adoption, but it cannot fund security indefinitely.

Protocols without sustainable cash flow eventually face:

- Security degradation

- Governance capture

- Incentive collapse

- Token death spirals

Protocols with durable cash flow can:

- Pay for security

- Attract top developers

- Outcompete subsidized rivals

- Survive prolonged bear markets

This is not theory. It is observable history.

Cash Flow Is the Final Filter

In the long run, crypto protocols are not valued by slogans or whitepapers. They are valued by their ability to convert user demand into retained economic value.

Protocol cash flow is not a “traditional finance lens” imposed on crypto. It is the native economic truth of decentralized systems. Transparent. Auditable. Unforgiving.

Everything else is secondary.

If a protocol cannot generate and retain cash flow, it does not matter how elegant its code is, how passionate its community is, or how compelling its narrative sounds. Economic reality will assert itself.

It always does.