Every time the crypto market crashes, people swear “this time is different.”

Every time it pumps, people swear “it will never go down again.”

Both sides are always wrong.

Crypto doesn’t move randomly. It doesn’t move logically either.

It moves cyclically, powered by human psychology, liquidity, leverage, innovation, and narrative — over and over again.

If you strip away the memes, the influencers, the charts, and the noise, what you’re left with is something surprisingly old-fashioned: market cycles that look eerily similar across every major crypto era.

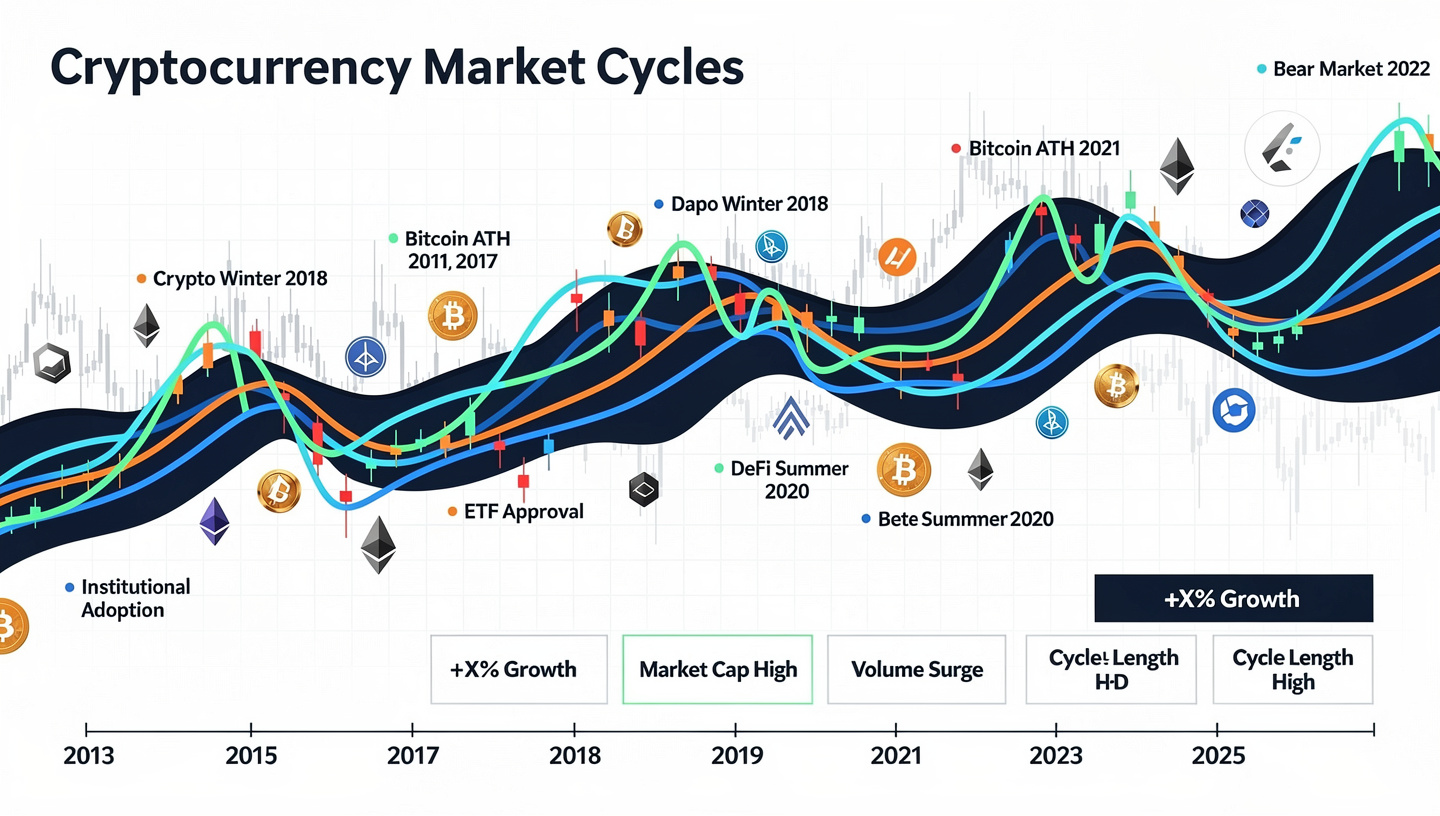

Bitcoin 2011.

Mt. Gox 2013.

ICO mania 2017.

DeFi summer 2020.

NFT + Metaverse 2021.

AI tokens, restaking, memecoin explosions later on.

Different tech. Same behavior.

This article will break down crypto market cycles using real historical examples, not textbook theory. We’ll walk through how each phase actually felt while it was happening — because that’s where most people lose money: not from lack of knowledge, but from lack of emotional context.

If you understand this, you stop chasing tops, stop panic-selling bottoms, and start playing the long game while everyone else plays themselves.

The Four Core Phases of Every Crypto Market Cycle

No matter the year, chain, or narrative, crypto cycles almost always move through four phases:

- Accumulation

- Expansion (Markup)

- Distribution

- Capitulation (Markdown)

Let’s not keep this abstract. Let’s put real history on it.

Phase 1: Accumulation — When Crypto Is “Dead”

Psychology: Apathy, Exhaustion, Distrust

Accumulation is the phase nobody wants to talk about — because it’s boring, painful, and lonely.

Prices move sideways. Volatility dies. Twitter engagement collapses.

Influencers disappear or pivot to “AI” or “real businesses.”

This is where smart money quietly buys while retail is emotionally broken.

Real Example: Bitcoin 2015–2016

After the Mt. Gox collapse and Bitcoin’s crash from ~$1,100 to ~$200:

- Media declared Bitcoin dead (again)

- Developers kept building quietly

- Volume dried up

- Price chopped sideways for months

There was no hype. No excitement. No urgency.

That’s the point.

Most people emotionally detach during accumulation. They either:

- Leave crypto entirely

- Or swear they’ll “buy later when it’s safer”

Later never comes.

Why Accumulation Feels Unsafe

Because it is.

There are no guarantees. No momentum. No confirmation.

You’re buying when the narrative is maximum uncertainty.

That’s why the rewards are asymmetric.

Phase 2: Expansion — The Slow Rise No One Trusts

Psychology: Skepticism → Hope → FOMO

Expansion begins quietly. Price starts trending up, but sentiment lags behind.

Early buyers are cautious. They don’t celebrate — they’ve been hurt before.

Real Example: Bitcoin 2016–Early 2017

Bitcoin climbs from ~$400 to ~$1,000.

What did people say?

- “Dead cat bounce”

- “It’s just manipulation”

- “I’ll buy after a pullback”

Then $1,000 breaks.

Suddenly headlines return. Google searches rise. New money enters.

But here’s the key:

The most profitable part of the cycle feels uncomfortable, not euphoric.

During early expansion, people sell too early because they don’t trust the move.

Phase 3: Mania — When Everyone Becomes a Genius

Psychology: Euphoria, Overconfidence, Greed

This is the phase everyone thinks they want — but few survive.

Prices go vertical. New narratives appear weekly. Risk tolerance explodes.

Real Example: ICO Boom 2017

- Whitepapers replaced products

- Tokens 10x’d on listing

- People quit jobs to trade full-time

- “Utility” was optional

- Everything was “the next Ethereum”

The most dangerous signal?

Everyone makes money — even bad traders.

That’s when discipline dies.

Leverage increases. Position sizes balloon. People stop taking profits because “it’s going higher.”

And it does — until it doesn’t.

Phase 4: Distribution — Smart Money Exits Quietly

Psychology: Denial

Distribution doesn’t look like a crash.

It looks like:

- Choppy price action

- “Healthy consolidation”

- “Just a shakeout”

Whales sell into strength while retail buys dips.

Real Example: Late 2021 (BTC ~$60k)

Narratives were endless:

- Metaverse

- NFTs

- Layer 2s

- Web3 everything

But on-chain data showed:

- Long-term holders distributing

- Exchange inflows rising

- Leverage at all-time highs

Retail didn’t want to hear it.

Why?

Because selling feels stupid when prices are high.

Phase 5: Capitulation — Pain, Panic, and Forced Selling

Psychology: Fear, Regret, Shame

This is where dreams die.

Prices collapse faster than people expect.

Bad news compounds. Liquidity vanishes.

Real Example: 2022 Crypto Winter

- Terra/LUNA collapse

- Celsius, Voyager bankruptcies

- FTX implosion

- Bitcoin from ~$69k to ~$15k

Everyone suddenly becomes “long-term.”

Not by choice.

This phase cleans the market:

- Overleveraged traders wiped

- Bad projects die

- Weak hands exit permanently

And quietly…

The next accumulation phase begins.

Why Crypto Cycles Are So Violent

Traditional markets have cycles too — but crypto exaggerates everything.

Reasons Crypto Cycles Are Extreme

- 24/7 Trading

No circuit breakers. No weekends to cool off. - High Leverage

Liquidations accelerate moves both up and down. - Narrative-Driven Valuation

Price moves faster than fundamentals. - Retail-Dominated Participation

Emotional capital reacts violently.

Crypto is not just a market — it’s a psychological pressure cooker.

Common Mistakes People Make Every Cycle

Despite history repeating clearly, most people repeat the same mistakes:

1. Buying Late Expansion

Because price feels “safe” when it’s already overpriced.

2. Holding Through Distribution

Because selling feels like betrayal of the narrative.

3. Panic-Selling Capitulation

Because pain finally overwhelms hope.

4. Missing Accumulation

Because boredom feels worse than fear.

How Professionals Actually Use Market Cycles

Smart participants don’t predict tops or bottoms.

They position according to phase.

Accumulation

- Small size

- Long time horizon

- Focus on survivable assets

Expansion

- Add on confirmation

- Let winners run

- Reduce leverage

Mania

- Scale out

- Rotate into strength

- Raise cash

Distribution

- Protect capital

- Ignore hype

- Watch on-chain behavior

Capitulation

- Preserve mental health

- Avoid revenge trades

- Prepare for next cycle

The Hard Truth: Cycles Are Emotional Tests, Not Technical Ones

Most people don’t lose money because they can’t read charts.

They lose because:

- They want certainty

- They want social proof

- They want comfort

Markets reward none of those.

Crypto rewards:

- Patience during boredom

- Discipline during euphoria

- Courage during despair

Final Thought: The Cycle Is the Teacher

Every cycle feels unique when you’re inside it.

Every cycle looks obvious in hindsight.

The goal isn’t to be perfect.

The goal is to survive long enough to see multiple cycles.

Because once you do, you stop reacting — and start anticipating.