Meme coins don’t die slowly.

They implode at birth.

Not after months of poor engagement. Not after the bear market arrives. They fail inside their first 24–72 hours — right at genesis — when attention is highest, liquidity is thinnest, and every architectural decision gets stress-tested by real capital.

If you’ve spent enough time on-chain, you already know the surface-level reasons:

Bad teams. No marketing. Rugs.

That explanation is lazy.

The real causes are structural. Predictable. Repeating.

Failed meme launches leave behind the same forensic signatures over and over: broken incentive loops, misaligned liquidity mechanics, poor narrative timing, amateur token engineering, and communities that never crystallized into culture.

This article breaks those patterns down — not from theory, but from observed launch behavior across hundreds of meme coins on Ethereum, Solana, Base, and BSC.

If you’re building, trading, or analyzing meme assets, this is the playbook of what not to do.

1. Most Meme Coins Don’t Have a Real Launch Strategy — Just a Deployment

Here’s the uncomfortable truth:

Deploying a token is not launching a product.

Yet most meme teams treat it that way.

They mint a contract, seed a pool, post a few tweets, open Telegram, and assume the market will do the rest.

That’s not a launch. That’s hope.

A real launch has:

- Liquidity engineering

- Distribution planning

- Narrative sequencing

- Influencer timing

- Community activation

- Market maker behavior modeling

Failed meme coins skip all of this.

They rely on organic discovery in an ecosystem where attention is algorithmically gated and capital is hyper-selective.

Result: dead charts within hours.

Successful launches design for flow:

- Flow of attention

- Flow of liquidity

- Flow of holders

- Flow of content

Failed launches drop a token into the void and pray.

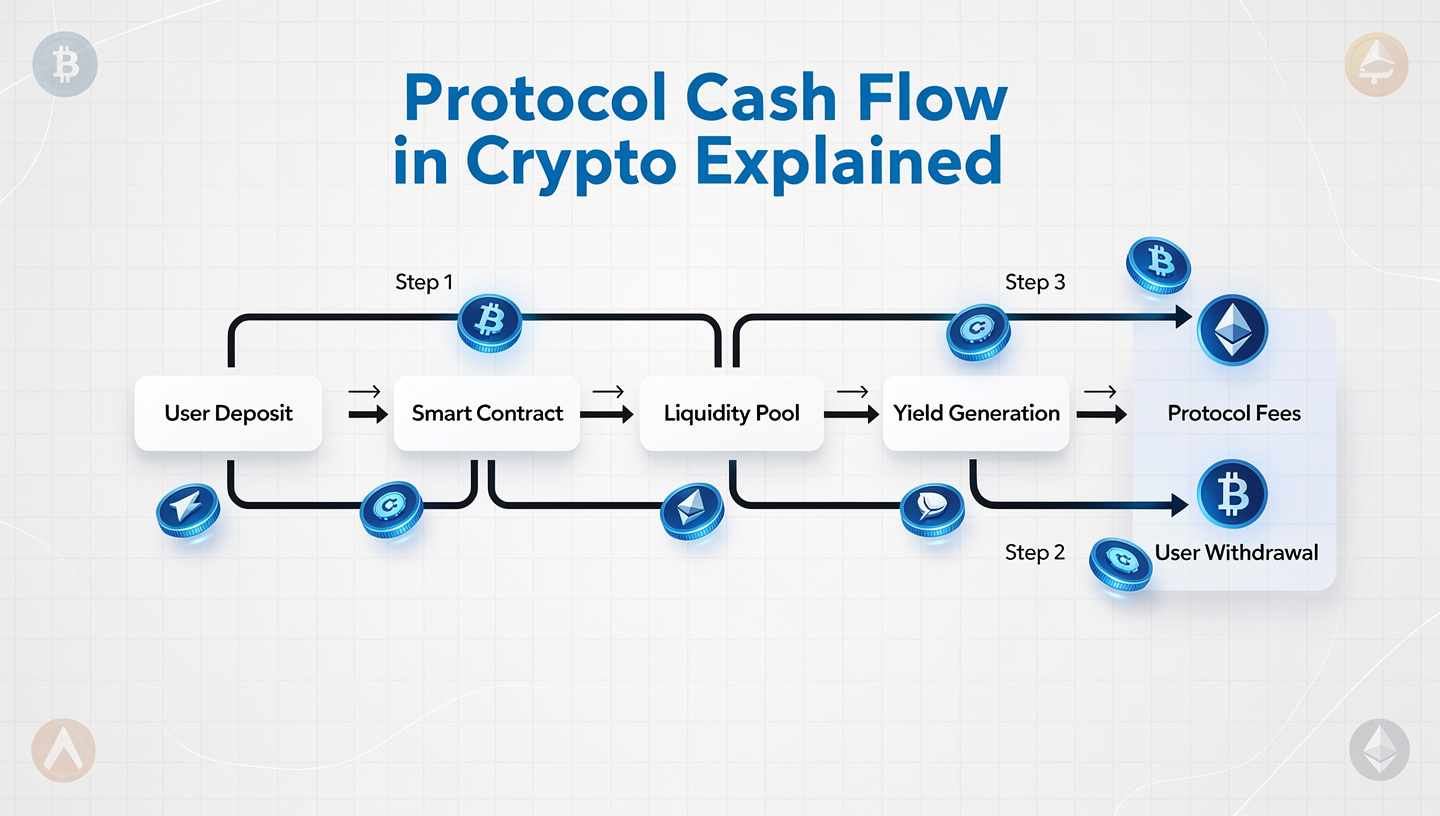

2. Liquidity Is Treated as a Checkbox Instead of a Weapon

Liquidity is not just fuel. It’s a strategic instrument.

Most failed meme coins commit one of two cardinal sins:

❌ Too little liquidity

This creates extreme volatility early on. A few small buys spike price, early wallets dump, chart collapses, confidence evaporates.

Retail interprets this as a rug, even when it isn’t.

Momentum dies before it forms.

❌ Too much liquidity

This flattens early price action. There’s no excitement, no visible upside, no sense of velocity.

In meme markets, perceived explosiveness is part of the product.

If the chart doesn’t move, attention leaves.

Advanced teams tune liquidity depth to create:

- Controlled volatility

- Visible momentum

- Buy pressure feedback loops

Failed teams just pick a number.

They don’t understand slippage psychology.

They don’t understand how early chart structure affects social propagation.

They don’t understand that liquidity placement is marketing.

3. Supply Distribution Is Almost Always Broken

Look at failed meme coins on any chain and you’ll see the same pattern:

- Top 10 wallets hold 40–70%

- Dev wallet is oversized

- Early snipers own the float

- Community owns scraps

This kills projects before they breathe.

Why?

Because meme coins are coordination games.

People don’t buy memes for fundamentals.

They buy because they believe other people will buy too.

Centralized supply destroys that belief.

Retail sees wallet concentration and backs away. Smart money front-runs dumps. Communities never form because participants feel extractive dynamics from block one.

Successful memes engineer wide early distribution, even at the cost of short-term price.

Failed memes optimize for dev bags.

Markets punish that instantly.

4. No Narrative Layer = No Market Memory

Every strong meme has a story.

Not lore. Not backstory.

Narrative.

Something that compresses into a sentence:

- PEPE: internet-native absurdity

- DOGE: ironic sincerity

- BONK: Solana revival energy

- WIF: visual identity + randomness

Failed meme coins launch without narrative gravity.

They pick random animals.

They copy trending formats.

They reuse tired slogans.

There’s nothing for people to anchor to mentally.

In crypto, attention is stored in narrative.

If your token doesn’t give traders something repeatable to say, quote, meme, or remix, it doesn’t propagate.

No propagation = no liquidity expansion.

Most failed launches don’t die from lack of code.

They die from lack of story.

5. Teams Underestimate the First 6 Hours

Genesis is everything.

The first six hours determine:

- Holder composition

- Social velocity

- Chart structure

- Reputation

And most teams are unprepared.

Common mistakes:

- Telegram opens late

- Twitter account isn’t warmed up

- No pinned roadmap or vision

- Mods absent during chaos

- No real-time comms

This creates uncertainty.

Uncertainty kills meme momentum.

Early buyers need:

- Immediate feedback

- Visible activity

- Responsive leadership

- Clear direction

Silence equals weakness.

Weakness equals exit liquidity.

6. Marketing Is Treated as Shilling Instead of System Design

Posting links is not marketing.

Buying influencer tweets is not marketing.

Real meme marketing is system-level:

- Content pipelines

- Community meme factories

- Alpha group seeding

- Cross-ecosystem bridges

- Coordinated timing

Failed meme coins rely on random callers and low-quality Telegram promos.

They don’t build distribution infrastructure.

They don’t cultivate creators.

They don’t seed culture.

They just spam.

Spam doesn’t build belief.

Belief builds markets.

7. Devs Exit Too Early — or Never Exit at All

Both are fatal.

Some devs dump immediately.

Others refuse to sell any tokens ever, thinking this signals strength.

Both behaviors break incentive alignment.

Markets want:

- Devs who take some profit

- But stay operational

- Continue shipping

- Continue engaging

When devs disappear, trust collapses.

When devs never realize gains, they burn out.

Failed meme coins almost always show unhealthy dev-token dynamics.

Either hyper-extractive or unrealistically idealistic.

Neither works.

8. Communities Are Built After Launch (Too Late)

Community formation is not a post-launch activity.

It must begin before deployment.

The strongest meme coins pre-seed:

- Discords

- Telegrams

- Twitter spaces

- Early believers

- Meme creators

Failed launches deploy first, recruit later.

That’s backwards.

You don’t launch a party and then invite guests.

You invite guests, then open the doors.

9. No Long-Term Game Plan Beyond “Go Up”

Ask failed meme teams what happens after initial pump.

You’ll get silence.

Or vague answers.

Or “we’ll see.”

Markets price uncertainty brutally.

Even memes need trajectories:

- NFT integrations

- AI bots

- Games

- Merch

- DAO tooling

- Agent frameworks

- Cross-chain expansion

Not because these features always matter — but because direction matters.

People hold narratives, not tickers.

10. They Ignore Market Cycles and Launch at the Wrong Time

Timing matters more than code.

Launching during:

- Low volatility regimes

- Risk-off macro

- Major unlock weeks

- Competing hype cycles

…is suicide.

Failed meme coins often deploy randomly.

Successful ones wait for:

- Liquidity rotation

- Narrative windows

- Chain-specific hype

Markets reward patience.

Final Thought: Meme Coins Are Economic Organisms

They are not jokes.

They are living coordination systems powered by belief, liquidity, and shared narrative.

Failed meme coins don’t fail because memes are stupid.

They fail because teams misunderstand:

- Human psychology

- Market microstructure

- Attention economics

- Distribution dynamics

A meme coin launch is closer to a social experiment than a software release.

If you ignore that reality, your chart will teach it to you.

Fast.