Crypto’s institutional era did not begin with a bell-ringing ceremony or a sudden ideological surrender. It started with custody paperwork. With compliance teams. With boardroom risk committees arguing over basis points and counterparty exposure. It began when spreadsheets replaced slogans—and when capital that moves pension funds and insurance reserves started to lean, carefully, into a system originally designed to operate without them.

This article is about that slow gravity.

Not about hype cycles or influencer narratives. Not about price candles. This is about structure: how institutions are entering crypto, what they are demanding in return, and how their presence is quietly rewiring everything from market microstructure to protocol governance.

The result is not simply “more money in crypto.”

It is a different crypto.

1. Institutions Didn’t Arrive All at Once—They Infiltrated by Layers

Retail came to crypto through curiosity and speculation. Institutions arrived through operational necessity.

Their path looked like this:

- First: regulated custody

- Then: derivatives and hedging instruments

- Then: passive exposure vehicles

- Finally: balance-sheet deployment

Each step required infrastructure. Each layer imposed constraints.

Early on, large asset managers couldn’t even hold native crypto without violating internal controls. That changed as qualified custodians emerged and as futures markets matured. Only then did products like spot ETFs become viable.

This sequencing matters because it explains why institutional adoption feels slow but irreversible.

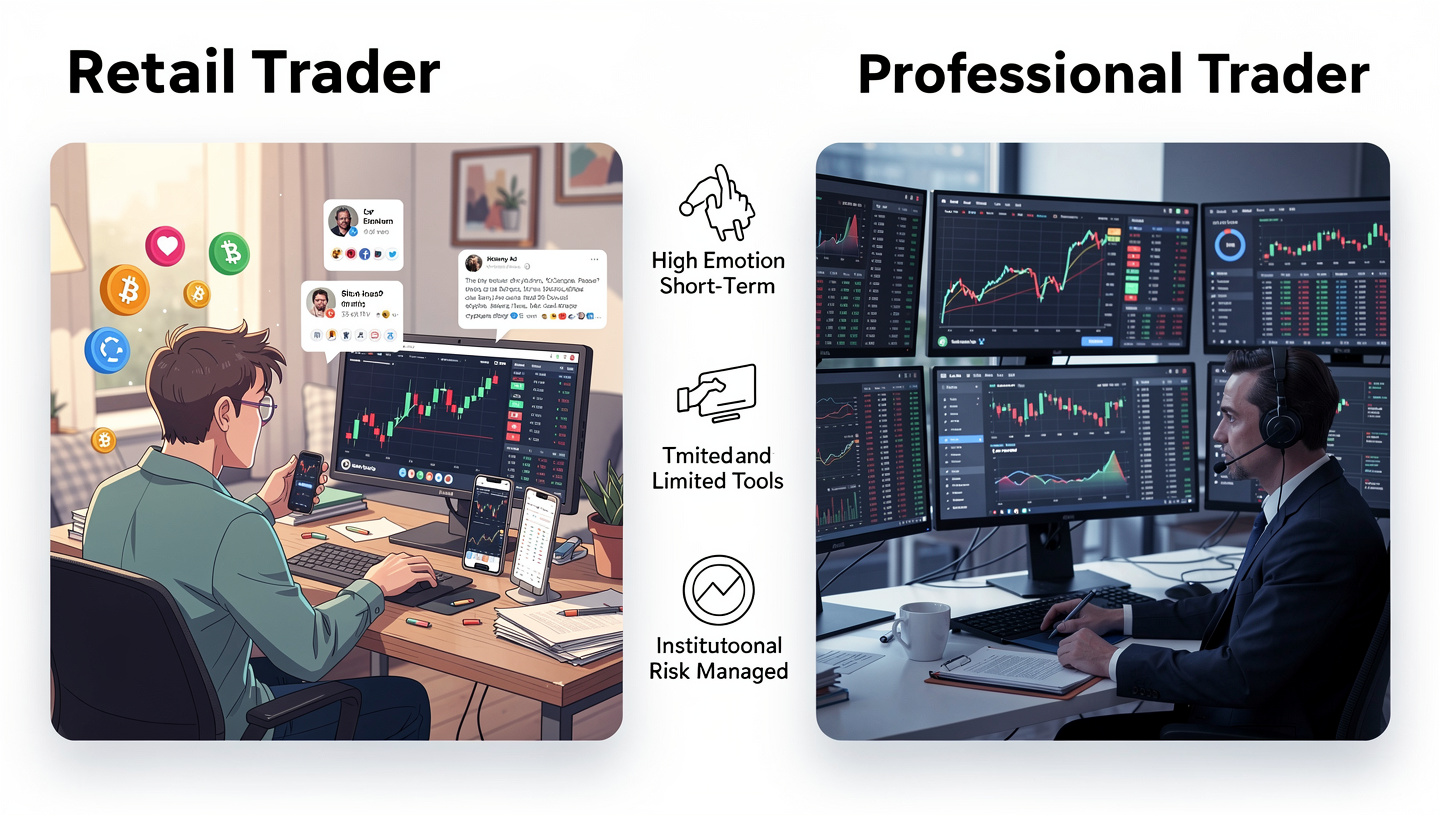

Retail adoption is emotional. Institutional adoption is procedural.

Once a pension fund builds crypto risk models into its portfolio framework, that work doesn’t get undone easily.

2. The ETF Era: Crypto Becomes a Portfolio Component

The approval of spot Bitcoin ETFs was not just a headline event—it was a structural inflection point.

Firms like BlackRock and Fidelity Investments didn’t enter crypto to speculate. They entered to productize exposure for clients who already trust their platforms.

That distinction is critical.

An ETF does three things simultaneously:

- Abstracts away private key management

- Integrates crypto into traditional brokerage accounts

- Normalizes Bitcoin alongside stocks and bonds

Once this happens, crypto stops being “alternative.” It becomes allocatable.

For financial advisors managing hundreds of millions, this is transformative. A 1–3% Bitcoin allocation no longer requires new operational workflows. It becomes a line item.

This is how institutional capital really enters markets—not with dramatic buys, but through model portfolios.

3. Regulation Isn’t Killing Crypto—It’s Reshaping It

The retail narrative often frames regulators as adversaries. Institutions see them differently: as gatekeepers to scale.

Agencies like the U.S. Securities and Exchange Commission don’t exist to validate decentralization. They exist to enforce disclosure, custody standards, and investor protections.

Institutions need this.

Without regulatory clarity:

- Compliance departments block exposure

- Auditors raise red flags

- Boards reject allocation proposals

Regulation introduces friction—but also legitimacy.

That legitimacy is what allows endowments, insurers, and sovereign funds to participate.

The irony is unavoidable: crypto’s path to mass institutional adoption runs directly through centralized oversight.

4. Market Structure Is Being Rebuilt from the Inside

Traditional finance runs on mature plumbing:

- Central clearing

- Margin frameworks

- Standardized settlement cycles

- Deep derivatives liquidity

Crypto historically had none of this.

Institutions demanded it.

Today, platforms like Coinbase provide institutional custody and prime brokerage services. The Chicago Mercantile Exchange offers regulated Bitcoin and Ethereum futures used by hedge funds for basis trades and risk hedging.

This is not cosmetic.

It changes volatility dynamics, arbitrage efficiency, and capital flow patterns.

As futures open interest grows, spot markets become increasingly influenced by derivatives positioning. Funding rates, options skews, and term structures now matter more than Twitter sentiment.

Crypto is evolving from a fragmented retail arena into a multi-layered financial market.

5. Balance Sheets Are Becoming On-Chain

Some institutions went beyond products and infrastructure—they put crypto directly on their balance sheets.

The most visible example remains MicroStrategy, which effectively transformed itself into a Bitcoin proxy through aggressive accumulation.

Whether one views this as visionary or reckless, it demonstrated something important: crypto could function as a treasury reserve asset.

That precedent matters.

Corporate treasuries are conservative by design. When even one publicly traded firm adopts Bitcoin as a primary reserve strategy, it forces CFOs everywhere to at least evaluate the thesis.

Institutions do not move in herds initially. They move by reference.

6. Passive Capital Is Changing Price Discovery

Retail markets are reactive. Institutional markets are allocative.

This difference reshapes price formation.

ETFs and index products introduce passive flows—capital that enters based on asset weightings rather than conviction. As more money moves through these vehicles, price discovery becomes increasingly mechanical.

This has several consequences:

- Momentum strengthens during inflows

- Corrections deepen during redemptions

- Correlations rise during macro shocks

Crypto begins to behave less like an isolated ecosystem and more like a risk-on asset class embedded in global liquidity cycles.

We already see this during Federal Reserve announcements and equity drawdowns.

Bitcoin now responds to macro.

That alone marks a profound shift.

7. Governance Is Quietly Centralizing

Decentralized protocols still exist. On-chain voting still happens.

But institutional participation introduces new power dynamics.

Large holders influence:

- Validator concentration

- Governance proposals

- Development funding priorities

When asset managers custody billions in tokenized assets, their preferences matter—even if they don’t vote directly.

Foundations notice. Core developers adapt. Roadmaps shift toward enterprise compatibility, compliance tooling, and scalability features that align with institutional needs.

This is not necessarily malicious.

It is structural gravity.

Capital shapes development.

8. DeFi Is Being Repackaged for TradFi

Institutions are not rushing into permissionless liquidity pools. They are building gated versions of decentralized finance.

We now see:

- Permissioned lending protocols

- KYC-enabled liquidity pools

- Tokenized Treasury products

- On-chain repo experiments

Asset managers like Grayscale Investments are pushing structured exposure products, while banks experiment with blockchain settlement layers behind closed doors.

The end result is a hybrid model:

Public chains for transparency.

Private rails for compliance.

Crypto is not replacing traditional finance.

It is being absorbed into it.

9. Volatility Is Being Financialized

Crypto volatility used to be a retail phenomenon.

Now it is a tradable product.

Options desks structure volatility trades. Hedge funds run basis strategies. Market makers arbitrage ETF flows against futures curves.

Volatility becomes yield.

This matters because financialized volatility tends to compress over time. As more participants monetize price swings, extreme moves become harder to sustain.

Not impossible—but structurally dampened.

The wild-west phase gives way to managed chaos.

10. The Cultural Shift No One Talks About

Institutional crypto does not speak the language of decentralization maximalism.

It speaks the language of:

- Risk-adjusted returns

- Sharpe ratios

- Capital efficiency

- Regulatory capital treatment

This cultural import changes community expectations.

Projects increasingly pitch:

- Enterprise integrations

- Compliance readiness

- Revenue models

Whitepapers look more like investor decks.

This is not accidental.

Founders follow funding.

11. What This Means for Individual Investors

Retail is not being displaced—but it is being outpaced.

Institutions bring:

- Lower funding costs

- Superior execution

- Better data access

This creates asymmetric competition.

However, retail retains advantages too:

- Faster decision cycles

- Willingness to explore emerging protocols

- Ability to take concentrated risk

The opportunity now lies earlier in the stack—before assets are packaged, regulated, and normalized.

Once institutions arrive in force, most of the exponential upside is already gone.

12. Crypto Is Becoming Infrastructure

The most important shift is conceptual.

Crypto is no longer just an asset class.

It is becoming financial infrastructure.

Tokenized securities. On-chain settlement. Programmable collateral. Atomic swaps.

These are not retail toys. They are efficiency upgrades for global finance.

Institutions see this clearly.

That is why they are building slowly, methodically, and permanently.

Final Thoughts: A Market Rewritten by Process, Not Passion

Crypto began as a rebellion.

It is evolving into a system.

Institutions did not conquer crypto through ideology. They entered through compliance manuals, custody agreements, and product committees. They did not overthrow decentralization—they reframed it inside legal and operational boundaries.

What emerges is neither pure crypto nor pure TradFi.

It is something new: a financial layer where programmable assets coexist with regulatory frameworks, and where decentralized networks serve centralized capital.

This transition will not feel dramatic day to day.

But years from now, we will look back and realize that the most profound change in crypto did not come from a bull market.

It came from institutions doing what they always do best:

Standardizing the future—one process at a time.