Cryptocurrency was born from an idea of financial freedom — borderless money, self-sovereignty, and independence from traditional institutions. But as crypto has grown from a niche experiment into a multi-trillion-dollar global market, one reality has become unavoidable: taxes.

For many users, crypto taxes feel confusing, intimidating, or even contradictory to the spirit of decentralization. Why should a peer-to-peer digital asset be taxed at all? How do governments track something designed to be pseudonymous? And what exactly counts as a taxable event?

This article aims to answer those questions — clearly, honestly, and thoroughly. By the end, you will understand how crypto taxes generally work, how gains and losses are calculated, what needs to be reported, and how to stay compliant without losing your sanity.

This is not legal advice, but it is a practical, real-world guide.

1. Why Governments Tax Cryptocurrency

Despite its decentralized nature, cryptocurrency is still considered property, assets, or income in most countries — not currency.

From a government’s perspective:

- Crypto can be bought, sold, traded, earned, and spent

- It can generate profits and losses

- It can be used as compensation or investment

That makes it taxable under existing frameworks.

Governments don’t tax crypto because they dislike innovation. They tax it because economic activity creates taxable value, regardless of whether that value is digital, physical, or decentralized.

Ignoring crypto taxes doesn’t make them disappear — it only increases future risk.

2. What Counts as a Taxable Crypto Event?

One of the biggest misconceptions is that taxes only apply when you “cash out” to fiat. In reality, many crypto actions trigger taxes.

Common taxable events include:

- Selling crypto for fiat (USD, EUR, VND, etc.)

- Trading one crypto for another (BTC → ETH)

- Using crypto to buy goods or services

- Receiving crypto as income (salary, freelancing, mining, staking)

- Earning rewards, airdrops, or referral bonuses

- NFTs sales and certain DeFi activities

Common non-taxable events:

- Buying crypto with fiat (no sale yet)

- Transferring crypto between your own wallets

- Holding crypto without selling (unrealized gains)

- Gifting crypto in some jurisdictions (rules vary)

Understanding this distinction is crucial. Taxes are usually triggered when value changes hands, not when prices move on paper.

3. Capital Gains: The Core of Crypto Taxation

Most crypto taxes revolve around capital gains.

What is a capital gain?

A capital gain occurs when you sell or dispose of crypto for more than you paid for it.

Example:

- You buy 1 ETH at $1,500

- Later, you sell it at $2,000

- Your capital gain is $500

That $500 is taxable.

Capital losses

If you sell for less than your purchase price, you incur a capital loss, which can often reduce your tax bill.

Example:

- Buy BTC at $40,000

- Sell at $32,000

- Capital loss: $8,000

In many countries, losses can offset gains and sometimes even other income.

4. Short-Term vs Long-Term Gains

Many tax systems distinguish between short-term and long-term gains.

Short-term gains

- Assets held for less than a defined period (often 12 months)

- Usually taxed at higher income tax rates

Long-term gains

- Assets held longer than the threshold

- Often taxed at lower, preferential rates

This encourages long-term investing rather than speculation.

Crypto traders who frequently buy and sell often face higher effective tax rates than long-term holders — even if their total profit is the same.

5. Cost Basis: The Hidden Complexity

Your cost basis is what you originally paid for an asset, including fees.

Sounds simple — until you:

- Buy crypto at multiple prices

- Trade across multiple exchanges

- Receive partial amounts

- Use DeFi platforms

- Bridge assets across chains

Different jurisdictions allow different accounting methods:

- FIFO (First In, First Out)

- LIFO (Last In, First Out)

- Average cost

The method you use can significantly impact your tax bill.

Poor record-keeping is one of the most common reasons people overpay or underreport crypto taxes.

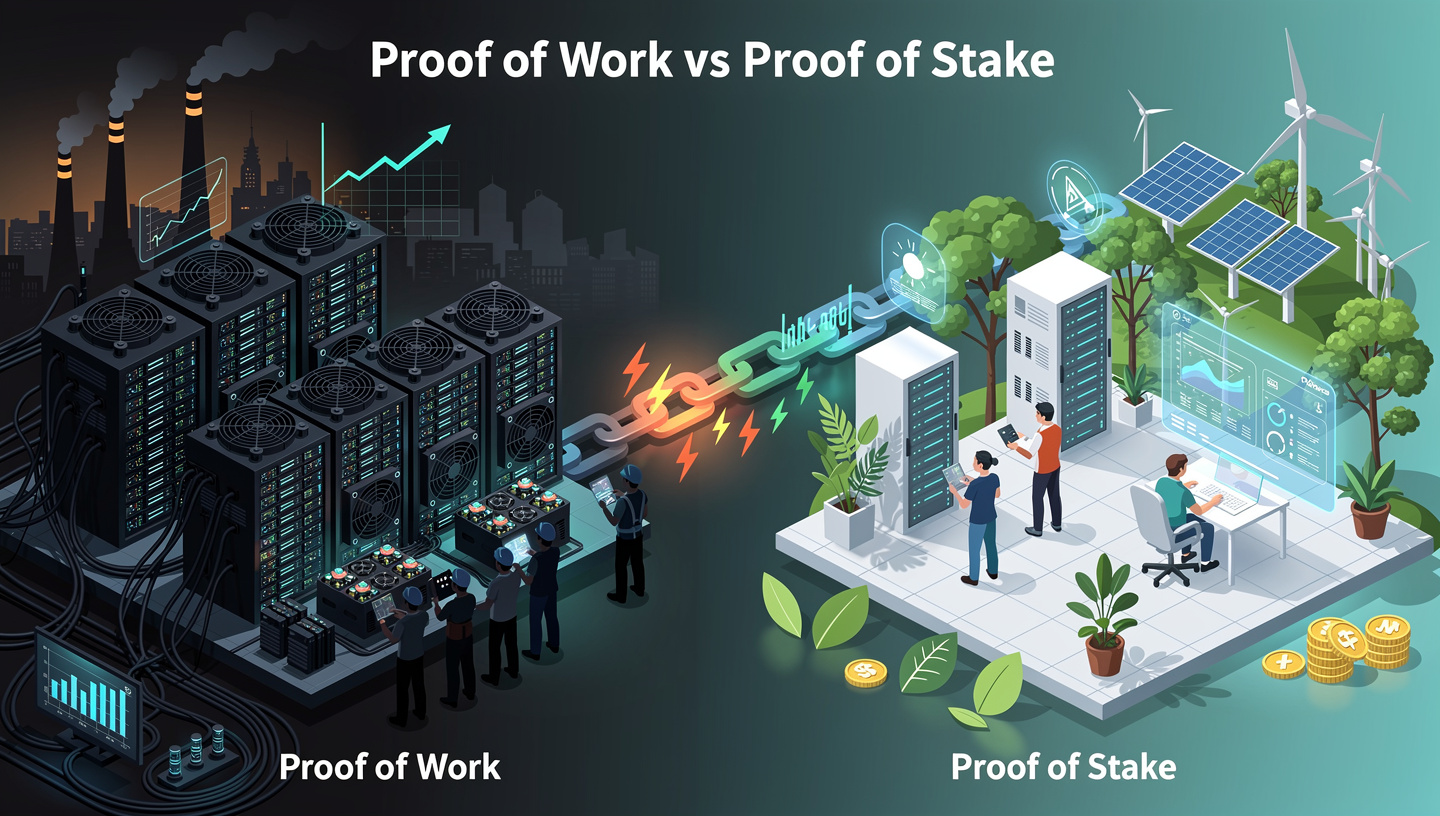

6. Crypto as Income: Mining, Staking, and Salaries

Not all crypto taxes are capital gains.

Crypto income includes:

- Mining rewards

- Staking rewards

- Yield farming rewards

- Salaries paid in crypto

- Freelance payments

- Referral bonuses

- Airdrops (in many jurisdictions)

This income is typically taxed at fair market value at the time you receive it — even if you don’t sell immediately.

Later, when you sell that crypto, capital gains tax may apply again based on price changes.

Yes, this means the same crypto can be taxed twice — once as income, once as a gain.

7. NFTs, DeFi, and Advanced Scenarios

As crypto evolves, tax rules become more complex.

NFTs

- Creating and selling NFTs may be considered business income

- Royalties are often taxable income

- Trading NFTs can trigger capital gains

DeFi activities

- Liquidity provision

- Token swaps

- Governance rewards

- Wrapped tokens

Many tax authorities treat these as taxable disposals, even if users view them as “technical operations.”

This gap between user intent and legal interpretation is one of crypto’s biggest tax challenges.

8. Reporting Crypto Taxes: What You Must Declare

Most tax authorities require:

- Total capital gains and losses

- Crypto income amounts

- Dates of acquisition and disposal

- Cost basis and sale value

- Wallets and exchanges used (in some cases)

Even if you lost money, you still need to report.

Failing to report is often a bigger issue than failing to pay.

9. Can Governments Track Crypto?

Many users assume anonymity protects them. This is increasingly false.

Governments can track crypto through:

- KYC exchanges

- Blockchain analytics

- Exchange reporting requirements

- Bank transaction monitoring

- International data sharing agreements

Crypto is pseudonymous, not invisible.

The idea that “they’ll never find out” is becoming outdated — and dangerous.

10. Penalties for Non-Compliance

Consequences vary by country but may include:

- Fines

- Interest on unpaid taxes

- Audits

- Account freezes

- Criminal charges in extreme cases

Often, voluntary disclosure leads to lighter penalties than waiting to be caught.

11. Practical Tips to Stay Compliant

1. Track everything early

Use spreadsheets or crypto tax software from day one.

2. Separate wallets

Consider different wallets for trading, long-term holding, and income.

3. Save transaction records

Exchanges may not keep data forever.

4. Understand local rules

Crypto tax laws differ significantly by country.

5. Don’t panic

Most tax authorities care more about honest reporting than perfection.

Final Thoughts: Freedom Comes with Responsibility

Crypto empowers individuals like no financial system before it. But true freedom isn’t about avoiding responsibility — it’s about understanding the rules and navigating them intelligently.

Taxes may not be exciting. They may even feel unfair at times. But learning how crypto taxes work protects you, preserves your gains, and allows you to participate in this new economy with confidence.

Crypto is the future.

Understanding crypto taxes is how you stay in it — long term.