Volatility is not a flaw in crypto markets. It is the raw material.

Traditional finance treats volatility as something to be feared, suppressed, or diversified away. Crypto forces a different posture: volatility is the engine that creates yield, liquidations, arbitrage, funding rates, and incentive emissions. If you are earning passive income on-chain, you are not avoiding volatility—you are monetizing it, whether consciously or not.

The problem is that most yield strategies monetize volatility asymmetrically. You collect small, steady returns, then periodically absorb catastrophic drawdowns.

That is not investing. That is selling insurance without pricing the tail risk.

This article is about building passive income strategies in crypto that survive volatility instead of being periodically destroyed by it.

Not through vague diversification. Not through blind “HODL and stake.”

Through deliberate structural hedging.

Volatility Is the Tax on Passive Crypto Yield

Every passive income strategy in crypto implicitly embeds a short-volatility position.

Let’s enumerate:

- Liquidity provision earns fees but loses to impermanent loss during large price moves.

- Lending earns interest but faces liquidation cascades during sharp drawdowns.

- Stablecoin farming assumes peg stability.

- Staking assumes token price resilience.

- Delta-neutral yield depends on funding remaining favorable.

- Structured vaults assume volatility remains within modeled ranges.

You are collecting premiums while carrying latent convex risk.

This is identical to options writing.

In traditional markets, selling volatility without hedging is considered professional malpractice. In crypto, it is marketed as “DeFi yield.”

The industry normalized asymmetric payoff profiles because early participants were compensated by exponential asset appreciation. That regime is over.

Now you must engineer resilience.

Passive Income Without Risk Management Is Not Passive

Passive income is a misnomer.

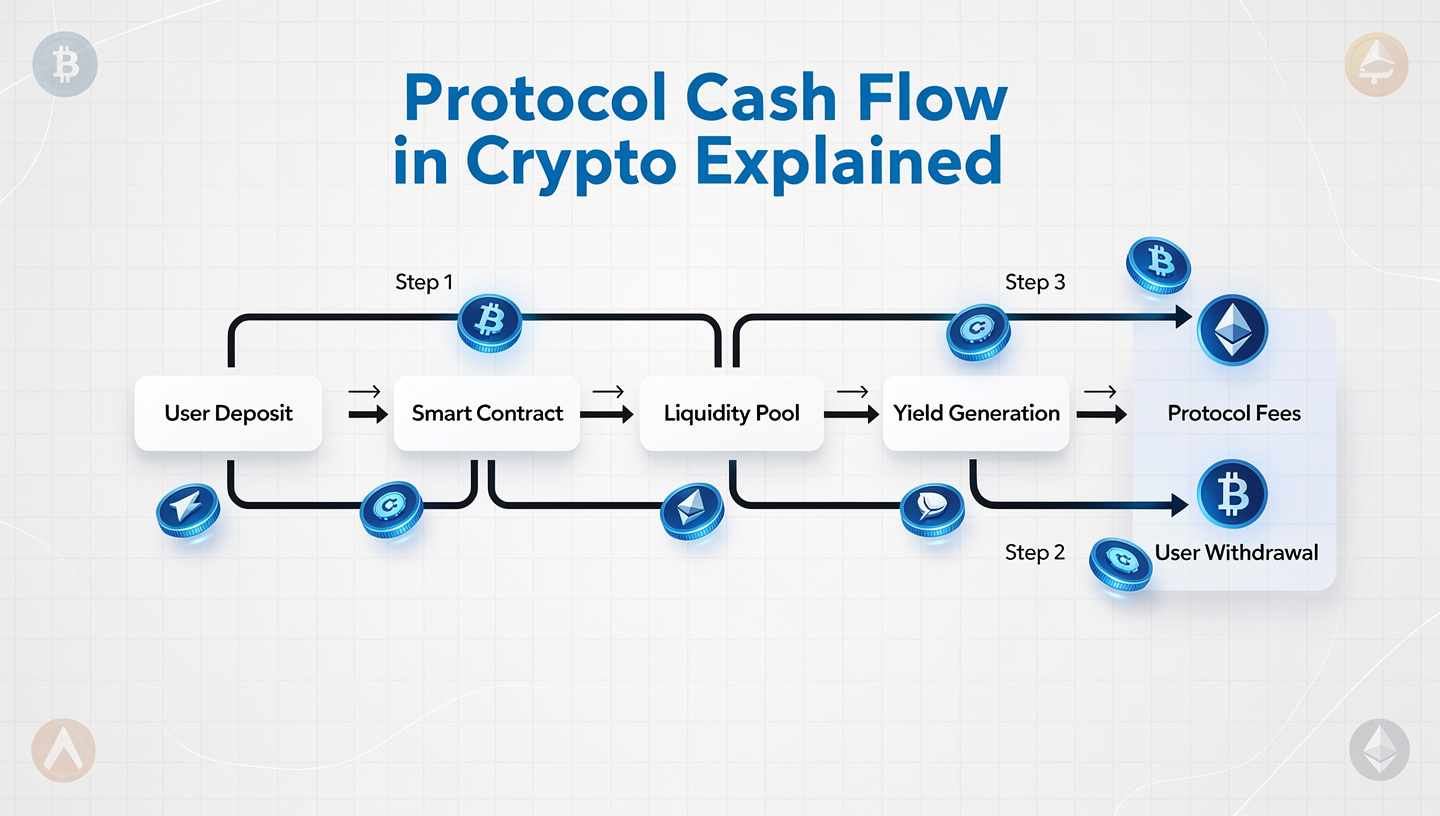

On-chain yield is active risk underwriting. You are underwriting:

- Smart contract risk

- Oracle risk

- Liquidity risk

- Market volatility

- Correlation spikes

- Stablecoin depegs

- Governance capture

- Regulatory discontinuities

Most strategies acknowledge only one variable: APY.

That is amateur capital allocation.

Real passive income begins when downside scenarios are explicitly modeled and hedged.

The Core Framework: Separate Yield Generation From Volatility Exposure

The most important conceptual shift is this:

Yield production and price exposure must be treated as independent systems.

Most participants blend them.

They stake ETH and hope ETH goes up.

They LP volatile pairs and pray ranges hold.

They lend assets and assume borrowers remain solvent.

Instead, design your portfolio in layers:

- Yield Layer – Generates cash flow (fees, interest, emissions)

- Exposure Layer – Determines directional market risk

- Hedge Layer – Neutralizes unwanted volatility

Once separated, you gain control.

Let’s walk through how this works in practice.

Stablecoin Yield Is Not Stable

Start with the simplest case: stablecoin farming.

Depositing USDC into protocols like Aave or market-making on Uniswap feels conservative.

It isn’t.

Stablecoin strategies are exposed to:

- Depeg risk

- Systemic liquidity crunches

- Protocol insolvency

- Collateral cascade failures

You are effectively long crypto system stability.

To hedge this, professional operators use volatility convexity:

- Allocate a small portion of yield to long volatility instruments (options or perps)

- Maintain tail hedges on major assets like Bitcoin and Ethereum

- Rotate stablecoin exposure across issuers and mechanisms

The math is simple: sacrificing 10–20% of yield to purchase convex protection massively improves long-term survival.

Most retail farmers refuse to do this.

They optimize APY.

They blow up.

Liquidity Provision: You Are Short Gamma Whether You Admit It or Not

Automated market makers reward liquidity providers for absorbing price movement.

That is a short-gamma position.

During slow markets, you outperform.

During trends, you bleed inventory.

If you provide liquidity on ETH/USDC, you are systematically selling ETH as price rises and buying as it falls.

That is anti-momentum.

Professional LPs hedge this by:

- Holding offsetting spot positions

- Running delta-neutral vaults

- Using perpetual futures to flatten exposure

- Dynamically rebalancing ranges

Without these techniques, LP income is a statistical illusion.

Fees feel real. Impermanent loss is deferred reality.

Delta-Neutral Farming Is Not Delta-Neutral Under Stress

Many modern strategies attempt to neutralize price risk using perpetual futures while farming yields elsewhere.

On paper:

- Long spot ETH

- Short ETH perp

- Farm rewards

In practice:

- Funding flips negative

- Liquidations spike

- Borrow rates explode

- Exchanges throttle withdrawals

Delta neutrality assumes continuous liquidity.

Crypto provides discontinuous liquidity.

That is the hidden risk.

Proper hedging requires:

- Multi-venue execution

- Conservative leverage

- Excess collateral buffers

- Automated unwind logic

If your strategy fails when volatility spikes, it is not hedged.

It is fragile.

Structured Products and DeFi Options: Retail-Friendly Risk Transfer

Protocols inspired by MakerDAO and newer structured vault platforms allow users to sell covered calls, puts, or volatility bands.

These instruments allow you to:

- Cap upside in exchange for yield

- Receive premiums for providing downside protection

- Monetize sideways markets

This is classical options theory, repackaged for DeFi.

The danger is opacity.

Most vault users do not understand:

- Strike placement

- Implied volatility

- Assignment probability

- Tail risk

If you cannot explain your payoff diagram, you are gambling.

The Portfolio-Level Hedge: Treat Crypto Like a Derivatives Book

At scale, volatility hedging becomes portfolio-level engineering.

Professionals think in terms of:

- Net delta

- Net gamma

- Vega exposure

- Correlation matrices

- Liquidity stress

Your passive income portfolio should be evaluated the same way.

A mature structure looks like this:

Core Yield Engine

- Stablecoin lending

- Conservative LP

- Low-leverage farming

Directional Allocation

- Spot BTC / ETH

- Select alt exposure

Hedge Overlay

- Long volatility positions

- Deep out-of-the-money puts

- Inverse perpetuals

- Cash reserves for forced deleveraging events

The hedge overlay is not designed to profit.

It is designed to prevent ruin.

The Buffett Parallel: Survive First, Compound Second

Warren Buffett built Berkshire Hathaway on a simple principle:

Never risk permanent capital loss.

Crypto culture inverted that logic.

It celebrates volatility. It glorifies drawdowns. It worships asymmetric upside.

But compounding requires continuity.

If your portfolio drops 70%, you need 233% just to recover.

That is arithmetic, not philosophy.

The real alpha is avoiding catastrophic resets.

Why Institutions Already Do This (Quietly)

Large capital allocators entering crypto—firms like BlackRock—do not chase APY screenshots.

They deploy capital with:

- Systematic hedging

- Conservative leverage

- Counterparty diversification

- Legal contingency planning

Retail strategies lag institutional frameworks by several years.

Learning from them now is not optional.

It is survival.

Practical Hedging Techniques You Can Implement Today

Here are concrete methods used by serious operators:

1. Yield Skimming to Buy Protection

Allocate a fixed percentage of weekly yield to purchasing downside protection.

Automate it.

2. Volatility Bucketing

Run separate strategies for:

- Low-volatility environments

- High-volatility regimes

- Crisis conditions

Switch based on realized volatility thresholds.

3. Asset Rotation

Rotate yield exposure between BTC, ETH, and stablecoins based on momentum and funding rates.

4. Dry Powder Reserves

Hold 10–30% in unallocated capital for liquidation cascades and forced sellers.

This is where generational entries occur.

5. Stress Testing

Model 30%, 50%, and 70% drawdowns.

If your strategy collapses under those scenarios, redesign it.

The Psychological Hedge

Volatility is not only financial.

It is cognitive.

Most investors abandon risk controls during bull markets and panic during crashes.

The discipline to maintain hedges when they feel unnecessary is what separates professionals from tourists.

Passive income strategies fail less from math and more from behavior.

The Endgame: From Yield Chasing to Capital Engineering

Crypto is evolving.

The early phase rewarded recklessness.

The next phase rewards structure.

Yield will compress. Competition will increase. Inefficiencies will disappear.

What remains is portfolio engineering.

The future of passive crypto income belongs to those who:

- Understand volatility as a resource

- Treat yield as insurance premiums

- Hedge systematically

- Preserve capital

- Compound patiently

Everything else is noise.

Final Thought

You do not hedge because you are afraid.

You hedge because you intend to stay.

Passive income in crypto is not about extracting maximum yield this month.

It is about designing systems that still exist five years from now.

That is the difference between farming and finance.