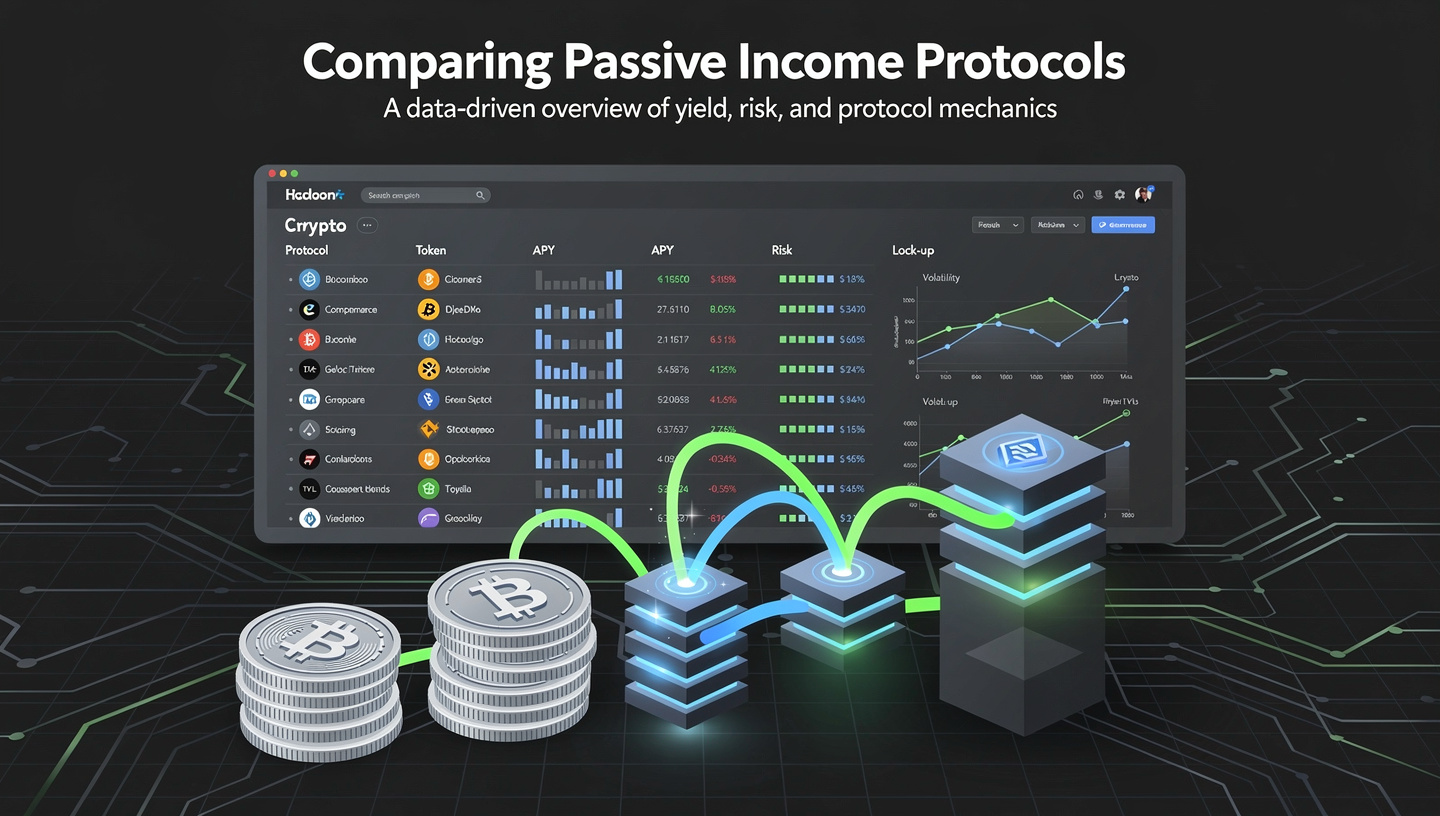

That single observation explains why most investors underperform in crypto—not because the tools are inadequate, but because the frameworks for comparison are shallow. In traditional markets, capital allocation is governed by cash flow durability, counterparty risk, and liquidity under stress. In crypto, those same principles apply—but they are obscured by APY banners, incentive emissions, and dashboards optimized for dopamine, not discipline.

If you study how long-horizon allocators think—investors like Warren Buffett—you’ll notice something consistent: returns are secondary to structure. They care about where yield comes from, who ultimately pays it, and what happens when conditions turn adverse.

This article applies that mindset to crypto.

Not to promote any protocol.

Not to rank them by headline yield.

But to build an objective, repeatable framework for evaluating passive income systems—one that survives market cycles.

1. Why “Passive Income” Is a Misnomer in Crypto

In crypto, yield does not emerge from productive enterprises in the classical sense. There are no factories, no inventory, no consumers purchasing goods.

Instead, yield is generated by:

- Borrowers paying interest

- Traders paying fees

- Networks paying inflation

- New participants subsidizing early adopters

Every protocol redistributes value from one cohort to another.

This means every passive income stream embeds:

- Counterparty risk

- Liquidity risk

- Market reflexivity

- Incentive fragility

Calling this “passive” is a marketing convenience.

In reality, you are underwriting a system.

2. A Taxonomy of Yield Sources

Before comparing protocols, you must classify yield by origin:

A. Interest-Based Yield

Generated from borrowers paying lenders.

Typical in money markets.

Characteristics:

- Dependent on borrowing demand

- Compresses rapidly in bear markets

- Sensitive to collateral volatility

B. Fee-Based Yield

Generated from trading or network activity.

Characteristics:

- Correlated to volume

- Highly cyclical

- More organic than emissions

C. Inflationary Yield

Generated by token issuance.

Characteristics:

- Dilutive

- Unsustainable long term

- Masks real performance

D. Hybrid Yield

A mix of the above, often with layered incentives.

Most DeFi protocols fall here.

Understanding which bucket your yield belongs to matters more than the APY itself.

3. Core Risk Dimensions You Must Measure

Objective comparison requires standardized variables:

1. Yield Source Quality

Who pays you—and why?

Is it:

- Traders?

- Borrowers?

- The protocol treasury?

- Token inflation?

High-quality yield comes from voluntary economic activity. Low-quality yield comes from emissions.

2. Liquidity Depth

Can you exit under stress without catastrophic slippage?

Thin liquidity turns paper profits into theoretical artifacts.

3. Smart Contract Surface Area

More contracts = more attack vectors.

Audit count is not equivalent to safety.

4. Governance Centralization

Who can change parameters?

Admin keys matter.

5. Correlation Risk

Does your yield collapse when the market collapses?

Many protocols fail here.

4. Major Categories of Passive Income Protocols

Let’s classify the landscape.

Money Markets

Protocols like Aave and Compound allow users to lend assets to borrowers.

Yield drivers:

- Borrow demand

- Collateral leverage cycles

Strengths:

- Simple model

- Transparent rates

Weaknesses:

- Capital inefficient

- Vulnerable during liquidation cascades

Decentralized Stable Systems

MakerDAO pioneered overcollateralized lending.

Yield often comes from:

- Stability fees

- Real-world asset integrations

Strengths:

- Conservative design philosophy

- Deep liquidity

Weaknesses:

- Complex governance

- Exposure to off-chain assets

Liquid Staking

Protocols such as Lido and Rocket Pool tokenize staked assets.

Yield source:

- Network issuance

- Validator rewards

Strengths:

- Capital efficiency

- Network-native yield

Weaknesses:

- Depeg risk

- Validator concentration

These systems are deeply coupled to Ethereum consensus dynamics.

Yield Aggregators

Yearn Finance automates strategy allocation across DeFi.

Yield source:

- Meta-optimization of existing protocols

Strengths:

- Professional strategy management

- Gas efficiency

Weaknesses:

- Strategy opacity

- Layered smart contract risk

AMM Liquidity Platforms

Curve Finance and Uniswap distribute trading fees to liquidity providers.

Yield source:

- Trader fees

Strengths:

- Organic revenue

- High transparency

Weaknesses:

- Impermanent loss

- Volume dependency

5. Protocol Archetypes and Structural Tradeoffs

Each category optimizes for different constraints:

| Type | Yield Stability | Risk Complexity | Capital Efficiency |

|---|---|---|---|

| Money Markets | Medium | Medium | Low |

| Liquid Staking | Medium | Medium | High |

| AMMs | Low–Medium | High | Medium |

| Aggregators | Variable | High | High |

There is no superior archetype—only tradeoffs.

6. Liquidity: The Forgotten Variable

Most dashboards show APY.

Few show exit depth.

Liquidity determines whether yield is real.

Ask:

- What is the 2% slippage size?

- How many days of volume back your position?

- Who provides the exit liquidity?

During stress events, liquidity evaporates first—yield second.

This is why identical APYs can have radically different real-world outcomes.

7. Emissions vs Organic Yield

A simple test:

Remove token incentives.

Does the yield survive?

If not, you are farming dilution.

Protocols that rely heavily on emissions exhibit:

- Rapid TVL inflows

- Short-lived loyalty

- Violent unwind phases

Organic yield grows slowly—but compounds reliably.

8. Smart Contract Risk Is Not Binary

“Has it been audited?” is the wrong question.

Better questions:

- How many composable dependencies exist?

- How frequently is code upgraded?

- Are admin keys timelocked?

- Has the protocol survived real stress?

Risk accumulates multiplicatively across layers.

9. A Comparative Evaluation Framework

Use this weighted model:

Yield Quality (30%)

Who pays you?

Liquidity Resilience (25%)

Can you exit?

Structural Complexity (20%)

How many things must go right?

Governance Risk (15%)

Who controls parameters?

Historical Stress Performance (10%)

Has it failed before?

Score each protocol.

Do not optimize for APY.

Optimize for survivability.

10. Practical Portfolio Construction Models

A disciplined passive-income portfolio often looks like:

- 40% network-native yield (liquid staking)

- 30% fee-based AMMs

- 20% conservative lending

- 10% experimental strategies

Rebalanced quarterly.

Exposure capped per protocol.

Liquidity always prioritized.

11. Red Flags Most Investors Miss

- Sudden APY spikes without volume increases

- Governance proposals rushed through with low participation

- Heavy reliance on protocol-owned liquidity

- Yield denominated in the protocol’s own token

- TVL growth outpacing user growth

These signal fragility.

12. The Long View: Sustainability Over Screenshots

Crypto rewards patience—but only when paired with structural thinking.

The highest returns do not come from chasing yield.

They come from understanding:

- Incentive alignment

- Liquidity mechanics

- Risk compounding

Passive income protocols are not savings accounts.

They are financial systems in beta.

Treat them accordingly.

Final Thought

In crypto, yield is easy to find.

Durable yield is rare.

Objective comparison requires abandoning narratives and adopting frameworks—measuring not just how much you earn, but why, from whom, and under what conditions.

Do that consistently, and you will outperform most participants—not by moving faster, but by thinking deeper.