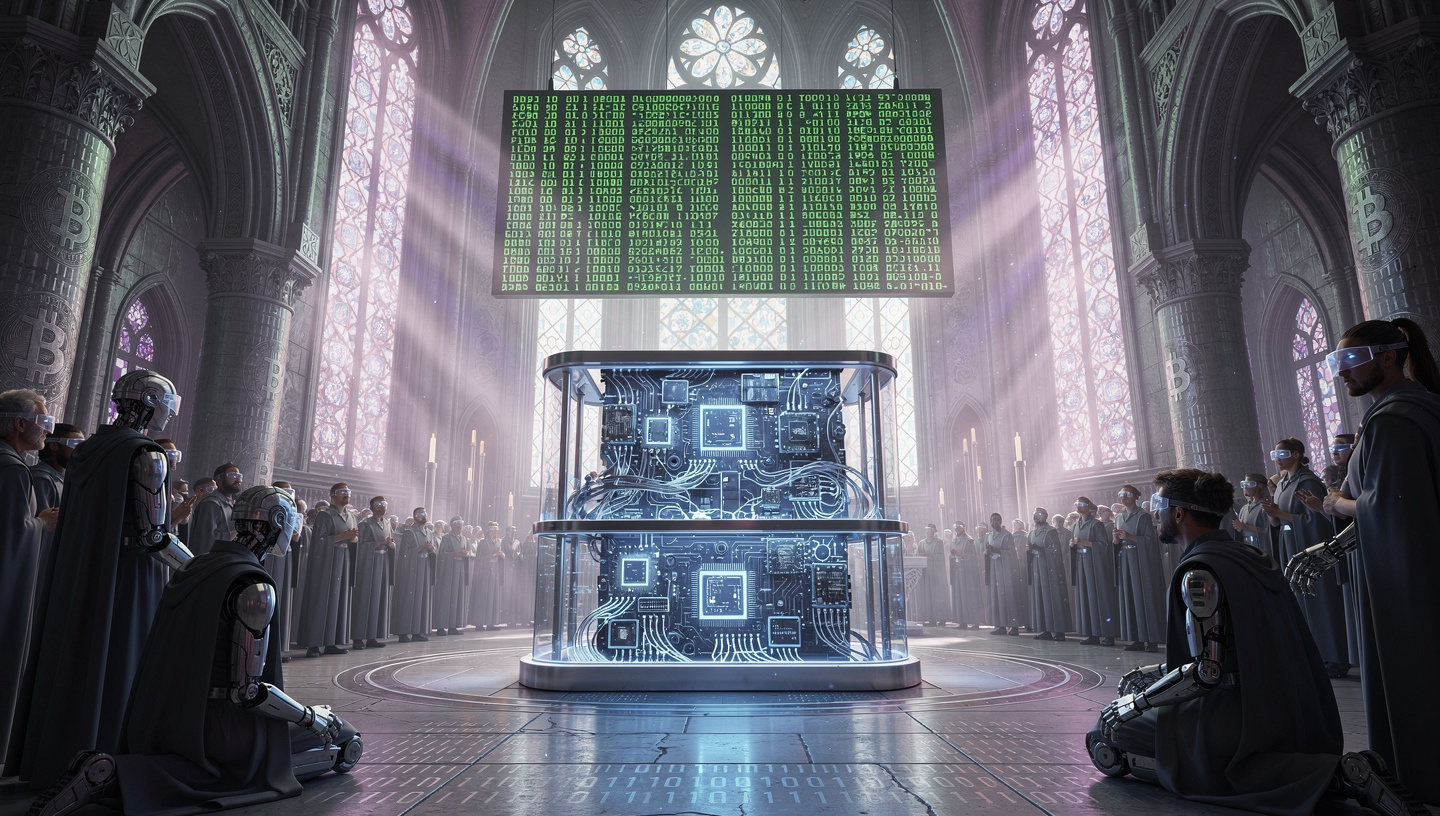

Cryptocurrency systems are not products. They are worlds.

Each blockchain network, decentralized protocol, and tokenized economy is a constructed environment governed by rules, incentives, physics (computational constraints), and social norms. Whether the project is built on Ethereum, Solana, or Bitcoin, it operates as a sovereign micro-civilization with its own monetary policy, governance structure, security model, and cultural mythology.

The failure rate of crypto projects is not merely a function of market volatility or regulatory pressure. It is more fundamental. Most projects fail because they misunderstand what they are building. They treat token issuance as product development rather than world design.

This article examines the most common worldbuilding mistakes in crypto. It approaches decentralized systems as designed environments—complex, adaptive, socio-technical systems—and analyzes where architects routinely go wrong. The goal is not critique for its own sake, but structural clarity. Worldbuilding errors compound. Early design decisions harden into irreversible protocol constraints. Poor foundations create brittle civilizations.

If crypto is the architecture of digital sovereignty, then its failures are architectural failures.

1. Confusing Token Mechanics with Economic Systems

One of the most pervasive mistakes is reducing economic design to token mechanics.

Projects obsess over:

- Fixed vs. inflationary supply

- Vesting schedules

- Staking rewards

- Burn mechanisms

- Emission curves

These are monetary levers, not economic systems.

An economy is defined by:

- Production

- Exchange

- Incentive alignment

- Capital allocation

- External demand

- Value capture

A token with a deflationary curve does not constitute a functioning economy. It constitutes a scarcity narrative.

Consider early ERC-20 era projects on Ethereum. Many implemented aggressive burn models to simulate digital gold dynamics inspired by Bitcoin. However, Bitcoin’s monetary model works because it is embedded in a network defined by proof-of-work security, energy expenditure, and a strong social consensus around scarcity. Copying issuance parameters without replicating systemic context produces hollow mimicry.

Structural Error:

Designing tokenomics in isolation from real utility and capital flows.

Consequence:

Reflexive price cycles without sustainable demand.

Worldbuilding requires modeling long-term economic behavior under varying conditions: liquidity shocks, governance capture, declining emissions, and protocol maturity. Most projects simulate none of this.

2. Ignoring Adversarial Environments

Crypto systems are adversarial by default. Every incentive is gamed. Every governance mechanism is stress-tested by rational exploiters.

Yet many projects design as if participants behave cooperatively.

This mistake became visible during the rise of algorithmic stablecoins, most notably Terra. The system assumed rational arbitrage would maintain peg stability indefinitely. It did not sufficiently model reflexive bank-run dynamics under confidence collapse. The design relied on equilibrium theory without incorporating adversarial liquidity cascades.

In worldbuilding terms: designers imagined a peaceful city; reality delivered siege warfare.

Structural Error:

Underestimating malicious optimization.

Consequence:

Economic death spirals and governance capture.

Any serious crypto architecture must incorporate:

- Game-theoretic attack modeling

- Worst-case liquidity stress simulations

- Governance takeover scenarios

- Oracle manipulation risks

- Validator cartel formation

Worlds are attacked. Designing as if they are not is negligence.

3. Overengineering Governance

Decentralized governance is often treated as a virtue in itself. Projects introduce:

- Multi-layer DAO frameworks

- Token-weighted voting

- Delegation systems

- On-chain proposal mechanisms

However, governance without legitimacy and participation is theater.

The evolution of governance in MakerDAO demonstrates the complexity of sustaining decentralized control over a stable monetary system. Participation concentration, voter apathy, and expert dominance emerged naturally over time. Governance design cannot override sociological reality.

Structural Error:

Assuming formal decentralization equals distributed power.

Consequence:

Oligarchic capture masked by procedural transparency.

Effective worldbuilding requires understanding that:

- Most participants are passive.

- Expertise centralizes influence.

- Token distribution shapes power asymmetry.

- Complexity suppresses engagement.

Governance must be minimal, legible, and incentive-aligned. Excess proceduralism produces paralysis or elite consolidation.

4. Building Without Cultural Cohesion

Crypto worlds are not purely technical systems. They are cultural systems.

Bitcoin has a coherent cultural narrative: sound money, censorship resistance, long-term holding. This culture reinforces protocol stability.

In contrast, many DeFi protocols lack a shared identity beyond yield optimization. Without cultural cohesion, participants behave as extractive agents.

Culture defines:

- Time horizon

- Loyalty

- Norm enforcement

- Acceptable risk

Projects that neglect cultural architecture face mercenary capital flight at the first sign of yield compression.

Structural Error:

Treating community as marketing instead of social infrastructure.

Consequence:

Liquidity volatility and narrative collapse.

Worldbuilding requires myth, ethos, and internal alignment. Technical superiority cannot compensate for cultural vacuum.

5. Designing for Growth Without Designing for Decline

Most crypto projects assume perpetual expansion:

- Increasing total value locked (TVL)

- Expanding user base

- Rising token demand

- Continuous development funding

Few design for contraction.

When market cycles reverse—as seen during the 2022 downturn affecting ecosystems like Solana and others—protocols with high fixed reward emissions and treasury liabilities faced structural imbalance.

Civilizations experience contraction phases. Worldbuilders must account for:

- Revenue collapse

- Liquidity withdrawal

- Developer attrition

- Security budget shrinkage

A sustainable system survives at minimum viable scale.

Structural Error:

Emission models dependent on continuous capital inflow.

Consequence:

Unsustainable treasury depletion and validator centralization.

Design must assume volatility as baseline, not anomaly.

6. Misaligning Security Budgets

Security in crypto is economic. Whether proof-of-work or proof-of-stake, network integrity depends on financial incentives.

Bitcoin secures itself through block subsidies and transaction fees. As block rewards diminish over time, fee market sustainability becomes central.

Proof-of-stake networks like Ethereum rely on staking incentives and slashing mechanisms.

Many smaller chains miscalculate:

- Required validator revenue

- Cost of capital

- Hardware requirements

- Opportunity cost of staking

Structural Error:

Underfunding security relative to token valuation.

Consequence:

Low-cost attack surfaces and validator centralization.

Security budgets must be treated as non-negotiable infrastructure expenses, not adjustable growth levers.

7. Fragmenting Liquidity

Liquidity is the circulatory system of crypto worlds.

The explosion of Layer 1s and Layer 2s—across ecosystems such as Ethereum and Solana—has created fragmented capital pools. Bridging solutions introduce counterparty risk and systemic fragility.

Designers frequently prioritize ecosystem sovereignty over capital efficiency.

Structural Error:

Launching isolated ecosystems without sustainable liquidity bridges.

Consequence:

Capital inefficiency and cascading bridge failures.

World coherence requires liquidity depth and composability. Fragmentation weakens economic gravity.

8. Treating Whitepapers as Marketing Documents

Whitepapers are often rhetorical artifacts rather than rigorous design documents.

Foundational documents like the Bitcoin: A Peer-to-Peer Electronic Cash System presented clear system constraints, threat models, and incentive alignment. Many modern equivalents prioritize token distribution diagrams over adversarial modeling.

Structural Error:

Narrative-first documentation.

Consequence:

Undefined edge cases and exploit-prone architecture.

Worldbuilding requires explicit articulation of:

- Security assumptions

- Failure modes

- Governance boundaries

- Economic equilibria

Documentation must function as constitutional law, not promotional literature.

9. Overreliance on Reflexivity

Crypto markets are reflexive. Price increases attract attention, which drives further demand. However, designing a world dependent on reflexive appreciation is structurally unstable.

Projects that rely on:

- Continuous staking APY expansion

- Ponzi-like referral growth

- Yield subsidies from token emissions

inevitably collapse once reflexive momentum stalls.

Structural Error:

Substituting growth mechanics for value creation.

Consequence:

Rapid boom-bust cycles.

Long-term systems anchor value in durable utility, not speculative acceleration.

10. Neglecting Exit and Migration Design

Crypto systems rarely design graceful exits.

When protocols fail, token holders are trapped in illiquid markets. When upgrades occur, contentious forks emerge. The split between Ethereum and Ethereum Classic illustrates how ideological fracture manifests in protocol bifurcation.

Worldbuilders must anticipate:

- Hard fork disputes

- Governance schisms

- Treasury wind-down procedures

- User migration pathways

Structural Error:

Assuming permanence.

Consequence:

Chaotic collapse or community fragmentation.

Every world requires an end-of-life protocol.

11. Ignoring Regulatory and External Constraints

Crypto systems do not exist in isolation. Regulatory pressures, macroeconomic shifts, and technological competition shape their survivability.

Stablecoin issuers operating in jurisdictions like the United States face compliance pressure. Exchanges, custody providers, and DeFi front-ends operate within legal frameworks that can change rapidly.

Worldbuilding that ignores external constraints creates brittle systems.

Structural Error:

Designing in a vacuum.

Consequence:

Forced redesign under legal duress.

External environment modeling is mandatory.

12. Equating Decentralization with Scalability

True decentralization imposes trade-offs:

- Throughput limits

- Coordination latency

- Governance complexity

Efforts to optimize scalability often reintroduce centralization vectors.

Projects that aggressively optimize transaction throughput without sufficient validator distribution risk creating performance-centric but politically centralized systems.

Worldbuilding requires explicit prioritization:

Security. Decentralization. Scalability.

All three cannot be maximized simultaneously.

Ignoring this constraint leads to incoherent architecture.

13. Underestimating Time

Time is the ultimate stress test.

Protocols that appear stable in their first year may collapse in their fifth. Emission decay, governance fatigue, and declining innovation pressure long-term viability.

Bitcoin survives because its core rules are conservative and resistant to rapid change. Many newer systems attempt perpetual reinvention.

Structural Error:

Optimizing for short-term narrative cycles.

Consequence:

Loss of identity and mission drift.

A world must endure generational shifts in participation.

Toward Better Crypto Worldbuilding

Avoiding these mistakes requires reframing crypto projects as sovereign systems rather than financial products.

A robust crypto world must include:

- Coherent Economic Foundations

Modeled across bull and bear conditions. - Explicit Adversarial Modeling

Stress-tested against rational exploitation. - Cultural Architecture

Shared norms that align long-term behavior. - Sustainable Security Budgeting

Economic guarantees of validator integrity. - Liquidity Gravity

Deep, composable capital structures. - Governance Minimalism

Legible, constrained authority. - Lifecycle Planning

Clear migration and failure protocols. - Environmental Awareness

Regulatory and macroeconomic integration.

Conclusion: Designing Civilizations, Not Tokens

Crypto worldbuilding is civilizational engineering in compressed timeframes.

Most failures are not technological—they are architectural. Designers miscalculate incentives, underestimate adversaries, overestimate community cohesion, and ignore entropy.

A blockchain is a city-state with code as constitution. Tokens are its currency. Validators are its military. Governance is its political structure. Culture is its social contract.

Worlds endure when their internal logic aligns with external reality. When incentives reinforce resilience. When security budgets scale with value. When decline is anticipated as rigorously as growth.

The next generation of crypto systems will not succeed because they are faster or cheaper. They will succeed because they are structurally sound.

In crypto, worldbuilding is destiny.