Price doesn’t politely “move.” It escapes, lunges, collapses, and occasionally rewrites portfolios in minutes. Charts are not passive diagrams—they’re battlegrounds where liquidity hunts stops, narratives mutate in real time, and crowds oscillate between euphoria and regret. Every serious trader eventually confronts the same core problem:

How do you tell a real breakout from a fakeout before it’s too late?

That single skill—correctly distinguishing structural expansion from engineered deception—separates consistent operators from perpetual churners.

This article is a deep, technical, practitioner-level breakdown of breakouts versus fakeouts in crypto markets: the mechanics, the psychology, the liquidity dynamics, and the frameworks professionals use to survive and compound.

No folklore. No motivational fluff. Just market structure.

Why Breakouts Matter More in Crypto Than Any Other Market

Crypto is uniquely hostile to breakout traders for three reasons:

- 24/7 trading with no centralized regulation

- Extreme retail participation

- Thin liquidity outside major pairs

Assets like Binance and Coinbase provide global access, but they also create fragmented liquidity across venues, enabling sophisticated players to engineer false signals with relative ease.

Unlike equities or FX, crypto lacks circuit breakers, coordinated market makers, or institutional volume guarantees. That makes breakout zones—high-visibility technical levels—prime hunting grounds.

Every horizontal resistance, every trendline retest, every compression wedge becomes a liquidity reservoir.

And liquidity always attracts predators.

First Principles: What a Breakout Actually Is

A breakout is not simply “price goes above resistance.”

That definition is amateur-level.

A true breakout is a regime shift in order flow—a transition where:

- Passive supply is exhausted

- Aggressive buyers dominate

- Structure expands with acceptance

- Value migrates upward

In other words, price doesn’t just touch a level.

It establishes value beyond it.

Technically, that requires:

- Expansion in volume

- Sustained closes outside the range

- Follow-through candles with minimal retracement

- Acceptance above prior value area

Anything less is noise.

The Anatomy of a Fakeout

A fakeout is a liquidity extraction event disguised as a breakout.

It occurs when:

- Price breaches a key level

- Retail traders enter aggressively

- Smart money uses that liquidity to offload positions

- Price reverses violently

Fakeouts exist because breakout traders behave predictably.

They:

- Enter late

- Use tight stops

- Cluster orders around obvious levels

That predictability creates opportunity.

Fakeouts are not accidents. They are engineered outcomes of crowd behavior.

Why Crypto Fakeouts Are So Brutal

Crypto fakeouts tend to be sharper and faster than traditional markets because:

- Leverage is easily accessible

- Stop-loss clusters are visible via derivatives order books

- Retail sentiment reacts emotionally, not structurally

On perpetual futures, liquidation cascades amplify reversals. One forced exit becomes ten. Ten becomes a thousand.

What starts as a minor rejection becomes a vertical collapse.

This is why breakouts on assets like Bitcoin and Ethereum often exhibit violent mean reversion when poorly structured.

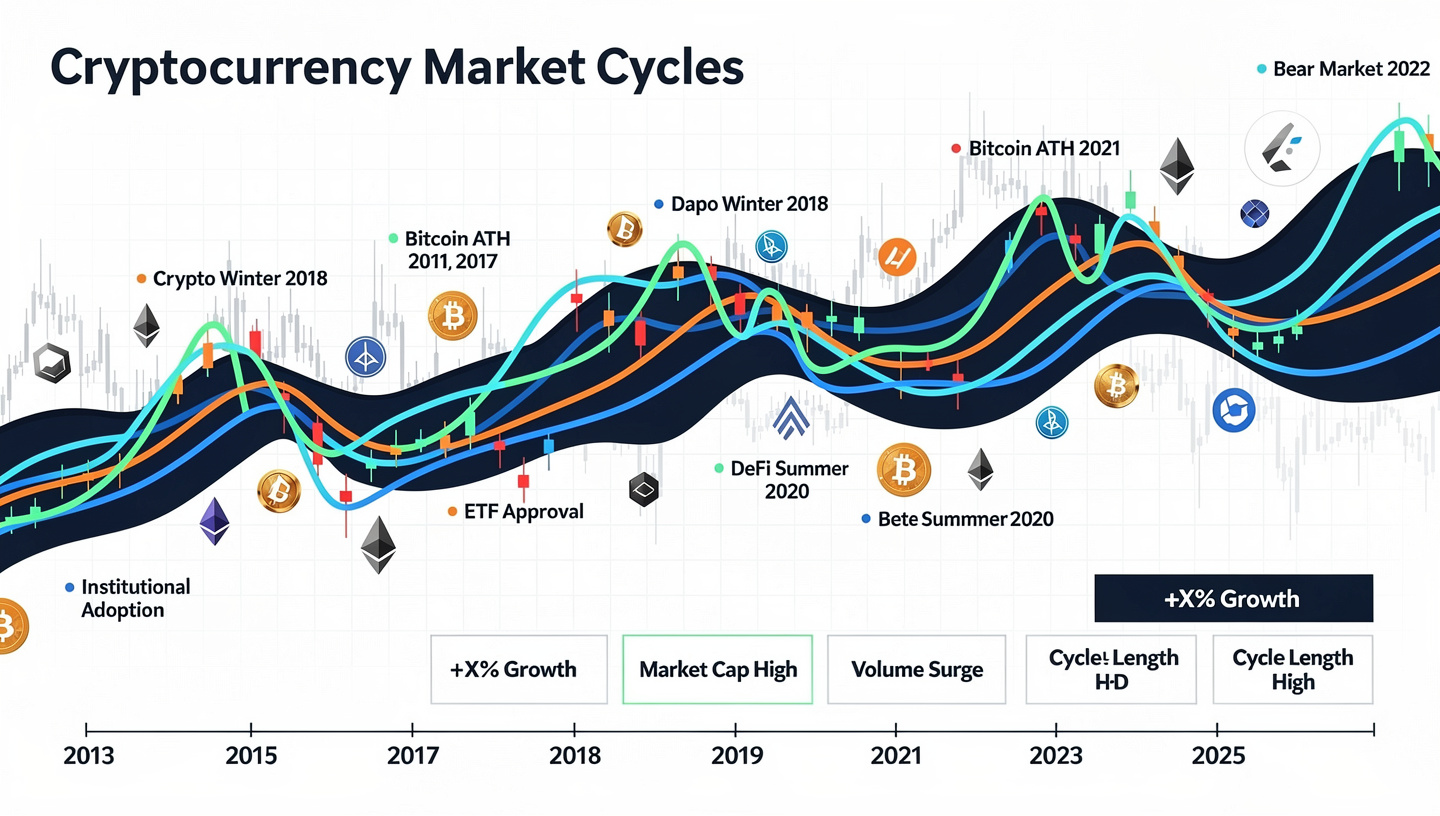

Market Structure: The Only Context That Matters

Before discussing indicators, patterns, or strategies, internalize this:

Breakouts only work in expansionary market regimes.

Structure comes first.

You must identify:

- Higher timeframe trend

- Range vs trend conditions

- Location within the broader market cycle

A breakout attempt at the top of a distribution range behaves very differently than one emerging from accumulation.

Without structural context, every breakout is a coin flip.

Accumulation vs Distribution: The Hidden Driver

Professional traders classify consolidation phases into two categories:

Accumulation

Characteristics:

- Long sideways movement

- Diminishing volatility

- Absorption of sell pressure

- Volume drying up

Breakouts from accumulation tend to follow through.

Distribution

Characteristics:

- Choppy tops

- Failed continuation attempts

- Rising volume on down candles

- Increasing volatility

Breakouts from distribution almost always fail.

Retail traders confuse both because price looks “compressed.”

Professionals differentiate using volume behavior and rejection dynamics.

Volume: The Most Abused Metric in Crypto

Volume is not confirmation by itself.

What matters is relative volume at key locations.

A valid breakout shows:

- Increasing volume after the level is cleared

- Strong bodies, weak wicks

- Continuation on subsequent candles

A fakeout typically shows:

- Volume spike on the breakout candle

- Immediate upper wick

- Collapse back into range

That spike is not bullish.

It is exit liquidity.

Retests: The Acceptance Test

The cleanest breakouts retest the level they just broke.

This retest should show:

- Reduced selling pressure

- Shallow pullbacks

- Quick reclaim if briefly lost

If price collapses back into the range and struggles to reclaim, the breakout has failed.

No exceptions.

Professional traders wait for this acceptance phase. Retail traders chase the initial impulse.

That single behavioral difference explains most P&L disparities.

The Role of Liquidity Pools

Highs and lows are not just chart artifacts.

They are order clusters.

Above equal highs sit buy stops. Below equal lows sit sell stops.

Institutions target these pools because they provide instant liquidity.

Fakeouts often occur precisely at:

- Range highs

- Trendline breaks

- Psychological round numbers

If your breakout setup aligns with one of these obvious zones, assume manipulation risk is elevated.

Indicators That Actually Help (When Used Correctly)

Indicators do not predict breakouts. They contextualize them.

Used properly, they refine probability.

VWAP

Volume-weighted average price reveals institutional fair value.

Breakouts that hold above anchored VWAPs have higher continuation odds.

RSI (Divergences Only)

Overbought readings mean nothing in trends.

Bearish divergence at resistance, however, often precedes fakeouts.

Open Interest

Rising price with falling open interest indicates short covering—not real demand.

That’s a classic fake breakout signature.

Multi-Timeframe Alignment

A breakout on the 5-minute chart means nothing if the 4-hour chart is rejecting resistance.

Professional traders stack timeframes:

- Daily defines bias

- 4H defines structure

- 15m defines entry

If higher timeframes do not agree, stand aside.

The Psychology of Breakouts

Breakouts exploit human impulses:

- Fear of missing out

- Desire for confirmation

- Aversion to waiting

Crowds enter late because they want certainty.

Markets punish certainty.

This is why emotionally driven traders consistently buy tops and sell bottoms.

Mastery requires doing the opposite: entering when it feels uncomfortable and exiting when it feels obvious.

News-Driven Breakouts: The Most Dangerous Category

Crypto reacts violently to headlines—especially when amplified by figures like Elon Musk.

These moves often lack structural backing.

Price spikes, social media explodes, liquidity floods in—and then price collapses.

News does not create trends.

Order flow does.

Treat news breakouts as high-risk unless confirmed structurally.

A Practical Breakout Validation Framework

Use this checklist:

- Is higher timeframe structure aligned?

- Is volume expanding after the level is cleared?

- Does price accept above resistance?

- Is open interest supporting the move?

- Did the retest hold?

If any answer is “no,” reduce size or avoid the trade.

Risk Management: The Only Real Edge

Even perfect analysis fails.

What matters is asymmetry.

Professionals risk 0.5–2% per trade. They accept small losses and wait for high-quality setups.

Retail traders overleverage, chase entries, and widen stops.

Breakouts demand tight invalidation and predefined exits.

No exceptions.

Common Breakout Traps

- Trading inside ranges

- Entering on the first candle

- Ignoring volume

- Overtrading minor levels

- Believing every pump is “the one”

These behaviors guarantee mediocrity.

Advanced Concept: Failed Breakouts as Entry Signals

Failed breakouts are often better trades than successful ones.

When price breaks resistance, fails, and re-enters the range, it signals trapped longs.

That creates forced selling.

Shorting failed breakouts with confirmation is one of the highest-probability setups in crypto.

Why Most Traders Never Master This

Because they chase excitement instead of structure.

They want action, not confirmation.

They want prediction, not reaction.

Markets reward discipline, patience, and probabilistic thinking.

Everything else is noise.

Final Thoughts

Breakouts are not moments. They are processes.

Fakeouts are not random. They are consequences of predictable behavior.

If you learn to read structure, respect liquidity, and wait for acceptance, you stop being prey.

Crypto does not reward optimism.

It rewards precision.

Master that distinction—and breakouts stop being gambles. They become calculated engagements in a market designed to exploit the careless.

That is the difference between participation and professionalism.