Crypto transaction fees are not incidental overhead. They are structural components of decentralized networks. Without them, blockchains would either collapse under spam or rely on centralized gatekeepers. Fees perform three interlocking functions: they allocate scarce block space, compensate validators, and secure the protocol against adversarial behavior.

In traditional payment systems, fees are often opaque and embedded within institutional margins. In cryptocurrency networks, fees are explicit and protocol-native. They are priced in real time, influenced by network congestion, economic incentives, and consensus rules. Understanding why crypto fees exist requires examining the mechanics of distributed systems, game theory, and cryptographic security.

This article provides a comprehensive, research-oriented explanation of crypto fees, including how they function in networks like Bitcoin and Ethereum, how fee markets operate, and why eliminating fees would destabilize decentralized systems.

1. The Core Problem: Scarce Block Space

Every blockchain has finite capacity.

In Bitcoin, blocks are produced approximately every 10 minutes, and each block has a limited size. In Ethereum, blocks are produced more frequently, but computation is bounded by a block gas limit.

This creates digital scarcity at the protocol layer:

- Only a fixed number of transactions fit in each block.

- Nodes must validate every transaction.

- Blocks cannot grow indefinitely without increasing centralization risks.

When demand exceeds available space, the network needs a prioritization mechanism. Fees are that mechanism.

Users attach fees to transactions. Validators select transactions offering the highest compensation per unit of block resource. This creates a competitive fee market.

Without fees, the system would have no rational method for ordering transactions under congestion.

2. Fees as Anti-Spam Mechanisms

Public blockchains are permissionless. Anyone can submit a transaction. This openness introduces a vulnerability: spam.

If transactions were free:

- Attackers could flood the mempool.

- Nodes would be forced to process unlimited computational requests.

- Network performance would degrade or halt.

Fees impose a cost on transaction submission. That cost scales with network usage.

This transforms spam from trivial to economically expensive. An attacker must pay for every byte or computational step they attempt to occupy. In effect, fees convert computational abuse into a capital-intensive activity.

This is analogous to postage in physical mail systems. The stamp prevents infinite free mail.

3. Incentivizing Validators and Miners

Blockchains require economic incentives to function.

In Proof-of-Work systems like Bitcoin:

- Miners expend electricity and hardware resources.

- They compete to add blocks.

- They are compensated via block rewards and transaction fees.

In Proof-of-Stake systems like Ethereum (post-Merge):

- Validators lock capital.

- They validate transactions and attest to blocks.

- They earn issuance rewards and fees.

Fees represent market-driven compensation. Over time, issuance (new coin creation) often declines. For example, Bitcoin’s block subsidy halves approximately every four years. Long-term network security is expected to rely increasingly on transaction fees.

If fees did not exist, validators would depend solely on inflation. As issuance trends toward zero, security would degrade.

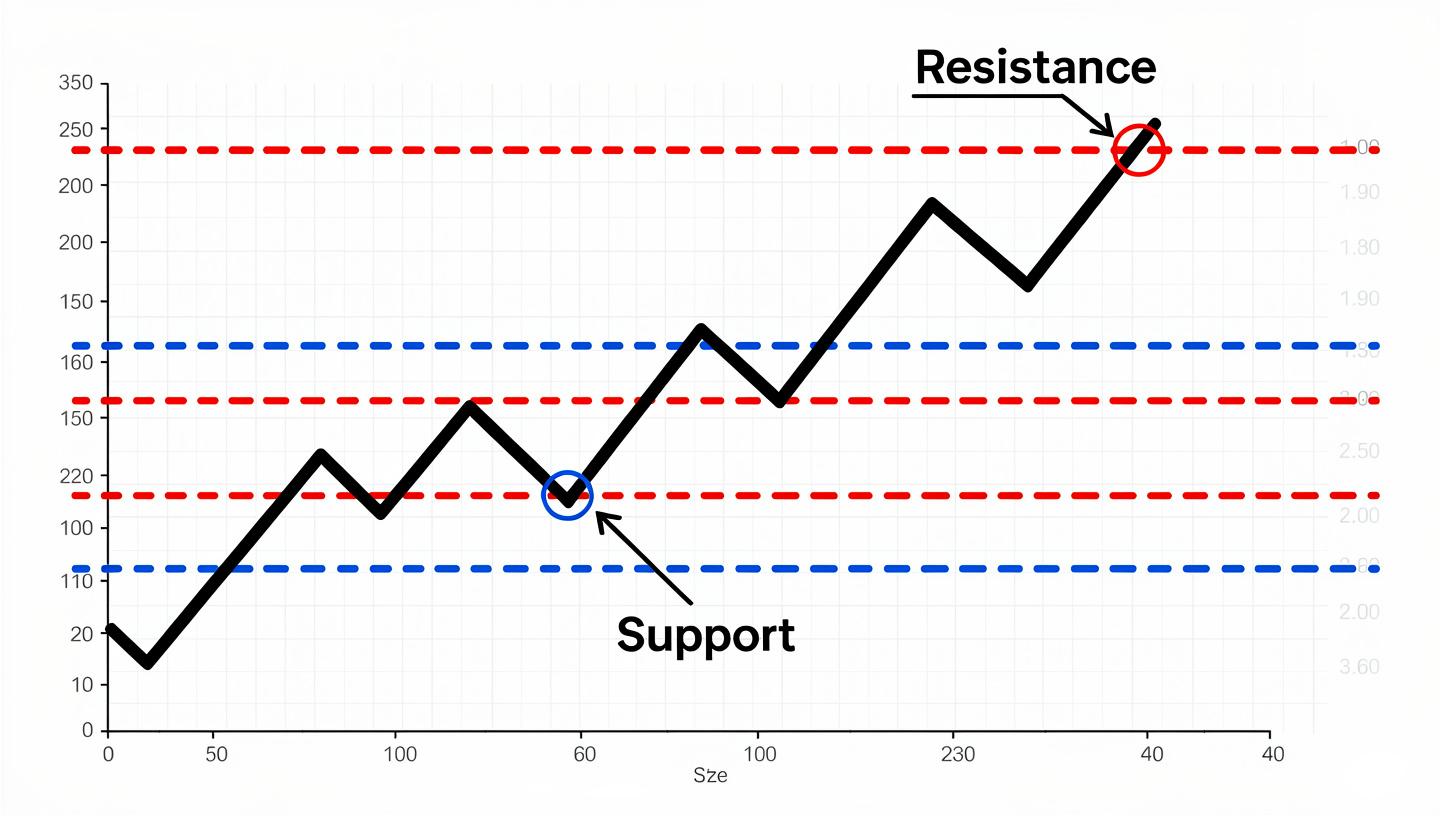

4. Fee Markets: Supply and Demand Dynamics

Crypto fees fluctuate because they are market-driven.

When demand is low:

- Transactions confirm quickly.

- Fees are minimal.

When demand surges:

- Users compete for inclusion.

- Fees increase.

In Ethereum, the introduction of EIP-1559 fundamentally restructured fee mechanics:

- A base fee adjusts algorithmically per block.

- Users add a priority tip.

- The base fee is burned.

This mechanism smooths volatility while preserving market pricing. It also introduces a deflationary dynamic, as a portion of fees is permanently removed from circulation.

Fee markets therefore reflect real-time network demand and encode it directly into protocol economics.

5. Gas: Pricing Computation

Not all blockchains measure cost in bytes.

Ethereum introduced the concept of “gas,” which prices computational complexity rather than just transaction size. Executing a smart contract consumes gas based on:

- Storage writes

- Arithmetic operations

- Contract calls

- Cryptographic functions

This prevents infinite loops or computational abuse. Each operation has a deterministic cost.

Users must estimate gas consumption. If insufficient gas is provided, execution fails—but the consumed gas is not refunded. This discourages careless or malicious contract invocation.

Gas is a precision tool. It monetizes computation at the opcode level.

6. Security Through Economic Finality

Fees are part of a broader economic security model.

Blockchains rely on rational actors. Validators behave honestly because:

- They earn fees and rewards.

- Misbehavior results in lost revenue.

- In Proof-of-Stake systems, slashing penalties apply.

Fees strengthen honest participation. They increase the total economic value securing the chain.

In high-usage networks, fee revenue can exceed block issuance. This creates a feedback loop:

More usage → Higher fees → Greater validator revenue → Stronger security → More trust → More usage.

Fees are not friction. They are security reinforcement.

7. Why Zero-Fee Blockchains Are Misleading

Some networks advertise “zero fees.” In practice, this typically means:

- Fees are subsidized by inflation.

- Fees are hidden in validator rewards.

- The network has low demand.

- The system is semi-centralized.

True zero-fee public blockchains are economically unstable. Without fees:

- Spam protection weakens.

- Validator incentives distort.

- Centralized infrastructure must intervene.

Even when fees are minimal, they exist implicitly through economic trade-offs.

8. The Role of Layer 2 Scaling

High fees during congestion led to the development of scaling solutions.

On Ethereum, Layer 2 systems such as rollups batch transactions and settle them on the main chain. These systems:

- Reduce per-user fees.

- Compress data.

- Share L1 security.

However, even Layer 2 transactions ultimately pay L1 settlement fees. The base layer fee mechanism remains fundamental.

Scaling reduces marginal cost per transaction. It does not eliminate the economic necessity of fees.

9. Fee Burning and Monetary Policy

EIP-1559 introduced fee burning in Ethereum:

- Base fees are destroyed.

- Only tips go to validators.

This changes the monetary policy:

- High network usage can reduce net issuance.

- ETH supply may become deflationary.

Fees now influence supply dynamics directly.

In Bitcoin, fees are not burned. They are entirely awarded to miners. As block rewards decline, fees will dominate miner income.

Both models demonstrate that fees are integral to long-term token economics.

10. Mempools and Transaction Ordering

Transactions do not enter blocks automatically.

They first enter the mempool—a waiting area where validators select transactions.

Higher fees:

- Increase probability of faster inclusion.

- Influence transaction ordering.

This introduces complexities such as MEV (Miner/Maximal Extractable Value), where validators reorder transactions for profit.

Fee mechanisms intersect directly with transaction ordering and arbitrage opportunities.

11. Fees as Market Signals

Crypto fees provide information.

They signal:

- Network congestion.

- Demand for block space.

- Economic activity levels.

- Application usage intensity.

High sustained fees often correlate with increased adoption or speculative activity.

In this sense, fees act as telemetry for blockchain ecosystems.

12. Long-Term Sustainability

The long-term viability of public blockchains depends on sustainable security budgets.

For Bitcoin:

- Block rewards decline geometrically.

- Fees must eventually sustain miner revenue.

For Ethereum:

- Security budget derives from issuance plus tips.

- Base fee burning alters supply but not validator compensation directly.

If fee revenue fails to sustain validator incentives, network security assumptions weaken.

Therefore, fees are not optional. They are foundational to long-term protocol resilience.

13. Comparative Perspective: Traditional Finance vs Crypto Fees

Traditional payment networks:

- Hide fees in interchange.

- Rely on centralized intermediaries.

- Do not expose fee markets to users.

Crypto networks:

- Expose fees transparently.

- Allow users to adjust priority.

- Encode fees at the protocol level.

The difference is structural. Crypto replaces institutional trust with incentive-aligned economics.

14. Misconceptions About High Fees

High fees are often framed as a flaw. In reality, they indicate:

- High demand.

- Limited block capacity.

- Active economic usage.

The challenge is scaling without compromising decentralization.

Fees are not bugs. They are demand signals interacting with fixed supply.

15. Theoretical Foundations: Game Theory and Mechanism Design

Fee systems are applications of mechanism design.

They must:

- Discourage spam.

- Incentivize honest validation.

- Allocate scarce resources efficiently.

- Resist manipulation.

The interplay between fee markets, validator incentives, and user behavior creates a complex equilibrium.

Design errors can lead to instability, centralization, or exploitation.

Successful fee systems balance simplicity, predictability, and economic robustness.

Conclusion: Fees as the Backbone of Decentralized Security

Crypto fees exist because decentralized systems require economic coordination. They solve three critical problems simultaneously:

- Resource allocation under scarcity.

- Spam resistance in open networks.

- Validator incentive alignment.

Without fees, blockchains would either centralize or collapse.

In networks like Bitcoin and Ethereum, fees are not incidental friction. They are the price of permissionless consensus.

Understanding crypto fees is essential to understanding how blockchains sustain security, resist abuse, and operate without centralized authority. They are the economic engine beneath decentralized trust.

As issuance declines and usage grows, fee markets will become even more central to protocol stability. Far from being a nuisance, they are the structural foundation that makes decentralized finance possible.