For decades, digital access has been governed by identity. Create an account. Verify your email. Submit documents. Pass KYC. Build a profile. In Web2 systems, access control is anchored to centralized identity registries and platform-enforced rules. In Web3, the promise was different: permissionless participation secured by cryptography rather than institutions.

Yet in practice, crypto ecosystems still rely heavily on identity proxies—wallet addresses, token balances, social graphs, and increasingly, centralized KYC providers. Access is binary: you hold the token, or you do not. You are allowlisted, or you are excluded. You are verified, or you are blocked.

This is structurally inefficient.

Reputation-based access models offer a different architecture: instead of granting access based on static identity or raw capital, systems grant access based on accumulated, verifiable behavior. Not who you are. Not how much you own. But what you have demonstrably done.

This article examines the design, mechanics, cryptographic foundations, governance implications, and future trajectory of reputation-based access in decentralized systems. It treats reputation not as a social signal, but as a programmable primitive.

1. The Limits of Identity-Centric Access

Traditional access control models are built on identity verification:

- Username/password authentication

- OAuth providers

- Government-issued ID

- KYC/AML compliance

- Role-based access control (RBAC)

These models assume that identity is stable, unique, and authoritative. In crypto, identity is deliberately minimized. Wallet addresses are pseudonymous and infinitely replicable. Token-based gating substitutes capital for credibility.

The problems are evident:

- Sybil attacks: A single actor creates multiple identities.

- Plutocracy: Access tied to token holdings favors capital over contribution.

- Exclusionary compliance: KYC processes centralize power and erode privacy.

- Lack of contextual nuance: Token ownership does not reflect quality of participation.

Crypto systems need access control that aligns with decentralization, privacy, and merit-based participation. Reputation is the missing abstraction.

2. Defining Reputation in Cryptographic Systems

Reputation in decentralized networks must satisfy specific properties:

- Verifiable: Claims must be cryptographically provable.

- Portable: Usable across protocols.

- Privacy-preserving: Selective disclosure preferred over full transparency.

- Sybil-resistant: Hard to fake or cheaply replicate.

- Contextual: Relevant to the domain in which access is requested.

- Composable: Interoperable with other on-chain primitives.

Unlike Web2 reputation systems (e.g., platform-specific star ratings), crypto reputation must operate without a central authority adjudicating truth.

Reputation-based access models therefore rely on three foundational layers:

- Behavioral attestations

- On-chain activity metrics

- Cryptographic proofs of credibility

3. On-Chain Activity as a Reputation Signal

Every blockchain interaction is an immutable record. In networks like Ethereum and Solana, wallets accumulate transaction histories that encode participation.

Reputation metrics can include:

- Governance voting participation

- Smart contract deployment history

- Liquidity provision longevity

- NFT minting behavior

- Contribution to public goods funding rounds

- DAO proposal authorship

- Interaction diversity across protocols

However, raw on-chain activity is insufficient. Quantity is not quality. A bot can generate thousands of transactions.

Reputation-based models must weight behavior based on:

- Time consistency

- Cross-protocol engagement

- Peer validation

- Economic stake at risk

- Contribution impact

This transforms transaction history into a credibility graph.

4. Attestations and Verifiable Credentials

Reputation matures when other entities issue attestations. Instead of self-declared claims, a wallet receives signed statements from trusted issuers.

Attestations can confirm:

- Participation in a hackathon

- Completion of a course

- Contribution to a protocol

- Bug bounty submission

- DAO voting alignment

- Role fulfillment in a governance process

Standards such as W3C Verifiable Credentials and decentralized identity frameworks provide structural scaffolding for portable attestations. On-chain registries can anchor these credentials immutably.

Protocols like Ethereum Attestation Service enable structured attestations stored on-chain, making reputation machine-readable and composable.

This shifts access logic from static identity to credential-based capability.

5. Soulbound Tokens and Non-Transferable Signals

One significant innovation in reputation design is the concept of non-transferable tokens. If reputation can be sold, it ceases to function as a trust signal.

Soulbound tokens (SBTs) represent:

- Non-transferable achievements

- Membership credentials

- Verified roles

- Contribution proofs

Unlike fungible tokens, SBTs bind reputation to a wallet without enabling speculative transfer. This reduces reputation markets and strengthens authenticity.

However, wallet binding introduces risk. If a private key is lost, reputation disappears. Advanced recovery models must integrate with non-transferable credentials.

6. Zero-Knowledge Proofs and Privacy-Preserving Access

Reputation should not require full disclosure. Access models must avoid forcing users to reveal complete transaction histories.

Zero-knowledge proofs (ZKPs) allow users to prove statements about their reputation without revealing underlying data:

- Prove participation in at least 5 governance votes.

- Prove cumulative staking duration exceeds 12 months.

- Prove contribution score above a threshold.

Protocols leveraging zk-SNARKs and zk-STARKs enable threshold-based access control without identity exposure.

Projects building privacy infrastructure on networks like Ethereum and Polygon are actively exploring reputation gating through zero-knowledge circuits.

This aligns reputation with decentralization’s core principle: minimal disclosure.

7. Sybil Resistance as a Design Constraint

Reputation systems collapse if they cannot prevent identity fragmentation.

Sybil resistance strategies include:

- Proof-of-personhood mechanisms

- Quadratic voting frameworks

- Social graph verification

- Stake-weighted reputation scoring

- Time-based accumulation models

Protocols like Gitcoin experiment with identity and contribution scoring to allocate public goods funding while mitigating Sybil attacks.

Effective reputation-based access requires layered defense:

- Behavioral cost to build reputation

- Community validation

- Economic or social bonding

- Cross-protocol data correlation

Reputation must be expensive to fake.

8. Reputation as an Access Primitive

Reputation-based access models can govern:

8.1 DAO Governance

Weighted voting based on contribution history rather than token holdings.

8.2 Protocol Feature Access

Early feature access for wallets with sustained engagement.

8.3 Credit and Lending

Under-collateralized lending based on repayment history and governance alignment.

8.4 Marketplace Trust

Lower escrow requirements for reputable participants.

8.5 Developer Grants

Access to funding pools gated by verified contribution history.

Instead of hard-coded allowlists, access becomes dynamically computed from reputation scores.

9. Algorithmic Reputation Scoring

Designing scoring mechanisms requires balancing:

- Transparency

- Resistance to gaming

- Interpretability

- Bias minimization

Reputation models can use:

- Weighted activity metrics

- Graph-based centrality analysis

- Peer endorsements

- Time decay functions

- Bayesian trust scoring

- Machine learning over public on-chain data

Graph analytics applied to blockchain networks create trust topology maps. Wallets with strong connectivity to reputable clusters inherit probabilistic trust.

However, opaque scoring models risk centralization of influence. Reputation systems must avoid recreating algorithmic gatekeeping reminiscent of Web2 platforms.

10. Economic Implications

Reputation-based access introduces non-financial capital as an economic input.

Impacts include:

- Reduced reliance on collateral

- Merit-based opportunity allocation

- Incentivized long-term participation

- Lower onboarding friction

- Network effects driven by trust accumulation

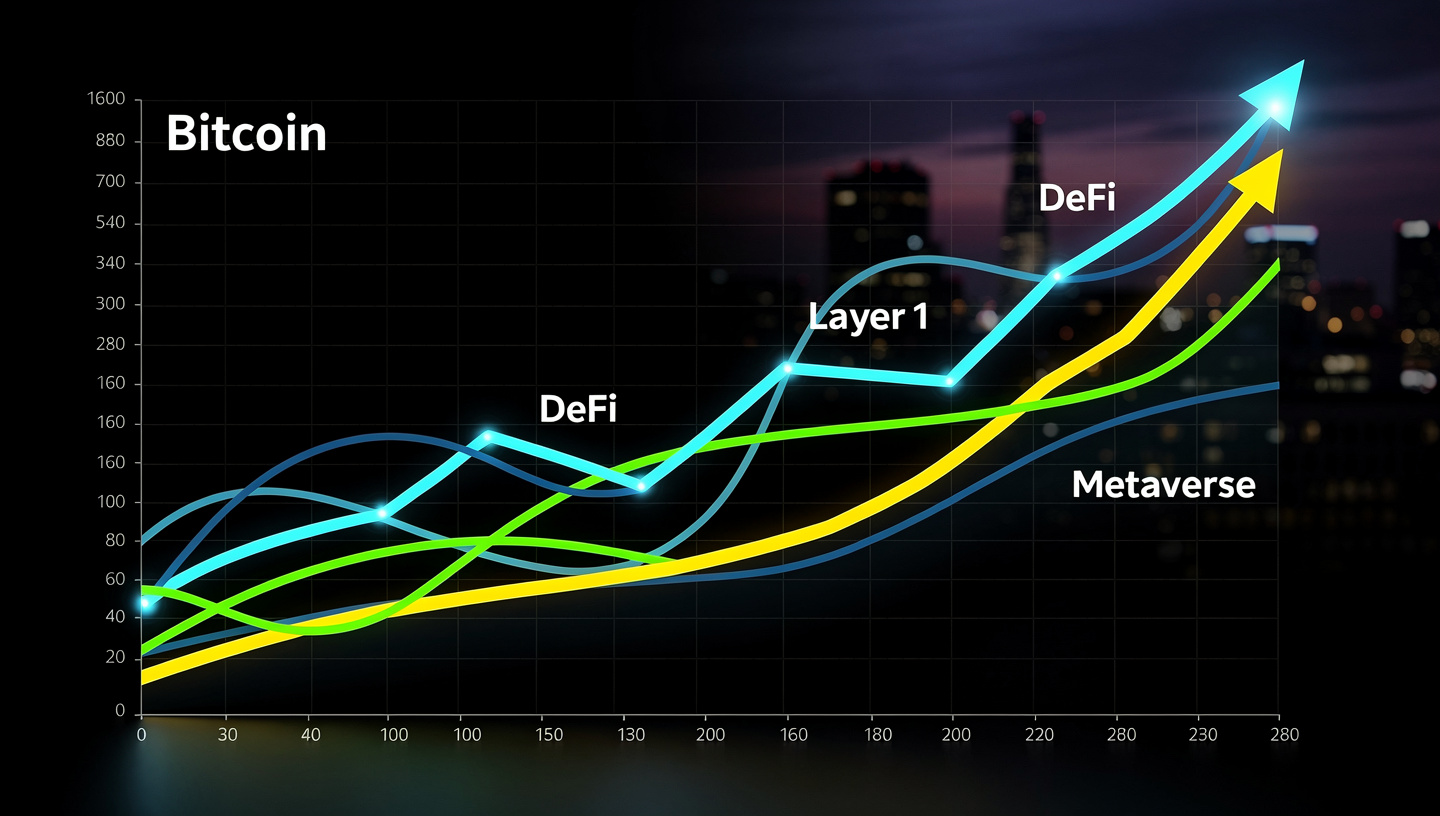

In decentralized finance (DeFi), this enables under-collateralized credit markets, peer-to-peer risk pooling, and dynamic insurance pricing.

Protocols operating within the broader Ethereum Foundation ecosystem increasingly explore identity-lite reputation primitives to unlock capital efficiency.

Reputation becomes a yield-bearing asset—not tradable, but productive.

11. Governance Risks and Centralization Pressures

Reputation systems can entrench power.

Risks include:

- Early adopters accumulating permanent advantage

- Closed reputation loops

- Biased credential issuers

- Overweighting historical participation

- Emergent oligarchies

Mitigation mechanisms:

- Time decay in scoring

- Rotating credential authorities

- Context-specific reputation (not global)

- Transparent algorithms

- Community oversight

Reputation must be dynamic, not static.

12. Cross-Protocol Portability

Fragmented reputation reduces utility. A wallet’s contribution to one DAO should inform access elsewhere—without forcing universal identity linking.

Interoperable standards enable:

- Cross-chain attestations

- Multi-chain reputation graphs

- Bridged credentials

- Inter-DAO trust recognition

Layer-zero infrastructure and cross-chain messaging protocols can anchor portable attestations while preserving autonomy.

The long-term vision: reputation as a layer above blockchains, not confined within them.

13. UX Implications

Reputation-based access must not introduce cognitive overhead.

Design considerations:

- Clear explanation of access requirements

- Real-time visibility into reputation metrics

- Transparent scoring breakdown

- Dispute resolution channels

- Non-technical language for thresholds

Users should understand:

- What actions increase access

- How reputation is measured

- What data is shared

- What proofs are required

Reputation must be legible.

14. Regulatory Intersections

Reputation-based access may serve as an alternative to identity-based compliance in some contexts.

Potential applications:

- Proof of accredited investor status via attestations

- Verified contributor status for grant eligibility

- Risk-tiered financial access

However, regulators may challenge systems that circumvent formal KYC requirements. The interplay between decentralized reputation and compliance frameworks remains unresolved.

15. Future Directions

The trajectory of reputation-based access models converges on:

- Privacy-preserving verifiable credentials

- Cross-chain reputation composability

- AI-assisted reputation analytics

- On-chain dispute arbitration

- Decentralized identity overlays

- Economic abstraction layers

Emerging cryptographic tools will reduce the trade-off between privacy and verifiability.

Reputation will evolve from a supplementary metric to a core governance and access primitive.

Conclusion: Access Reimagined

Reputation-based access models represent a structural shift in decentralized system design. Instead of identity or capital, behavior becomes the gating mechanism. Instead of static permission lists, dynamic credibility graphs determine opportunity.

This approach aligns with the ethos of decentralization:

- Minimize trust.

- Maximize verifiability.

- Preserve privacy.

- Incentivize contribution.

The success of crypto innovation depends not only on consensus mechanisms and scaling solutions, but on social coordination encoded in code. Reputation-based access is the bridge between cryptographic security and human trust.

Access is no longer granted because you exist. It is granted because you have earned it—provably, privately, and programmatically.