Crypto is no longer just an engineering discipline. It is a civilizational design space.

What began with Bitcoin has evolved into a dense ecosystem of programmable economies, autonomous organizations, and digitally native cultures. Early pioneers like Satoshi Nakamoto and later architects such as Vitalik Buterin did not merely introduce new financial primitives—they opened the door to something larger: entire worlds constructed from code, incentives, narratives, and collective belief.

Today, crypto networks behave less like software products and more like emerging societies. They have borders (protocol boundaries), laws (consensus rules), currencies (native tokens), institutions (DAOs), and cultures (memes, norms, language). Builders are no longer just developers. They are world architects.

This article presents a practical, research-oriented framework for building crypto worlds—not apps, not platforms, but coherent digital civilizations. The focus is structural: how economic systems, governance models, identity layers, and cultural dynamics interlock to create resilient, self-sustaining ecosystems.

1. Defining “Crypto Worlds”

A crypto world is a persistent, permissionless socio-technical system composed of:

- A base protocol

- An economic substrate

- Governance mechanisms

- Identity and reputation systems

- Cultural narratives

- Interoperability pathways

Unlike traditional platforms, crypto worlds are not centrally administered. They are collectively maintained through cryptography, incentives, and social coordination.

The most successful examples—such as Ethereum, Solana, Polkadot, and Cosmos—already exhibit world-like properties:

- Native populations (users, validators, developers)

- Internal economies

- Political processes

- Migration flows

- Cultural differentiation

Worldbuilding in crypto means intentionally designing these layers rather than letting them emerge accidentally.

2. Layer One: The Physical Laws (Protocol Architecture)

Every world begins with physics.

In crypto, physics is protocol design: block times, finality models, virtual machines, fee markets, and security assumptions.

Key considerations:

Determinism vs. Flexibility

Rigid protocols provide stability but resist evolution. Flexible systems allow rapid innovation but risk fragmentation. Successful worlds balance immutable core rules with upgradable peripheral layers.

Security as Gravity

Security attracts population. Capital, developers, and applications flow toward chains with credible neutrality and robust consensus.

Weak security repels settlement.

Performance as Geography

Latency, throughput, and composability shape economic geography. High-throughput chains enable dense financial districts. Modular architectures encourage specialization across zones.

Protocol choices directly determine what kinds of societies can exist on top.

3. Layer Two: Economic Substrate

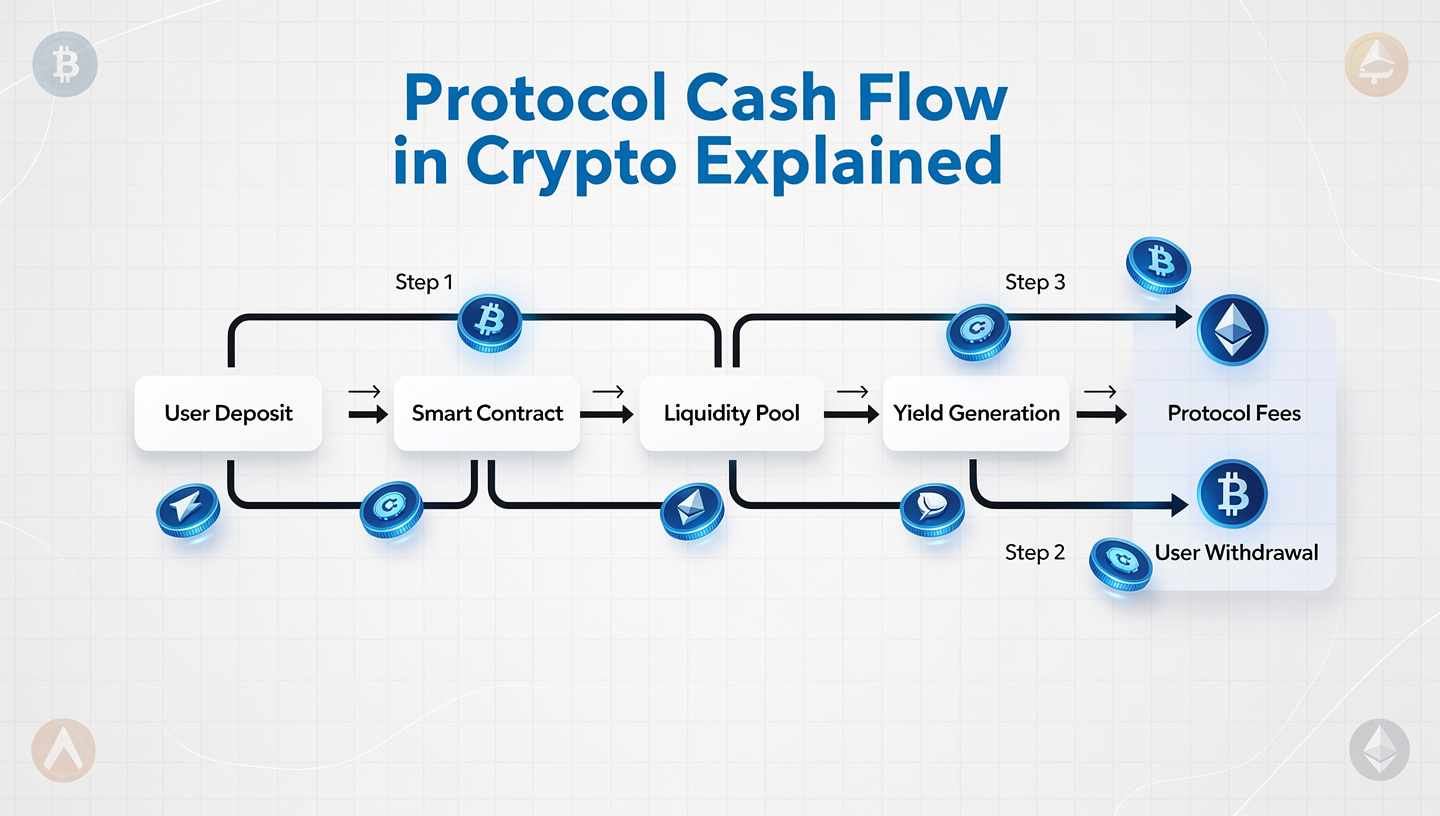

Economics is the circulatory system of crypto worlds.

Token design is not branding—it is monetary policy.

Native Currency Functions

A well-designed native asset must simultaneously act as:

- Medium of exchange

- Unit of account

- Store of value

- Governance signal

- Security collateral

Failure in any one dimension destabilizes the whole system.

Incentive Alignment

Validators, developers, users, and speculators each optimize for different outcomes. Token emissions, staking rewards, and fee structures must harmonize these incentives or risk extractive behavior.

Productive vs. Speculative Capital

Healthy worlds channel capital into infrastructure and applications. Diseased worlds trap liquidity in reflexive speculation loops.

Mechanisms such as:

- Fee burns

- Restaking

- Protocol-owned liquidity

- Builder grants

help convert speculative inflows into durable economic foundations.

4. Layer Three: Governance as Political Architecture

Every crypto world contains politics.

Ignoring this does not eliminate power—it merely obscures it.

Formal Governance

On-chain voting, DAOs, and proposal systems define official decision-making channels.

Critical design questions:

- Who can propose changes?

- How is voting power allocated?

- What thresholds trigger upgrades?

- How are emergency interventions handled?

Informal Governance

Equally important are off-chain processes:

- Developer leadership

- Social consensus

- Community forums

- Cultural norms

Most protocol changes are socially negotiated long before they are technically executed.

Effective worlds design for both.

5. Layer Four: Identity and Reputation

Wallets are not identities. They are containers.

Crypto worlds need richer identity primitives:

- Persistent pseudonyms

- Verifiable credentials

- Contribution histories

- Social graphs

Reputation systems enable:

- Sybil resistance

- Trust-based coordination

- Meritocratic influence

- Long-term accountability

Without reputation, every interaction becomes transactional. With it, cooperative cultures emerge.

This is where crypto diverges from traditional finance and begins to resemble civilization.

6. Layer Five: Culture, Myth, and Meaning

Code does not create loyalty. Stories do.

Every successful crypto world develops:

- Founding myths

- Shared symbols

- Memetic language

- Cultural heroes

- Collective traumas

These narratives perform essential functions:

- Attract newcomers

- Reinforce norms

- Justify sacrifices during downturns

- Create emotional attachment

Markets alone cannot sustain communities. Meaning must be designed—or at least cultivated.

Builders who dismiss culture as marketing consistently fail.

7. Layer Six: Interoperability and Migration

No world exists in isolation.

Crypto ecosystems increasingly resemble archipelagos connected by bridges, messaging protocols, and liquidity pathways.

Interoperability determines:

- User mobility

- Capital efficiency

- Developer reach

- Cultural cross-pollination

Worlds that isolate themselves become stagnant. Worlds that interconnect thrive through trade and migration.

Designing for seamless exit is paradoxically one of the strongest ways to encourage long-term settlement.

8. Population Dynamics

Users are citizens. Developers are architects. Validators are infrastructure operators.

Each group requires different incentives:

Users

- Low friction onboarding

- Clear value propositions

- Psychological safety

Developers

- Tooling

- Documentation

- Grants

- Social recognition

Validators

- Predictable rewards

- Slashing clarity

- Operational support

A world that neglects any one group eventually collapses.

9. Institutional Design

As crypto worlds mature, informal coordination gives way to institutions:

- Foundations

- Core development teams

- Ecosystem DAOs

- Treasury committees

These entities must balance legitimacy with effectiveness.

Too centralized, and they undermine decentralization.

Too diffuse, and nothing gets built.

Institutional minimalism—small, accountable structures with narrow mandates—has proven most resilient.

10. Failure Modes

Most crypto worlds fail. Understanding why is essential.

Common collapse patterns:

- Token hyperinflation

- Governance capture

- Developer exodus

- Cultural toxicity

- Security breaches

- Liquidity death spirals

These failures rarely stem from single bugs. They emerge from systemic misalignment across layers.

Worldbuilding is holistic. Partial excellence is insufficient.

11. A Practical Worldbuilding Framework

For builders, the process can be structured into six phases:

Phase 1: Cosmology

Define your core values, threat model, and target population.

Phase 2: Physics

Design protocol constraints and upgrade pathways.

Phase 3: Economy

Engineer token flows and incentive systems.

Phase 4: Politics

Establish governance processes and legitimacy sources.

Phase 5: Identity

Implement reputation and social coordination primitives.

Phase 6: Culture

Seed narratives, rituals, and community practices.

Each phase informs the others. Iteration is continuous.

12. Measuring World Health

Traditional metrics—TVL, market cap, transaction volume—are insufficient.

Better indicators include:

- Developer retention

- Governance participation

- Cross-ecosystem integrations

- User cohort longevity

- Cultural coherence

These reveal whether a world is merely active or genuinely alive.

13. The Long Arc

Crypto is still early.

Most current networks resemble frontier settlements: volatile, speculative, and structurally incomplete. Over time, successful worlds will evolve into complex digital societies with stable institutions, layered identities, and persistent cultures.

The builders who understand this shift—from product development to civilization design—will shape the next century of the internet.

Closing: Builders as World Architects

Crypto worldbuilding is not about shipping features.

It is about designing reality layers.

Every protocol parameter encodes a political choice. Every token model shapes social behavior. Every governance mechanism redistributes power.

To build in crypto is to legislate physics, economics, and culture simultaneously.

This responsibility demands rigor.

The future will not belong to the fastest chains or the loudest communities. It will belong to the worlds that achieve internal coherence—where technology, incentives, and meaning reinforce each other.

Crypto does not need more apps.

It needs better civilizations.