Housing has always been one of civilization’s core primitives. Before markets, before states, before formal law, humans built shelter—and from shelter emerged neighborhoods, governance, and economies.

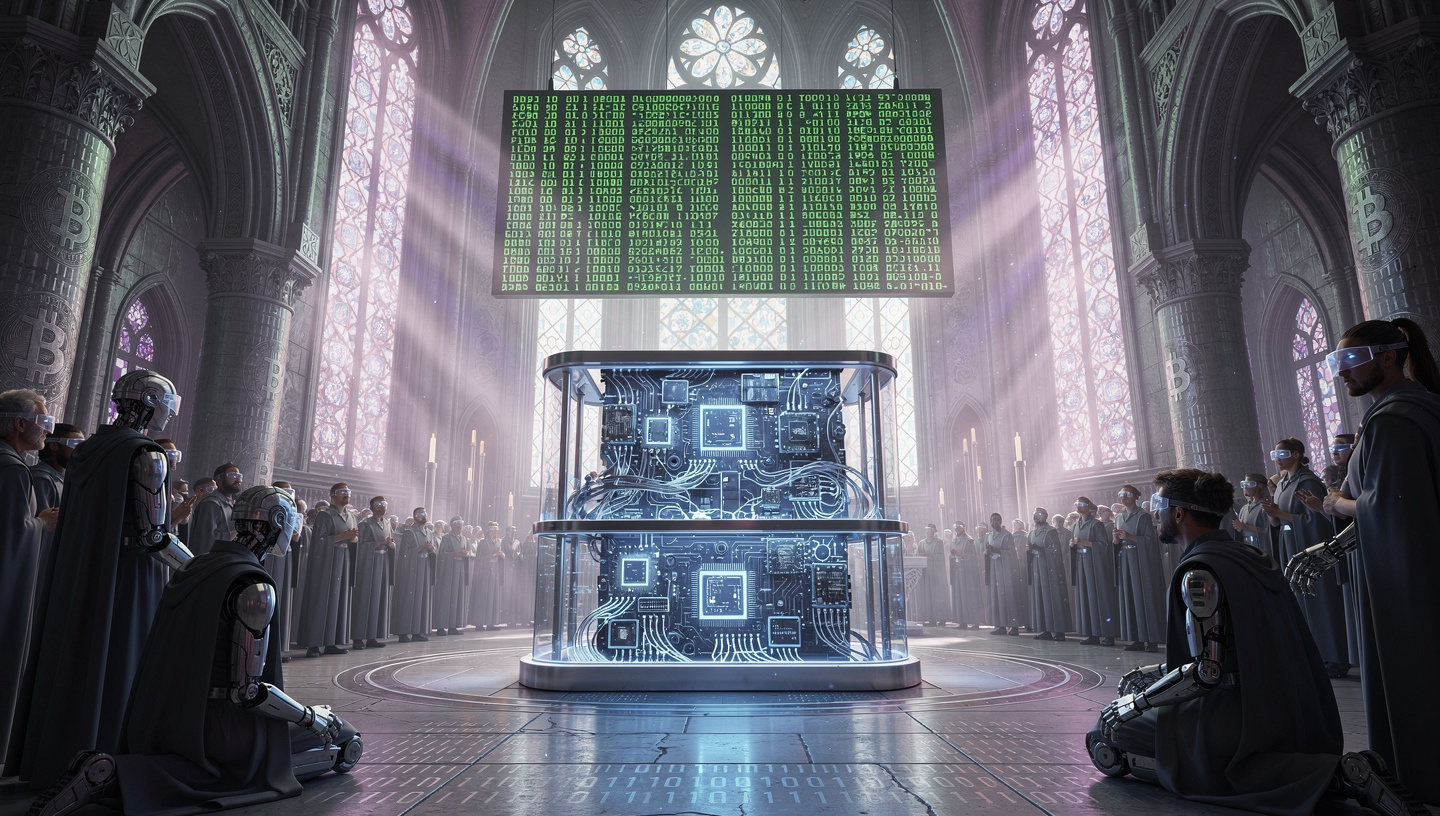

Crypto introduces a radical inversion of that historical sequence.

Instead of cities creating property systems, property systems now have the capacity to create cities.

Tokenization collapses ownership, governance, financing, and identity into programmable objects. When applied to housing, this doesn’t merely digitize deeds—it transforms dwellings into composable economic instruments. Homes become APIs. Buildings become liquidity pools. Neighborhoods become protocol layers.

This article explores housing as a tokenized asset class—not from a speculative angle, but as a worldbuilding discipline: how societies structured around crypto-native property might actually function.

We will cover:

- The technical architecture of tokenized housing

- Ownership models beyond traditional freehold

- On-chain governance of buildings and districts

- Economic implications for rent, mortgages, and development

- Urban design consequences

- Social stratification risks

- Failure modes and attack surfaces

This is not a story. This is a systems design exercise.

1. What “Tokenized Housing” Actually Means

Tokenized housing is not simply “NFT houses.”

At minimum, it implies:

- Legal claim abstraction

A dwelling’s ownership rights are represented by cryptographic tokens. - Programmable transferability

These tokens can be moved, split, collateralized, or time-locked via smart contracts. - On-chain governance hooks

Rules governing maintenance, access, and modification are embedded directly into the asset. - Composability with financial protocols

Housing integrates with lending, insurance, identity, and reputation systems.

A properly tokenized home is:

- divisible

- programmable

- composable

- enforceable

It is closer to a financial primitive than a physical object.

The building is merely the substrate.

The asset lives on-chain.

2. Ownership Is No Longer Binary

Traditional housing has a binary model: you own or you don’t.

Tokenized housing explodes this into a spectrum.

Fractional Ownership

A single residential unit may be divided into thousands of tokens:

- 40% held by occupants

- 30% by long-term investors

- 20% by the development DAO

- 10% reserved for community treasury

Each fraction carries proportional voting rights, yield entitlements, and exit liquidity.

This allows:

- crowd-funded construction

- community-backed ownership

- liquid secondary markets for housing exposure

In crypto-native cities, “buying a home” often means acquiring a controlling stake, not full title.

Time-Sliced Ownership

Housing tokens can be wrapped in time-bound contracts:

- seasonal residency rights

- rotating occupancy

- usage leases independent of equity

Your wallet may hold:

- a perpetual ownership token

- a one-year residency token

- a three-month access credential

These are separate assets.

Shelter becomes modular.

3. Buildings as Autonomous Organizations

Once ownership fragments, governance must follow.

A tokenized apartment complex is not managed by a landlord.

It is governed like a protocol.

Each building becomes a micro-DAO:

- token holders vote on maintenance budgets

- residents propose upgrades

- service providers stake reputation tokens

- disputes are arbitrated on-chain

Elevator repairs, facade renovations, security upgrades—every operational decision passes through smart contract logic.

This is not theoretical.

Organizations such as World Economic Forum already model tokenized real estate as programmable infrastructure, while groups like Ethereum Foundation fund primitives that make this possible.

In crypto cities:

- stairwells have treasuries

- rooftops have governance tokens

- parking garages have liquidity pools

Real estate becomes organizational software.

4. Rent Becomes Yield

Rent is historically extractive.

Tokenization converts rent into protocol yield.

Here’s how:

- Residents pay occupancy fees into a smart contract

- Fees are algorithmically distributed to token holders

- A portion routes to maintenance reserves

- Another portion funds neighborhood infrastructure

Instead of landlords collecting rent:

- investors receive yield

- communities receive budget

- occupants earn governance influence

This reframes housing economics.

Residents are no longer passive tenants. They are participating stakeholders.

Long-term occupants accumulate voting power. Loyal residents receive discounted tokens. Maintenance contributions increase ownership share.

Housing evolves into a participatory financial system.

5. Mortgages Are Replaced by Collateral Graphs

Crypto-native housing does not use traditional mortgages.

There are no 30-year fixed-rate loans.

Instead, homes plug directly into collateral networks.

Your housing tokens can be:

- posted as collateral

- rehypothecated into DeFi pools

- wrapped into structured products

- cross-marginized with your identity reputation

Default does not trigger foreclosure.

It triggers automatic rebalancing.

Ownership gradually dilutes. Access rights decay. Voting power redistributes.

There is no bank.

There is only math.

6. Identity Is Embedded in Architecture

Tokenized housing requires cryptographic identity.

Not names or passports—but persistent wallet reputation.

Residency is determined by:

- historical payment behavior

- contribution to building governance

- dispute resolution outcomes

- community trust scores

Your apartment knows who you are.

Doors unlock based on wallet signatures.

Utilities meter usage directly to your address.

Trash disposal credits are tokenized.

This creates cities where:

- housing access is permissioned by protocol

- reputation follows you between buildings

- eviction is algorithmic, not legal

Physical space becomes an extension of your on-chain persona.

7. Urban Planning Becomes Protocol Design

Once housing is programmable, city planning ceases to be bureaucratic.

It becomes economic engineering.

Zoning laws are replaced by contract parameters:

- maximum density encoded on-chain

- green space enforced by token supply caps

- noise pollution managed via penalty markets

Neighborhoods compete for residents by adjusting protocol incentives.

A district may lower occupancy fees to attract creators.

Another may subsidize families via treasury emissions.

Infrastructure is financed through bonded liquidity pools.

Sidewalks have yield curves.

Parks have staking rewards.

Cities become market-driven organisms.

8. Social Stratification Risks

Tokenized housing is brutally efficient.

That efficiency carries danger.

Without intervention, crypto cities converge toward:

- elite gated protocols

- reputation-based exclusion

- wealth-weighted governance

- permanent underclass wallets

Early participants accumulate property tokens.

Late arrivals rent from algorithms.

Housing DAOs drift toward plutocracy.

This is not hypothetical.

Any system where voting power correlates with capital will reproduce inequality unless explicitly constrained.

Worldbuilders must design:

- quadratic voting for buildings

- residency-weighted governance

- anti-hoarding token decay

- progressive access curves

Otherwise, tokenized housing becomes feudalism with smart contracts.

9. Physical Security in a Digital Property World

When homes are controlled by wallets, new attack surfaces emerge:

- private key theft equals home invasion

- governance exploits reassign maintenance funds

- oracle manipulation falsifies occupancy data

- smart contract bugs freeze entire districts

A compromised multisig could lock thousands out overnight.

Cybersecurity becomes civil defense.

Crypto cities require:

- hardware identity vaults

- biometric fallback layers

- offline emergency overrides

- human-in-the-loop safety systems

Tokenized housing cannot be purely autonomous.

Some authority must remain local and physical.

10. Construction Economics Change Completely

Developers no longer raise capital from banks.

They mint housing tokens.

Pre-construction units are sold as NFTs.

Future rent streams are securitized before foundations are poured.

Material suppliers accept governance stakes.

Architects receive royalties encoded in building contracts.

Every square meter is pre-financed by distributed investors.

This collapses development timelines and globalizes real estate capital.

A neighborhood in Southeast Asia can be funded by wallets in Europe within minutes.

Geography loses relevance.

11. Cultural Consequences

Tokenized housing reshapes culture.

People no longer “settle down.”

They rebalance portfolios.

Residency becomes fluid.

Communities form around protocol alignment rather than geography.

You don’t move to a city.

You join a housing network.

Citizenship dissolves into access credentials.

Belonging becomes programmable.

This echoes themes explored in The Sovereign Individual—but crypto makes it operational.

12. Designing for Human Stability

Despite all this abstraction, humans still need:

- permanence

- privacy

- predictability

- emotional attachment to place

Worldbuilders must resist over-financialization.

Not every wall needs liquidity.

Not every room needs governance.

Successful crypto housing systems deliberately include:

- non-transferable residency rights

- long-term stability guarantees

- opt-out zones from speculation

- commons protected from tokenization

Without these, cities become transient trading floors.

Shelter must remain shelter.

Conclusion: Housing as Civilization’s Smart Contract

Tokenized housing is not a feature.

It is a foundation.

Once shelter becomes programmable, everything downstream changes:

- family formation

- wealth distribution

- urban design

- political legitimacy

- social cohesion

Crypto does not merely decentralize finance.

It re-architects habitation.

In future on-chain societies, homes are no longer static assets. They are living protocols—interfacing with identity, capital, governance, and culture in real time.

Worldbuilding with tokenized housing demands rigor.

You are not designing apartments.

You are designing civilizations.

And in crypto-native worlds, every wall is a ledger entry, every hallway a governance surface, every rooftop a financial instrument.

Housing becomes code.

And code becomes society.