Tokenization promises a radical reconfiguration of economic life. Assets become programmable. Ownership becomes composable. Governance becomes algorithmic. In theory, this shift replaces opaque institutions with transparent ledgers and replaces entrenched gatekeepers with permissionless networks.

In practice, tokenized societies reproduce many of the same structural inequalities found in legacy economies—sometimes faster, sometimes more brutally.

This article examines how economic inequality emerges, mutates, and hardens inside crypto-native systems. It treats blockchains not as speculative playgrounds, but as proto-civilizations: early-stage economic orders whose incentive structures already reveal their long-term social consequences.

We will analyze wealth concentration, early adopter advantage, protocol rents, governance capture, labor stratification, and the formation of crypto elites—then outline design patterns that could plausibly mitigate these dynamics.

This is not advocacy. It is systems analysis.

1. What Is a Tokenized Society?

A tokenized society is any social or economic system where access, ownership, reputation, or governance is mediated primarily through cryptographic tokens recorded on distributed ledgers.

These systems typically exhibit:

- On-chain property rights

- Programmable monetary policy

- Automated market coordination

- Token-weighted governance

- Borderless participation

The canonical examples are public blockchains like Bitcoin and Ethereum, but the concept extends to DAOs, DeFi ecosystems, NFT economies, and on-chain identity frameworks.

Tokenized societies differ from nation-states in one crucial way: economic rules are embedded directly into software. There is no central bank discretion. No fiscal legislature. Only code, incentives, and emergent behavior.

This makes inequality less politically negotiable—and more structurally determined.

2. The Genesis Problem: Inequality at Birth

Every tokenized economy begins with a distribution event.

Whether through mining, staking, ICOs, airdrops, or venture allocations, initial supply always lands somewhere. And wherever it lands, power follows.

2.1 Early Adopter Advantage

Early participants benefit from:

- Lower acquisition costs

- Higher risk premiums

- Asymmetric information

- Technical competence barriers

This mirrors frontier economies: those who arrive first acquire the most valuable land.

In crypto, this effect is amplified by exponential price appreciation. A small initial stake can compound into generational wealth within a single market cycle.

Unlike traditional economies—where land, labor, or capital impose physical constraints—digital assets scale globally at near-zero marginal cost. This makes early advantage disproportionately powerful.

2.2 Venture Capture

Modern protocols often launch with heavy venture capital participation. Seed rounds, private sales, and foundation reserves frequently control 30–60% of total supply before public access exists.

This creates an immediate plutocracy: governance rights and upside accrue to a small, coordinated class long before “decentralization” becomes a marketing narrative.

Token-weighted voting then formalizes this imbalance.

3. Wealth Concentration on the Ledger

On-chain transparency reveals what traditional finance hides.

Most token ecosystems display extreme Gini coefficients, with:

- Top 1% wallets controlling 30–80% of supply

- Governance proposals decided by a handful of addresses

- Liquidity provision dominated by capital-rich actors

This is not accidental.

3.1 Capital Efficiency Compounds Inequality

DeFi rewards scale with capital. Yield farming, liquidity mining, and MEV extraction are structurally biased toward large balance sheets.

Small holders cannot compete with:

- Automated strategies

- Flash loans

- High-frequency arbitrage

- Validator cartels

The result: capital begets capital.

3.2 Financialization Without Redistribution

Traditional states partially counterbalance wealth accumulation through taxation and transfer programs. Tokenized societies rarely implement comparable mechanisms.

There is no built-in welfare layer.

Protocols optimize for growth, not equity.

4. Governance: From One Person, One Vote to One Token, One Vote

Token-based governance replaces civic equality with financial weight.

This produces predictable outcomes:

- Large holders dominate proposals

- Delegation concentrates power further

- Voter apathy among small holders increases capture

- Governance forums become performative

This is not democracy. It is shareholder capitalism with cryptographic enforcement.

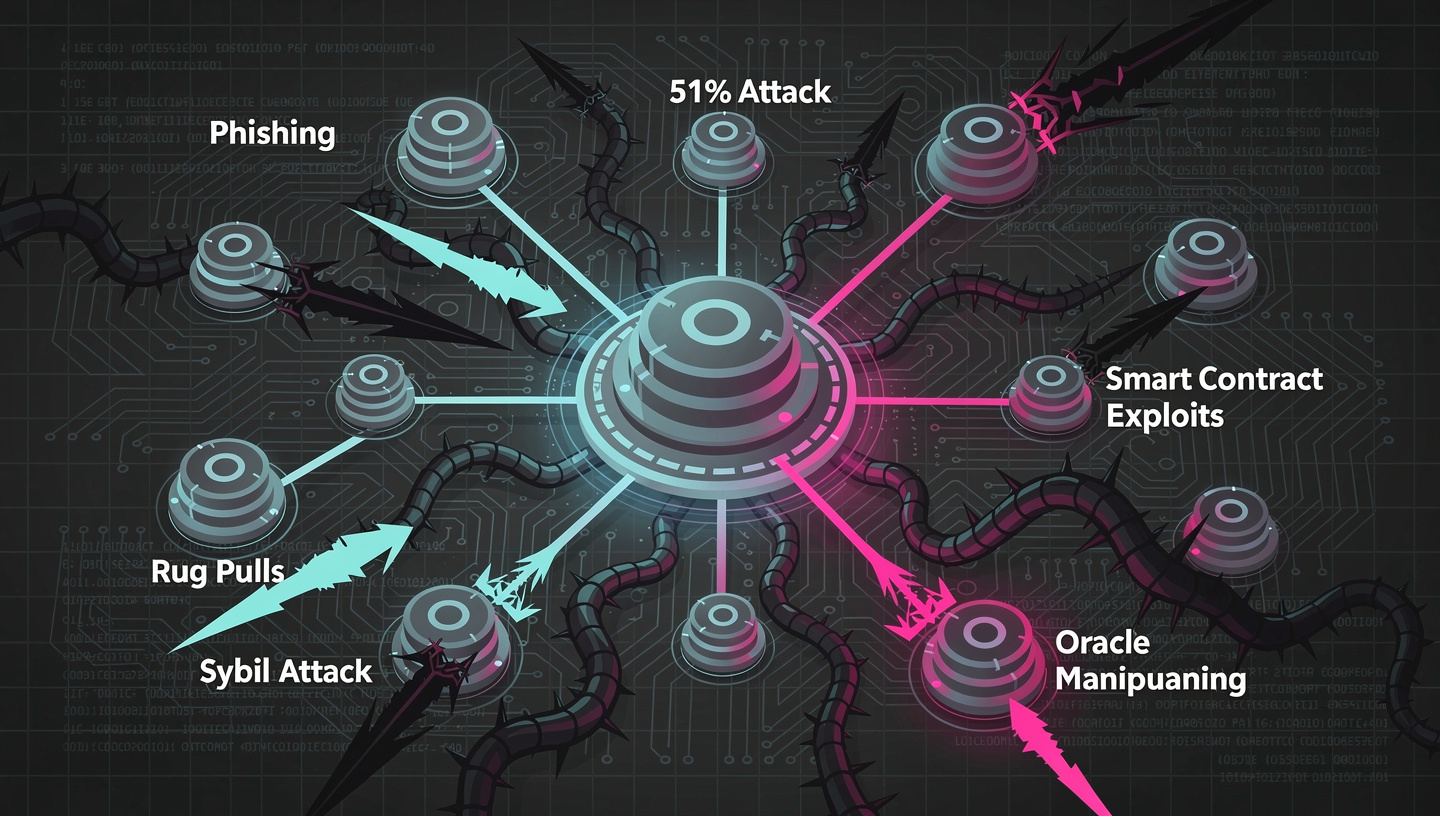

Even when quadratic voting or reputation systems are introduced, whales find ways to sybil or collude.

Governance tokens become political capital.

Political capital consolidates.

5. The New Class Structure

Tokenized societies already display recognizable social strata.

5.1 The Crypto Aristocracy

- Early miners

- Protocol founders

- Large venture funds

- Infrastructure operators

They control liquidity, narrative, and governance. Their wealth is typically diversified across multiple chains and protocols.

They shape standards.

They write improvement proposals.

They fund research.

They are the de facto ruling class.

5.2 The On-Chain Middle Class

- Developers

- DAO contributors

- Medium-scale traders

- NFT creators

They earn through labor, speculation, or grants. Their position is fragile, highly correlated with market cycles.

They possess skills, not structural leverage.

5.3 The Token Precariat

- Retail users

- Late entrants

- Play-to-earn participants

- Airdrop hunters

They provide liquidity, attention, and network effects. Their upside is capped; their downside is immediate.

They absorb volatility.

6. Labor in Token Economies

Tokenized societies reframe labor as task-based, reputation-mediated, and globally competitive.

This has consequences.

6.1 Hyper-Competition

Anyone with an internet connection can compete for the same bounties, gigs, or DAO roles.

Wages converge downward.

Only top-tier contributors command premium compensation.

6.2 Unbundled Employment

No benefits. No job security. No jurisdictional protections.

Work becomes modular and transactional.

The safety nets of industrial society do not exist on-chain.

7. Assetization of Everything

In tokenized systems, everything becomes financialized:

- Art becomes NFTs

- Social capital becomes reputation tokens

- Governance becomes tradeable power

- Identity becomes composable credentials

While this increases liquidity, it also converts human activity into speculative instruments.

Those with capital extract value from those with time.

8. Geographic Inequality Does Not Disappear

Crypto is global, but inequality remains geographically patterned.

Participants from lower-income regions often enter as labor providers or retail speculators, while capital formation remains concentrated in financial hubs.

Remittances improve.

Access improves.

But ownership still clusters.

This mirrors findings long documented by institutions like the World Bank—global connectivity does not automatically produce equitable outcomes.

9. The Piketty Problem, On-Chain

Economist Thomas Piketty famously argued that when returns on capital exceed economic growth, inequality accelerates.

Crypto intensifies this dynamic.

Token yields, staking rewards, and protocol incentives routinely exceed real-world productivity growth.

Capital appreciation outpaces labor income.

The rich get richer—at block speed.

10. Psychological Inequality: Status and Narrative Control

Beyond material wealth, tokenized societies generate symbolic hierarchies:

- Blue-chip NFT ownership

- Verified wallet status

- Protocol insider access

- Alpha group memberships

These markers confer social power.

Narrative control becomes as important as capital control. Influencers, fund managers, and core developers shape market perception, often front-running their own audiences.

Information asymmetry becomes a weapon.

11. Why Inequality Is Harder to Fix in Crypto

Three structural properties make inequality particularly resilient:

- Immutability – early mistakes are frozen into ledgers

- Permissionlessness – no authority can force redistribution

- Financial primacy – tokens encode power directly

There is no constitutional layer.

Only forks.

And forks favor incumbents.

12. Possible Design Interventions (Not Silver Bullets)

While no solution is perfect, several mechanisms could soften inequality trajectories.

12.1 Progressive Protocol Fees

Redirect a portion of transaction revenue toward public goods or universal distributions.

12.2 Universal Token Grants

Periodic per-human allocations tied to proof-of-personhood systems.

12.3 Non-Transferable Reputation

Separate governance rights from financial assets.

12.4 Time-Locked Whale Voting

Reduce instantaneous capture by large holders.

12.5 Commons-Based Ownership

Allocate protocol equity to contributor pools rather than investors.

Each introduces trade-offs: complexity, attack surfaces, or reduced capital efficiency.

But without intervention, plutocracy is the default.

13. Worldbuilding Implications: If Token Societies Mature

Project forward fifty years.

If tokenized systems become dominant:

- Citizenship is replaced by wallet identity

- Welfare is replaced by protocol dividends

- Law is replaced by smart contracts

- Inequality is enforced by cryptography

Social mobility depends on:

- Technical literacy

- Early access to networks

- Capital accumulation strategies

Birthplace matters less.

Wallet history matters more.

This is not utopia.

It is a new feudalism, written in Solidity.

Conclusion: Code Does Not Care About Fairness

Tokenized societies do not eliminate inequality. They formalize it.

They convert economic advantage into programmable privilege. They reward speed, capital, and technical fluency. They strip away the political mechanisms that once moderated accumulation.

Crypto does not democratize wealth by default.

It accelerates whatever distribution logic you embed at genesis.

If builders want equitable outcomes, they must design for them explicitly—at the protocol level, from day one.

Otherwise, tokenized futures will look familiar:

A small elite holds the keys.

Everyone else holds volatility.