Trillions of idle dollars, euros, and yen sat in balance sheets and sovereign bonds, earning fractions of a percent while automation quietly hollowed out entire professions. Productivity climbed. Wages stagnated. Capital accumulated faster than human labor could absorb it. That imbalance—mathematical, structural, inevitable—created the conditions for something unprecedented:

A global economy where income detached from employment.

Not as policy.

Not as ideology.

As infrastructure.

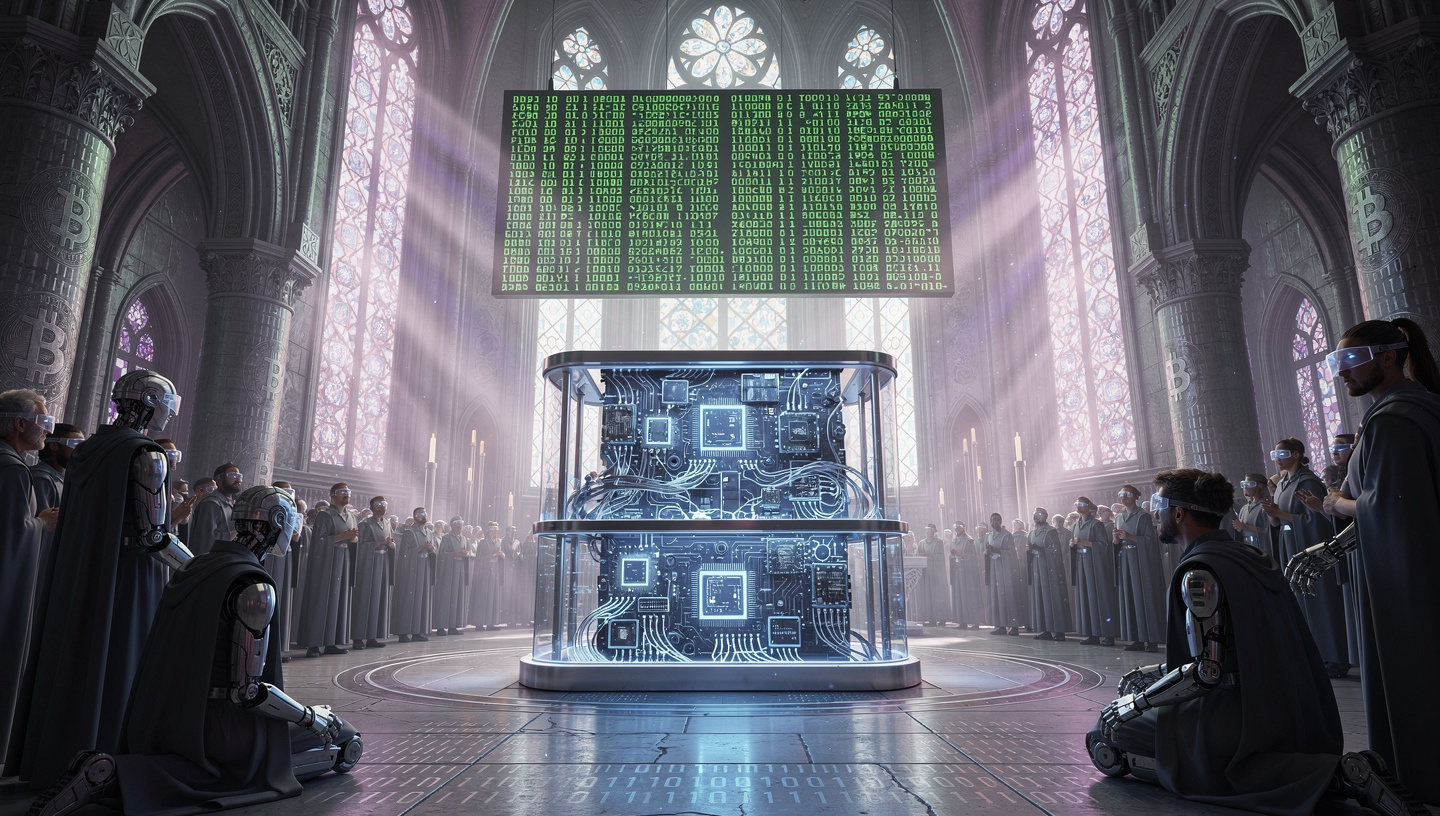

This article examines that transition through a speculative but technically grounded lens: a near-future financial system in which crypto-native yield becomes the primary source of livelihood for hundreds of millions of people. It is science fiction in framing, but anchored in real protocols, real incentives, and real economic trajectories.

This is not a story about traders getting rich.

It is about what happens when yield replaces jobs.

The Slow Collapse of Wage Centrality

For most of industrial history, income followed labor. You worked. You were paid. Capital ownership existed, but for the majority of people it was secondary: pensions, savings accounts, maybe equity exposure through mutual funds.

That model depended on three assumptions:

- Human labor would remain economically scarce.

- Firms would require large, stable workforces.

- Governments could redistribute income through taxation and welfare.

All three assumptions failed simultaneously.

Automation removed scarcity from labor.

Platforms reduced firms to thin coordination layers.

Global capital mobility outpaced national fiscal policy.

By the early 2030s, entire categories of white-collar work—accounting, compliance analysis, logistics planning, content production—had been reduced to supervisory roles over machine systems. Employment didn’t vanish overnight. It eroded.

But income erosion preceded job erosion.

Real wages flattened while asset prices accelerated.

Those who owned capital benefited. Those who did not were slowly priced out of participation.

Traditional policy responses—stimulus checks, job retraining programs, minimum wage increases—addressed symptoms, not structure. The core issue was that economic output no longer required proportional human input.

Value was being generated by code.

And eventually, value distribution followed.

Crypto Didn’t Invent This. It Operationalized It.

Decentralized finance did not create capital concentration. That existed long before blockchains.

What crypto introduced was permissionless yield.

For the first time in history, anyone with an internet connection could access automated financial systems that:

- Accepted deposits without identity verification

- Allocated capital algorithmically

- Distributed returns continuously

- Operated 24/7 without human intermediaries

This began experimentally with Bitcoin and expanded with Ethereum, whose programmable contracts allowed financial primitives—lending, swapping, derivatives—to exist entirely on-chain.

The early architects, starting with Satoshi Nakamoto, framed these systems as alternatives to banks.

They underestimated their real consequence.

Crypto didn’t compete with finance.

It abstracted finance into software.

Once that happened, yield stopped being a product sold by institutions and became a property of networks.

Protocols like Uniswap and Aave turned liquidity itself into an income-generating asset class. Capital could be deposited, routed, collateralized, and rewarded without any human approval.

Money began to work autonomously.

Yield as a Primitive

In classical economics, yield is derivative. It comes from businesses producing goods and services.

In crypto-native systems, yield is primary.

It emerges from protocol incentives:

- Liquidity providers earn fees from automated market makers

- Lenders earn interest from overcollateralized borrowers

- Stakers earn rewards for securing networks

- Arbitrageurs earn spreads by aligning prices

None of this requires factories, warehouses, or sales teams.

It requires:

- Code execution

- Capital pools

- Economic feedback loops

Yield becomes endogenous.

And once yield becomes endogenous, it becomes composable.

A deposit in one protocol becomes collateral in another. That collateral backs a synthetic asset elsewhere. That synthetic asset is staked for governance tokens, which themselves accrue voting power over future emissions.

This recursive architecture—often criticized in early years as unsustainable—proved remarkably resilient once risk models matured and leverage constraints became formalized.

By the mid-2030s, large segments of global savings had migrated into these stacked yield systems.

Not because people loved crypto.

Because nothing else paid.

The Rise of the Yield Class

The social transformation followed quietly.

First came the freelancers who supplemented income with staking rewards.

Then the remote workers who began living off protocol yields in lower-cost regions.

Then the retirees who abandoned bond markets entirely.

Finally, entire households structured their finances around on-chain income streams.

A new class emerged: not investors, not entrepreneurs—yield citizens.

They didn’t work traditional jobs.

They curated portfolios of protocol exposure.

Their primary economic activity was capital allocation:

- Rebalancing between liquidity pools

- Monitoring smart contract risk

- Voting in DAOs

- Hedging stablecoin pegs

- Optimizing tax jurisdiction arbitrage

They treated their wallets the way previous generations treated careers.

Morning routines shifted from commutes to dashboards.

Status was no longer derived from job titles but from Sharpe ratios and protocol governance influence.

Children grew up learning wallet security before résumé writing.

Universities replaced finance degrees with on-chain systems engineering.

Employment didn’t disappear—but it lost cultural centrality.

Yield became the baseline.

Governments Tried to Catch Up

States were not blind to this transition.

They attempted:

- Central bank digital currencies

- Regulated staking products

- National DeFi sandboxes

- On-chain tax collection

But they faced a fundamental problem: crypto-native yield flows across borders faster than regulation can propagate.

Traditional welfare systems are territorial.

Protocols are global.

Some governments embraced the change, issuing sovereign tokens and funding public services through protocol participation.

Others resisted, imposing capital controls and banning self-custody—only to watch liquidity migrate elsewhere overnight.

A few experimented with hybrid models: universal basic income funded partially by state-managed DeFi treasuries.

Results were mixed.

The deeper issue was philosophical.

When income comes from networks rather than employers, what is citizenship?

When capital allocates itself, what is labor policy?

When value creation is automated, what does “productivity” even mean?

There were no historical playbooks for this.

The New Inequality

Crypto did not eliminate inequality.

It transformed it.

The primary divide was no longer between workers and owners.

It was between those who understood on-chain systems and those who didn’t.

Wallet literacy became destiny.

People who learned early how to manage private keys, evaluate smart contract risk, and diversify protocol exposure accumulated compounding advantages.

Those who arrived late faced thinner yields, more complex architectures, and higher systemic correlation.

Education lagged.

By the time public institutions introduced blockchain curricula, the early yield class had already entrenched itself through governance tokens and protocol treasuries.

Power concentrated not in corporations, but in DAOs with opaque voting dynamics and whale-dominated proposals.

The rhetoric remained decentralized.

The reality was technocratic.

Work Didn’t Vanish. It Mutated.

Despite popular narratives, humans did not become idle.

They simply stopped selling time for survival.

Creative work exploded: research, art, open-source development, speculative engineering.

But these activities were no longer income-dependent.

They were optional.

People worked because they wanted influence, reputation, or meaning—not because rent demanded it.

Some became protocol auditors.

Others curated data feeds.

Many participated in decentralized science networks.

The most valuable human role became judgment:

- Assessing systemic risk

- Designing incentive mechanisms

- Mediating governance disputes

- Interpreting ambiguous signals in automated markets

Machines handled execution.

Humans handled ambiguity.

Employment became project-based, reputation-driven, and globally fluid.

The concept of a lifelong career faded.

The concept of a lifelong wallet replaced it.

Psychological Consequences

A society funded by yield behaves differently.

Time horizons lengthen.

Short-term desperation decreases.

But new anxieties emerge:

- Smart contract failures

- Stablecoin depegs

- Governance attacks

- Protocol capture

People began experiencing portfolio PTSD—stress responses tied not to job loss, but to liquidity events.

Mental health frameworks adapted.

Therapists learned to discuss drawdowns.

Financial dashboards became emotional interfaces.

The human nervous system struggled to adapt to real-time global capital flows.

Yet, over time, cultural norms stabilized.

Yield volatility became background noise.

Just like weather.

The End of Employment as Identity

Perhaps the most profound shift was existential.

For centuries, people answered the question “What do you do?” with an occupation.

In the yield era, that question lost relevance.

People answered with:

- What they were building

- What communities they belonged to

- What protocols they governed

- What problems they cared about

Economic survival no longer defined identity.

Participation did.

This did not create utopia.

It created complexity.

But it marked a clear break from industrial-age assumptions.

Conclusion: Yield Is Not Income. It Is Infrastructure.

“When Yield Replaced Jobs” is not a prediction of mass leisure or universal abundance.

It is a projection of a system already in motion.

Crypto has introduced a new economic primitive: autonomous, composable yield.

Once that exists, labor can no longer monopolize income.

Once income detaches from employment, societies must redefine purpose, governance, and fairness.

This transition will be uneven.

It will produce new elites and new vulnerabilities.

But it will also dismantle one of history’s most persistent constraints: the requirement to sell one’s time simply to exist.

Yield is not just a financial return.

It is a structural force.

And like all structural forces, it reshapes everything it touches.

The future did not arrive with spectacle.

It arrived as a protocol update.