The last banknote did not disappear in a blaze of headlines. It vanished the way oxygen leaves a room: quietly, imperceptibly, until one day people noticed they were breathing something else.

Money failed first at the edges.

It failed in refugee camps where paper bills warped in rain.

It failed in inflationary states where salaries dissolved between morning and night.

It failed in global supply chains where settlements took days while cargo moved in minutes.

It failed in software economies where value lived entirely inside servers.

By the time governments realized that money no longer needed weight, wallets, or vaults, the abstraction was already complete.

Currency had become software.

And software, unlike metal or cotton fiber, does not respect borders.

This article explores that irreversible transition—not as a nostalgic history of cash, and not as a speculative fantasy—but as a research-driven, near-future framework: how money shed its physical form, what replaced it, and what kind of civilization emerges when value becomes pure code.

The Structural Problem Physical Money Could Never Solve

Physical money evolved for a slower world.

Coins and notes worked when trade was local, when ledgers were handwritten, and when trust was enforced by proximity. But modern economies operate at machine speed. The limitations of physical currency became systemic liabilities:

- Settlement latency measured in days

- Counterparty risk embedded in every transaction

- Capital locked inside national infrastructures

- Identity dependent on institutions rather than cryptography

- Auditing constrained by human bureaucracy

Traditional finance attempted to patch these flaws with digitized banking layers: cards, wire networks, clearinghouses, and correspondent banks. But these were prosthetics attached to an obsolete core.

The underlying architecture never changed.

Money was still issued by central authorities.

Still reconciled through intermediaries.

Still gated by geography.

Still opaque by design.

Every “digital payment” remained anchored to legacy rails.

Until one protocol broke that dependency.

The publication of a decentralized monetary system by Satoshi Nakamoto marked the first instance in history where value could be transmitted peer-to-peer without institutional custody.

That was not innovation.

That was a paradigm rupture.

For the first time, money existed independently of states, banks, or corporations. Ownership became mathematical. Trust became algorithmic. Finality became cryptographic.

Cash had competition.

And it lost.

From Objects to Ledgers to State Machines

Money has taken three dominant forms across civilization:

- Physical commodities (gold, shells, paper)

- Centralized ledgers (banks, governments, clearing networks)

- Decentralized state machines (blockchains)

The third phase is categorically different.

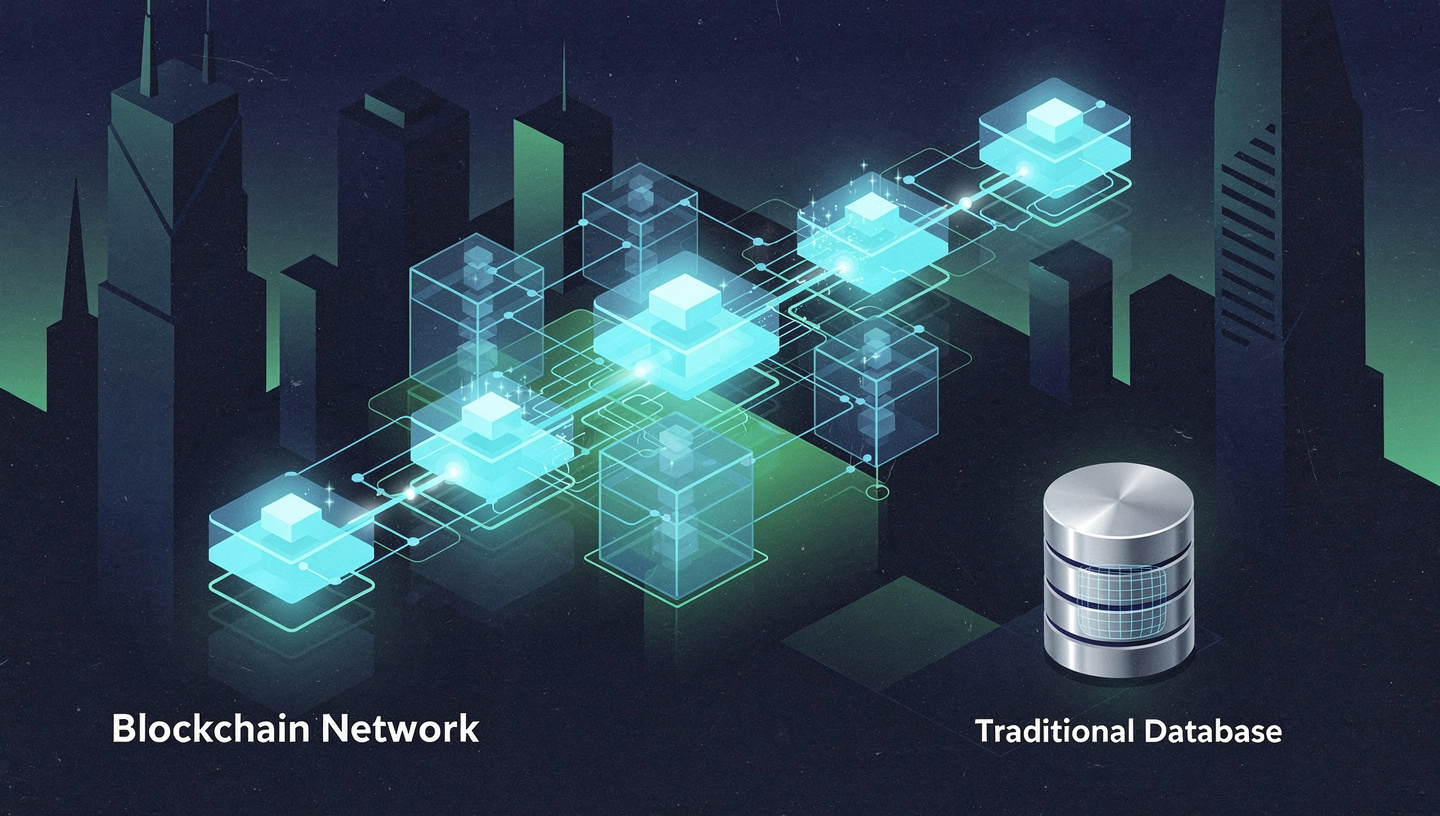

A blockchain is not merely a database. It is a globally synchronized computer that executes deterministic rules. Every balance is a state variable. Every transaction is a function call. Every contract is code.

This transforms money from an object into a process.

Instead of asking who holds it, we ask what state the system is in.

Instead of relying on institutional enforcement, we rely on cryptographic proofs.

Instead of trusting intermediaries, we verify computation.

The implications are profound:

- Settlement becomes instant and final

- Ownership becomes self-custodial

- Transparency becomes default

- Programmability becomes native

Once value lives inside a shared computational substrate, finance becomes software engineering.

The Moment Currency Became Programmable

The second shockwave arrived with smart contracts—autonomous programs that execute financial logic without human intervention.

Under this model, money no longer waits for signatures or approvals. It reacts to conditions.

Loans liquidate automatically.

Insurance pays out based on oracles.

Payroll distributes on-chain.

Royalties stream in real time.

Entire markets become composable primitives.

The organizations stewarding these infrastructures—such as the Ethereum Foundation—did not merely provide platforms. They enabled a new financial grammar: one where capital behaves like software modules.

You do not apply for services.

You interact with protocols.

Banks become APIs.

Contracts become logic trees.

Compliance becomes code.

This is not decentralization as ideology. It is decentralization as engineering.

Identity Detached from Institutions

Physical money required physical identity.

You needed documents. Addresses. Registrations. Accounts.

Digital money requires only keys.

A cryptographic wallet does not ask for your nationality, your employer, or your credit score. It verifies signatures. That is all.

This breaks a foundational assumption of modern governance: that economic participation must be permissioned.

In programmable money systems:

- Identity is optional

- Participation is global

- Access is open-source

- Verification is mathematical

This does not eliminate regulation—it displaces it.

Instead of KYC forms, compliance emerges through transparent ledgers and provable reserves. Instead of audits, real-time on-chain analytics. Instead of black-box balance sheets, open financial graphs.

Trust migrates from institutions to infrastructure.

When Borders Lost Monetary Meaning

The most destabilizing effect of non-physical money is jurisdictional.

Physical currencies are anchored to geography.

Cryptographic currencies are anchored to networks.

A transaction from Lagos to Seoul settles the same way as one across a table.

Capital flows no longer require correspondent banks. Migrant workers no longer lose 8–12% to remittance intermediaries. Entrepreneurs in restricted economies no longer wait months for international accounts.

Money becomes natively global.

This forces a reckoning:

Tax systems designed for territorial assets confront borderless capital. Monetary policy designed for closed economies confronts open networks. Financial surveillance designed for intermediaries confronts peer-to-peer rails.

States adapt slowly. Protocols iterate weekly.

The asymmetry is permanent.

The New Financial Stack

By the mid-2030s, the financial architecture of advanced economies resembles a layered software system:

Base Layer: Settlement Networks

Decentralized blockchains providing immutable state and finality.

Middleware: Liquidity and Credit Protocols

Automated market makers, lending pools, derivatives engines.

Application Layer: Consumer Interfaces

Wallets, payment apps, DAO dashboards, accounting tools.

Companies like Coinbase serve as on-ramps, but they are not the system. They are gateways into it.

The system itself is permissionless.

This stack replaces:

- SWIFT with block propagation

- Clearinghouses with smart contracts

- Custodians with private keys

- Lawyers with code audits

Finance stops being an industry.

It becomes infrastructure.

Labor, Ownership, and the Tokenization of Everything

Once money is programmable, everything becomes divisible.

Real estate fragments into digital shares.

Art becomes fractional.

Companies issue tokens instead of stock.

Communities fund themselves through DAOs.

Work changes accordingly.

Instead of salaried employment, people participate in protocol economies:

- Developers earn governance tokens

- Designers receive automated royalties

- Moderators are paid per contribution

- Educators monetize knowledge directly

Value flows continuously, not quarterly.

Ownership becomes granular. Compensation becomes real time.

This dismantles the 20th-century employer model and replaces it with fluid, protocol-mediated collaboration.

The Psychological Shift: From Saving to Staking

Physical money encouraged hoarding.

Digital money encourages participation.

In decentralized systems, idle capital earns nothing. Productive capital is staked, lent, or deployed into liquidity pools. Users become micro-allocators of global finance.

Every individual becomes a portfolio manager.

This alters behavior:

- Savings accounts become yield strategies

- Retirement plans become on-chain indexes

- Risk management becomes personal responsibility

The financial literacy curve steepens dramatically.

You do not passively store wealth.

You actively route it.

Surveillance, Privacy, and the Transparent Paradox

Blockchains are radically transparent.

Every transaction is visible. Every balance is traceable. This enables unprecedented accountability—but also unprecedented surveillance.

Privacy does not disappear. It mutates.

Zero-knowledge proofs, stealth addresses, and encrypted mempools allow selective disclosure. Individuals can prove compliance without revealing identity. Corporations can verify reserves without exposing clients.

Financial privacy becomes a cryptographic problem, not a legal one.

This is a new social contract:

You do not hide transactions.

You mathematically control who can see them.

Macroeconomics in a Post-Physical World

When money becomes code, monetary policy becomes protocol design.

Inflation schedules are baked into consensus rules. Supply changes require network-wide agreement. Emergency stimulus cannot be printed overnight.

This removes discretionary control from central authorities and replaces it with transparent algorithms.

Economies stabilize around predictable issuance curves.

Debt markets operate continuously.

Currency debasement becomes computationally impossible.

The global financial system transitions from policy-driven to rule-driven.

Some institutions resist. Others adapt. Forums like the World Economic Forum debate frameworks for coexistence.

But the direction is fixed.

You cannot uninvent programmable money.

What Actually Died When Cash Died

It was not coins.

It was not paper.

It was friction.

It was opacity.

It was permissioned access to value.

Physical money carried with it assumptions about scarcity, locality, and authority. Digital money discards those constraints.

Value becomes:

- Instant

- Global

- Composable

- Auditable

- Autonomous

This does not create utopia.

It creates a different playing field.

One where technical literacy matters more than credentials.

Where cryptography outranks bureaucracy.

Where code governs capital.

The Civilization That Emerges

A society built on non-physical money reorganizes itself around networks instead of nations.

Citizens become nodes.

Institutions become protocols.

Law becomes executable logic.

Economic coordination accelerates. Corruption becomes harder. Innovation compounds.

But fragility increases too.

Bugs replace bribes.

Key management replaces physical security.

Software upgrades replace legislation.

This is not a cleaner world.

It is a more explicit one.

Every rule is visible. Every transaction is traceable. Every failure is on-chain.

There is no back room.

Only open systems.

Final Observation

Money did not dematerialize.

It escaped.

It escaped vaults, borders, and intermediaries. It escaped the slow gravity of paperwork and policy cycles. It entered a domain where value behaves like information.

That transition is already underway.

And once money becomes software, every society becomes a programmable economy—whether it planned to or not.

Physical currency was a technological artifact of a pre-digital age.

Code is not.

This is what it means when money stops being physical forever.