A birth certificate used to be paper. Then it became a database row. The next version is a hash.

Not metaphorically—a hash. A cryptographic fingerprint anchored to a global ledger, replicated across thousands of machines, immune to clerical error and political revision. Somewhere between neonatal vitals and biometric scans, a new artifact is emerging: an identity that never existed off-network.

This article examines that transition.

Not as hype. Not as investor rhetoric. And not as a coming “wave.”

As infrastructure.

We are witnessing the earliest formation of a demographic class whose legal presence, financial agency, educational credentials, social graphs, and reputational capital originate on blockchains. They are not “users.” They are native citizens of distributed systems. They will not onboard into crypto later in life. Crypto will be their default substrate.

They are the first generation born on-chain.

From Digital Records to Cryptographic Selves

Digitization solved storage.

Blockchain attempts to solve trust.

Traditional systems rely on institutional authority: governments issue IDs, banks hold balances, universities certify degrees. These structures assume central registrars, audit trails, and enforcement mechanisms. They work—until they don’t. Corruption, exclusion, data breaches, and bureaucratic fragility are not edge cases. They are structural properties.

Blockchains replace institutional trust with verifiable computation.

Instead of believing a registry, you verify a proof. Instead of requesting permission, you present a signature. Instead of appealing to authority, you check consensus.

That shift seems abstract until applied to identity.

Self-sovereign identity frameworks already allow individuals to hold credentials in cryptographic wallets: birth attestations, vaccination proofs, academic transcripts, employment history. These credentials are issued by recognized entities but controlled by the individual. Verification requires no central database—only public keys and zero-knowledge proofs.

For adults, this is a migration.

For children born into it, it is baseline reality.

Their first “document” will not be a paper certificate. It will be a decentralized identifier bound to a keypair created at or before birth, with guardianship smart contracts managing permissions until legal maturity.

Their earliest economic activity may be a micro-endowment streamed to their wallet by relatives across borders, arriving instantly without intermediaries.

Their first reputation score will be algorithmic.

They will grow up knowing that identity is not granted—it is generated.

The End of Account Creation

Accounts are artifacts of centralized systems.

You create an account because a platform needs to recognize you.

On-chain systems invert that relationship.

You exist first. Platforms integrate with you.

Wallets replace accounts. Keys replace passwords. Authentication becomes cryptographic, not procedural. There is no signup flow—only signature verification.

For the first generation born on-chain, this will feel natural. They will not remember typing email addresses into registration forms or waiting for verification links. Presence will be proven, not approved.

This matters because accounts fragment identity. Each platform owns a slice of you. On-chain identity consolidates it. A single cryptographic root can selectively disclose attributes to any application: age range, residency proof, educational level—without revealing full personal data.

Privacy stops being a policy. It becomes a mathematical property.

Childhood in a Programmable Economy

Money is already abstract.

On-chain money is programmable.

For the on-chain generation, financial literacy will not begin with savings accounts. It will begin with smart contracts.

Allowances will be streamed per second, not deposited monthly. Chores may trigger micropayments. School achievements could mint verifiable credentials tied to scholarship DAOs. Birthday gifts may arrive as tokenized assets with embedded conditions.

Inheritance will be automated.

Trust funds will execute themselves.

This is not speculative. These primitives already exist: programmable wallets, token streaming protocols, decentralized autonomous organizations coordinating capital without boards or executives.

Children growing up inside these systems will understand money as code. They will see governance as a set of parameters. They will treat financial rules as editable logic.

They will ask different questions.

Not “how much does this cost?”

But “what does this contract allow?”

Education as a Public Ledger

Academic credentials today are siloed. Diplomas are issued by institutions, stored in databases, and verified manually. Fraud is common. Portability is limited.

On-chain education reverses this.

Courses issue cryptographic attestations. Skills are represented as composable credentials. Portfolios live in wallets, not resumes. Employers verify claims instantly by checking proofs against public registries.

Learning becomes modular.

A student might assemble a curriculum from dozens of providers—formal universities, open-source communities, DAO academies—each issuing verifiable credentials. No single institution controls the narrative of competence.

For the first on-chain generation, transcripts will be living objects. Their educational history will be queryable, programmable, and globally interoperable.

They will not graduate from a system.

They will continuously evolve within one.

Governance Without Geography

Citizenship has always been territorial.

On-chain governance is not.

DAOs already coordinate millions of participants across continents, allocating capital, voting on proposals, and managing treasuries without incorporation in any single jurisdiction.

For adults, this is experimental.

For children born into it, it will be ordinary.

They may belong simultaneously to a city, a nation-state, and multiple digital polities—each with its own rules, rights, and responsibilities. Voting power may be tied to contribution metrics rather than passports. Representation may be algorithmic.

Disputes will be resolved through arbitration protocols. Laws will be partially encoded. Compliance will be enforced by smart contracts.

This does not eliminate governments. It competes with them.

The on-chain generation will grow up navigating layered sovereignties: physical and digital, local and global, legacy and cryptographic.

They will not ask where authority comes from.

They will inspect the code.

Reputation Becomes Capital

In legacy systems, reputation is informal. It lives in references, reviews, and social networks.

On-chain, reputation becomes structured data.

Every action can be recorded. Every contribution can be attributed. Every interaction can feed into composable reputation graphs. These graphs can unlock access to communities, capital, or opportunities.

This creates a new form of capital: provable participation.

For the first generation born on-chain, reputation will be as tangible as money. They will curate it deliberately. They will understand that identities accrue history and that history has economic consequences.

They will also confront the permanence of ledgers early in life.

Mistakes may be harder to erase.

Which is why privacy-preserving reputation systems—using zero-knowledge proofs and selective disclosure—are not optional. They are foundational. The difference between a surveillance economy and a sovereign one lies in cryptographic design choices made today.

Parents, Guardians, and Cryptographic Custody

Children cannot manage private keys.

So guardians will.

This introduces a new domain: cryptographic parenting.

Multi-signature wallets already allow shared control over assets. Time-locked contracts can release permissions at predefined ages. Recovery mechanisms can distribute custody among trusted parties.

For newborns, identity wallets will likely be governed by parents, healthcare providers, and public institutions in multi-party schemes. Over time, control will shift gradually to the individual.

Adulthood will not arrive with a paper ID.

It will arrive with key rotation.

Labor in a World of Autonomous Markets

The on-chain generation will enter a workforce where borders matter less than bandwidth.

They will compete in global talent markets mediated by smart contracts. Payments will clear instantly. Work histories will be verifiable. Reputation will be portable.

They may never submit a traditional CV.

Instead, they will present a wallet.

Inside it: project credentials, DAO contributions, on-chain references, code commits, governance participation, and financial history—cryptographically signed.

Employment will be granular. People will fluidly move between projects, DAOs, and protocols, assembling income streams from multiple sources.

Work will resemble an API.

The Cultural Layer: Memes, Markets, and Meaning

Every generation has its native language.

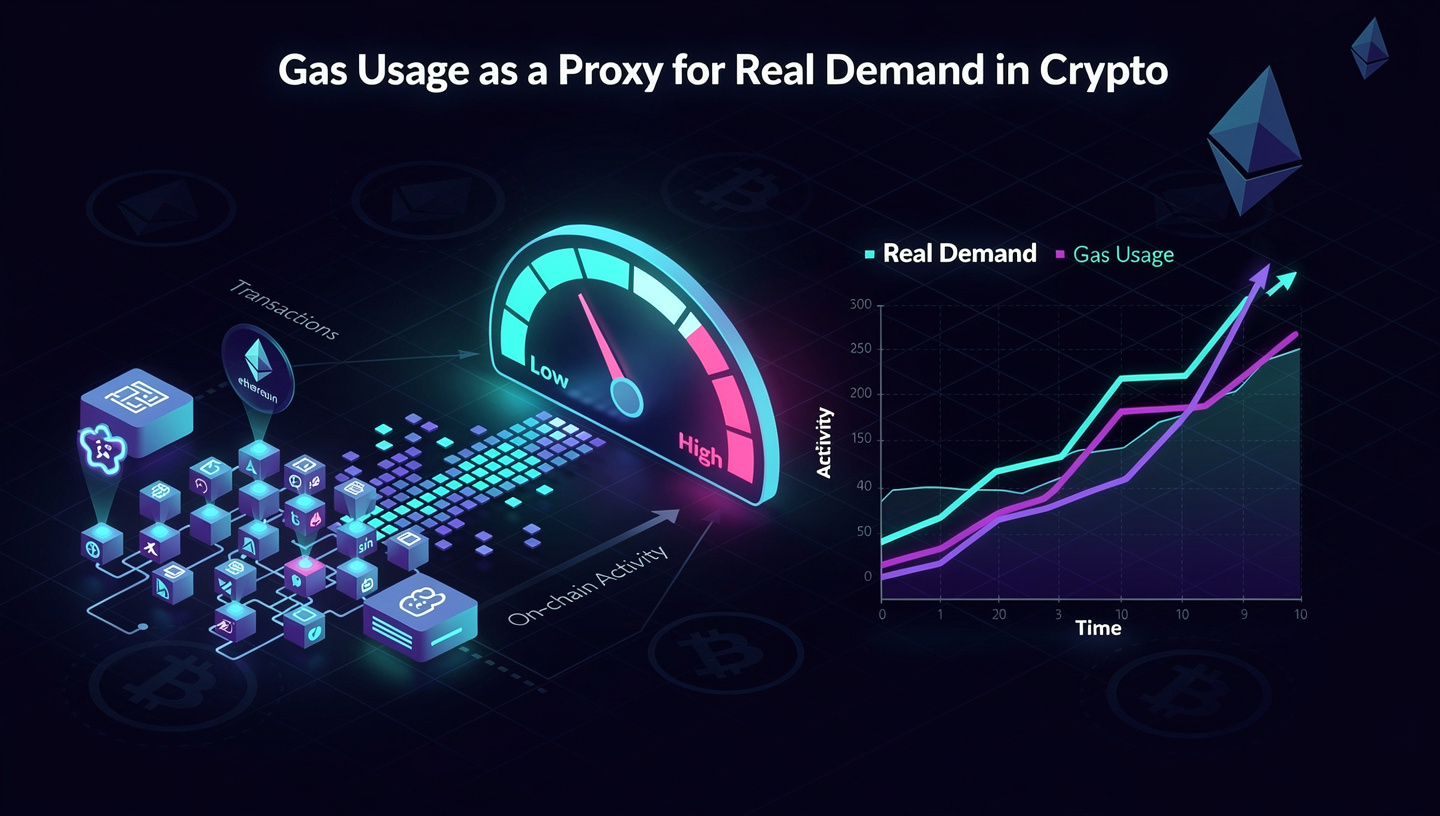

For this one, it will include hashes, gas fees, and governance proposals.

They will grow up inside meme economies where cultural artifacts are tokenized. They will trade digital objects with provable scarcity. They will participate in collective experiments where communities bootstrap themselves with tokens and narratives.

Value creation will blur with identity formation.

And because these systems are open, they will absorb global culture at unprecedented speed. A teenager in Lagos, Hanoi, or São Paulo will have access to the same financial rails and creative tools as one in New York.

Geography will still matter.

But less.

Architects of the Substrate

This world is not emerging spontaneously. It is being engineered by cryptographers, protocol designers, and open-source communities.

Figures like Vitalik Buterin helped popularize programmable blockchains, while organizations such as the Ethereum Foundation coordinate research into scalability, privacy, and governance.

Entire cities—like Shenzhen—have become hardware backbones for decentralized infrastructure, manufacturing the devices that secure these networks.

And parallel advances in AI, driven by labs such as OpenAI, are accelerating the automation of on-chain systems, from smart contract auditing to autonomous agents managing DAO treasuries.

The first on-chain generation will inherit this stack.

They will not question it.

They will build on it.

Risks: Immutability Cuts Both Ways

Ledgers do not forget.

That is both feature and threat.

Poorly designed identity systems can ossify inequality. Early mistakes can become permanent scars. Wealth disparities can compound algorithmically. Surveillance can be baked into infrastructure.

If credentialing systems privilege certain regions or institutions, they will reproduce legacy hierarchies in cryptographic form.

If governance tokens concentrate, decentralization becomes cosmetic.

If privacy is optional, it will be abused.

The on-chain generation will live with the consequences of architectural decisions made now. This is why protocol design is moral design. Defaults matter. Incentives matter. Upgrade paths matter.

There is no neutral infrastructure.

What Makes This Generation Different

Every technological shift produces adaptation.

This one produces ontological change.

Previous generations learned computers.

This generation will be represented by them.

Their existence will be partially encoded. Their relationships will be partially automated. Their rights will be partially enforced by software. They will experience sovereignty as a combination of cryptography and community.

They will not distinguish sharply between online and offline selves. Both will be real. Both will have consequences.

They will grow up knowing that institutions can be replaced by protocols, that coordination can occur without permission, and that identity can be self-custodied.

They will expect systems to be open, composable, and verifiable.

They will find opaque authority alien.

The Long Arc

This is not about speculation cycles.

It is about demographic momentum.

Once identity, money, education, and governance converge on shared cryptographic rails, reversal becomes unlikely. Network effects harden. Standards propagate. Children normalize what adults debate.

The first generation born on-chain will not argue about whether blockchains matter.

They will assume they do.

Their world will be one where wallets precede bank accounts, where credentials are machine-readable, where communities form around code, and where participation is provable.

They will inherit a planet still bounded by physics—but increasingly organized by ledgers.

And decades from now, when historians trace the origin of this shift, they will not point to a market rally or a whitepaper.

They will point to a quieter moment:

The day identity stopped being issued—and started being generated.