Most people enter crypto the same way they enter poker.

They stare at charts.

They chase momentum.

They guess direction.

They believe profit comes from predicting price.

That belief is quietly costing them money.

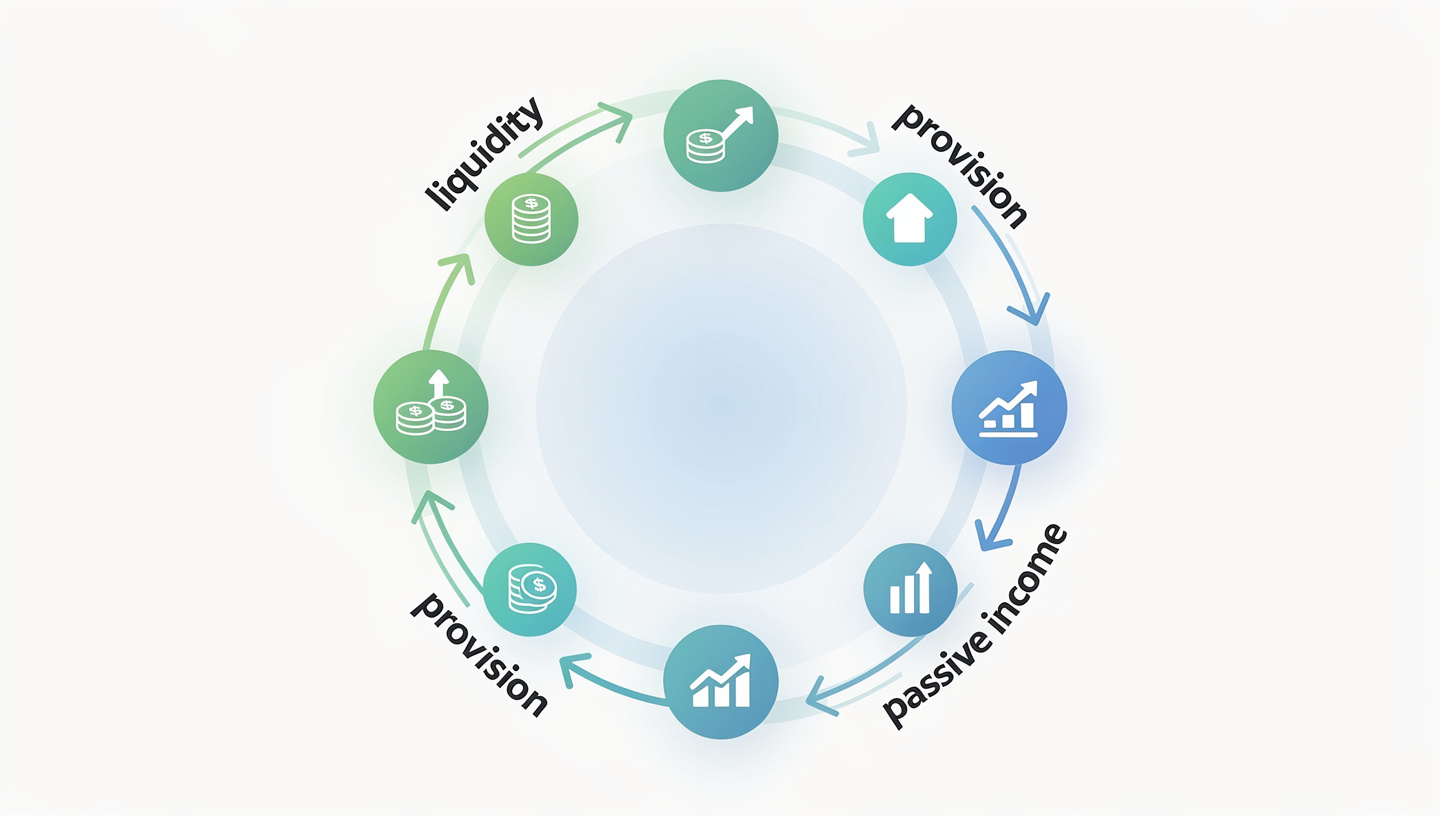

In every financial market that has ever existed — stocks, forex, commodities, or crypto — the most consistent profits do not belong to traders. They belong to liquidity providers.

Not the loud participants.

The invisible ones.

The people who get paid simply for standing in the middle of every transaction.

If you understand this single concept, your entire view of “passive income” in crypto changes.

Liquidity provision is not about getting rich fast.

It is about positioning capital where activity happens, not where emotion happens.

This article explains liquidity provision from first principles:

- What liquidity really means in crypto

- How automated market makers (AMMs) work

- Where LP yield actually comes from

- Why impermanent loss exists

- How professional LPs think about risk

- When liquidity provision makes sense — and when it does not

- How LP compares to staking, farming, and holding

- The structural advantages and hidden costs

No hype. No shortcuts. Just mechanics.

1. What Liquidity Actually Means (Without Marketing Language)

Liquidity is simply the ability to exchange assets instantly without moving the price significantly.

If you can sell $10,000 worth of ETH and the price barely changes, that market is liquid.

If selling $10,000 crashes the price by 5%, that market is illiquid.

Every trade requires a counterparty.

Liquidity providers are that counterparty.

They supply both sides of a market so others can transact.

In traditional finance, this role is handled by professional market makers.

In DeFi, this role is handled by you, via liquidity pools.

Instead of buyers matching with sellers, traders interact with pools of capital.

These pools are funded by users called LPs (Liquidity Providers).

LPs deposit two assets into a smart contract.

Traders swap against that contract.

Every trade pays a fee.

Those fees go to LPs.

That’s the entire business model.

No prediction.

No timing.

No chart reading.

Just providing inventory.

2. Automated Market Makers: The Engine Behind DeFi Liquidity

Traditional exchanges use order books.

DeFi mostly uses Automated Market Makers (AMMs).

The most common AMM model is:

x * y = k

Where:

- x = token A

- y = token B

- k = constant

Uniswap popularized this.

When someone buys ETH from an ETH/USDC pool:

- ETH decreases

- USDC increases

- Price automatically adjusts

There is no negotiation.

No bids.

No asks.

Just math.

The pool always quotes a price based on its internal balance.

LPs deposit both assets at the current market ratio.

In return, they receive LP tokens representing their ownership of the pool.

Whenever someone trades:

- A fee (usually 0.05%–0.3%) is charged

- That fee is distributed proportionally to LPs

This is your income.

3. Where LP Yield Really Comes From

Liquidity provision does not magically create money.

Returns come from three sources:

1. Trading Fees

Every swap generates fees.

High volume = high yield.

Low volume = low yield.

Volatility helps only if it creates activity.

A quiet market pays nothing.

A chaotic market pays well.

This is why meme coin pools often show insane APYs — massive churn.

2. Incentive Emissions

Protocols often add token rewards on top of fees.

This is not organic yield.

It is dilution-based marketing.

Early DeFi called this “liquidity mining.”

It boosts APY but increases risk.

Once emissions end, yield collapses.

Professional LPs separate fee APR from reward APR.

Only fee APR is sustainable.

3. Asset Rebalancing (Often Negative)

AMMs constantly rebalance your assets.

When price rises, you sell.

When price falls, you buy.

You are systematically selling winners and accumulating losers.

This is why LP performance diverges from simply holding.

Which brings us to the most misunderstood concept in DeFi.

4. Impermanent Loss: The Cost of Being the House

Impermanent loss (IL) is not a bug.

It is the price of providing liquidity.

If one asset outperforms the other, LPs underperform holding.

Example:

You LP ETH/USDC.

ETH doubles.

The pool automatically sells ETH into USDC as price rises.

You end with less ETH than if you had just held.

That difference is impermanent loss.

Fees may or may not compensate.

Key insight:

Liquidity provision is structurally bearish on volatility.

LPs profit when price oscillates, not when it trends hard.

Strong trends punish LPs.

Range-bound markets reward them.

This is why professional LPs prefer:

- Stablecoin pairs

- Correlated assets (ETH/LST, BTC/wBTC)

- Tight ranges with high volume

Not moonshots.

5. Concentrated Liquidity Changed Everything

Uniswap V3 introduced concentrated liquidity.

Instead of providing liquidity across all prices, you choose a range.

This allows:

- Higher capital efficiency

- Much higher fee APR

- Active management

But it also introduces:

- Range risk

- Repositioning costs

- Operational complexity

You are no longer passive.

You become a manual market maker.

Outside your range, you earn nothing.

Inside your range, yield spikes.

This is powerful — and dangerous.

Most retail LPs underestimate how much maintenance this requires.

6. LP vs Staking vs Holding: Structural Comparison

Let’s compare objectively.

Holding

- Pure directional exposure

- Maximum upside

- Maximum volatility

- Zero yield

Holding is speculation.

Staking (PoS)

- Yield from inflation + fees

- Subject to slashing

- Token price risk

- Dilution over time

Staking rewards often fail to beat token inflation.

It feels productive but frequently underperforms holding.

Liquidity Provision

- Yield from activity

- Neutral to direction

- Exposed to IL

- Capital fragmented across assets

LP is volatility harvesting.

You monetize other people’s trades.

But you sacrifice convex upside.

This is not a growth strategy.

It is an income strategy.

7. Professional LP Thinking (How Institutions Approach This)

Serious LPs do not chase APY dashboards.

They model:

- Volume stability

- Fee density

- Correlation

- Volatility regimes

- Tail risk

They ask:

- Is this pair structurally active?

- Are both assets investable long term?

- Is fee income predictable?

- Can I exit without slippage?

They prefer boring pairs with relentless volume.

USDC/USDT

ETH/stETH

BTC/wBTC

Low drama.

High turnover.

Consistent fees.

Retail chases 800% APY on exotic tokens.

Professionals collect 8–20% quietly on deep pools.

This is exactly how traditional market makers think.

8. Real Risks Most LP Guides Ignore

Liquidity provision carries risks beyond IL.

Smart Contract Risk

Your funds live inside code.

One exploit = total loss.

Audit ≠ guarantee.

Oracle Manipulation

Thin pools can be drained via price manipulation.

Especially on forks and low-liquidity chains.

Token Death

If one side collapses, you accumulate trash.

IL becomes permanent.

Protocol Governance Risk

Fees can change.

Incentives can stop.

Rules can be rewritten.

DeFi is not immutable economics.

It is mutable software.

9. When Liquidity Provision Makes Sense

LP works best when:

- You already want exposure to both assets

- Volume is consistently high

- Price oscillates more than it trends

- Fee APR alone is acceptable

- You understand exit mechanics

It fails when:

- You expect strong directional moves

- You rely on emissions for yield

- Assets are highly speculative

- You ignore rebalancing costs

Liquidity provision is not passive income.

It is capital deployment into infrastructure.

You become part of the exchange.

10. A Buffett-Style Mental Model

Warren Buffett does not trade stocks.

He owns businesses.

Liquidity provision is similar.

You are not betting on price.

You are owning a toll booth.

Every trader pays you.

Some days traffic is light.

Some days it’s heavy.

But the road keeps operating.

Your job is to place the booth on a highway, not a dirt path.

Highway = volume.

Everything else is noise.

Final Thoughts

Liquidity provision is one of the few mechanisms in crypto where retail participants can directly access market-making economics.

That alone makes it remarkable.

But it is routinely misunderstood, misused, and oversold.

It is not free money.

It is not riskless yield.

It is a tradeoff:

You exchange upside convexity for transactional income.

You trade speculation for infrastructure.

Done correctly, LP can produce steady returns independent of market direction.

Done carelessly, it quietly bleeds value.

The difference lies in asset selection, volume analysis, and risk discipline — not APY screenshots.

In crypto, most people try to predict price.

The house collects fees.

Liquidity providers are the house.

Choose accordingly.