Crypto doesn’t reward those who arrive first.

It rewards those who arrive correctly.

In meme coin markets, this distinction is everything.

Every cycle, thousands of tokens appear overnight. Most die quietly. A few explode violently. And an even smaller fraction sustain momentum long enough to reshape portfolios and narratives. The surface-level observer sees price charts and volume spikes. The serious participant sees something deeper: behavioral signatures, liquidity choreography, wallet topology, attention mechanics.

The mistake most traders make is treating growth as a single variable.

Price goes up. Volume increases. Twitter gets loud.

They call it “bullish.”

But price appreciation alone tells you nothing about whether demand is authentic or manufactured.

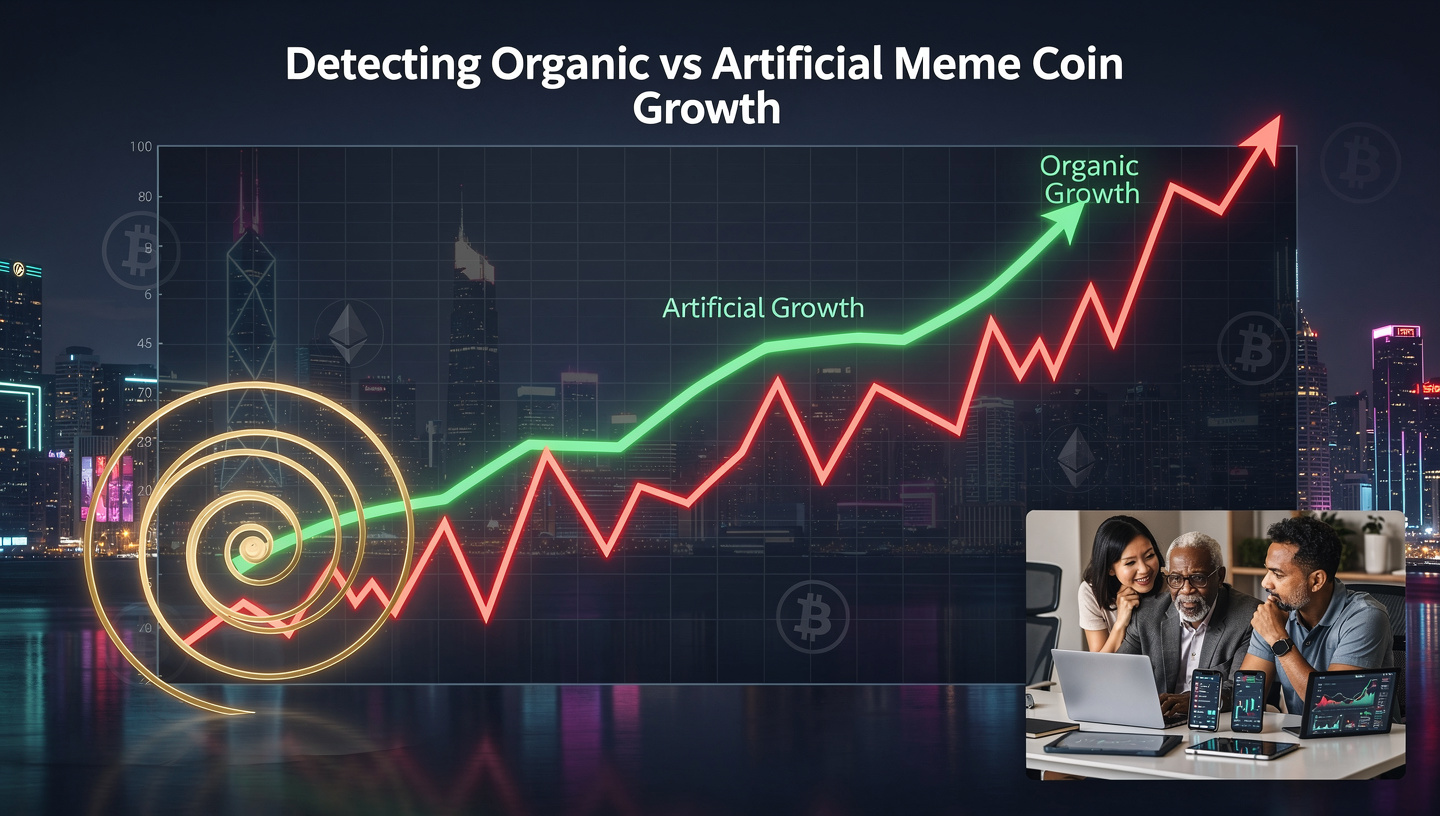

Understanding meme coin growth requires recognizing that there are fundamentally two different phenomena at play: organic expansion driven by distributed human interest, and artificial expansion orchestrated by capital concentration and coordinated actors.

These two look similar on charts.

They feel completely different under a microscope.

This article lays out a practical, research-backed framework for distinguishing between them.

Not theory. Not vibes.

Signal.

Why Meme Coins Demand a Different Analytical Lens

Traditional crypto assets derive value from utility narratives: throughput, decentralization, execution environments, developer ecosystems.

Meme coins operate in a different dimension.

They are attention-native assets.

Their primary drivers are emotional velocity, cultural resonance, and network contagion. Liquidity follows sentiment, not roadmap delivery. Community cohesion matters more than GitHub commits.

Because of this, meme coins attract a disproportionate number of engineered launches. Low development overhead plus viral potential creates an environment where artificial growth strategies thrive.

Bots simulate engagement.

Wallet clusters manufacture volume.

Insiders rotate supply.

Influencer amplification is purchased.

Liquidity is staged.

To the untrained eye, it all looks like adoption.

But organic growth leaves fingerprints.

Artificial growth leaves patterns.

If you learn to read those patterns, you stop chasing pumps and start positioning ahead of real momentum.

Organic Growth Is Chaotic. Artificial Growth Is Structured.

This is the first principle.

Real communities are messy.

They arrive in waves. They ask redundant questions. They argue. They create uneven content. They onboard slowly at first, then accelerate unpredictably.

Artificial campaigns are clean.

They spike sharply. They deploy synchronized messaging. They exhibit smooth engagement curves. They rely on narrow wallet participation. They show precision.

Chaos is human.

Precision is capital.

Your job is to identify which you’re dealing with.

On-Chain Distribution: The Foundation of Truth

Everything begins with wallet topology.

Organic growth distributes tokens naturally. Artificial growth concentrates them deliberately.

In authentic meme coin expansion, you’ll observe:

A long-tail holder distribution with thousands of wallets owning small amounts

Progressive decentralization over time

Early holders gradually reducing dominance

New wallets appearing continuously, not in bursts

Transaction sizes varying widely

In artificial growth scenarios, patterns invert:

Top 10 wallets control extreme supply percentages

New wallets appear in batches within minutes

Transaction values cluster tightly

Early wallets recycle tokens between themselves

Distribution plateaus instead of diffusing

A key metric is Gini coefficient applied to token holdings. Organic ecosystems trend downward over time. Artificial ecosystems remain flat or worsen.

Another signal is wallet age. Real buyers come from diverse historical timelines. Manufactured volume often relies on freshly created wallets or dormant addresses suddenly activating simultaneously.

If you see 200 new holders appear in five minutes, that’s not adoption.

That’s orchestration.

Liquidity Behavior Reveals Intent

Liquidity is narrative in motion.

Organic meme coins attract liquidity passively. LP grows gradually as confidence builds. Liquidity providers are numerous. Pools deepen unevenly.

Artificial launches deploy liquidity aggressively. Large LP injections appear at creation. Liquidity often originates from a single source. Pools are oversized relative to holder count.

Watch for these red flags:

Liquidity added immediately after deployment

LP tokens not burned or locked

Liquidity controlled by one or two wallets

Rapid LP removal during early pumps

Real projects exhibit asymmetric liquidity growth. Fake ones exhibit symmetry: price up, liquidity up, price down, liquidity disappears.

The presence of deep liquidity alone means nothing.

Who controls it means everything.

Volume Is Easy to Fake. Participation Is Not.

Volume can be manufactured.

Engagement cannot.

Wash trading inflates numbers, but it does not create behavioral diversity.

Organic meme coin volume shows natural variance. Spikes correlate with social catalysts. Transactions come in inconsistent sizes. Buy-to-sell ratios fluctuate organically.

Artificial volume is rhythmic.

You’ll see repetitive transaction amounts. Buy and sell cycles execute within seconds. The same wallets appear on both sides of trades. Volume rises without corresponding increases in unique holders.

A powerful technique is analyzing inter-transaction timing.

Human-driven activity produces irregular intervals.

Bots produce symmetry.

If blocks show mirrored trade sizes at consistent intervals, you’re watching a machine.

Social Growth: Velocity vs Texture

Most people evaluate meme coins through follower counts.

That’s shallow.

What matters is conversational texture.

Organic communities demonstrate:

Unstructured discussion

Redundant questions from newcomers

User-generated memes

Debate and disagreement

Varied linguistic styles

Slow accumulation of inside jokes

Artificial communities look sterile:

Identical phrases repeated

Emoji-heavy hype posts

Low reply depth

Few unique contributors

High post frequency, low engagement diversity

Measure the ratio of posters to readers.

In organic environments, this expands over time.

In artificial environments, it remains narrow.

Another subtle signal is sentiment distribution. Real communities oscillate emotionally. Artificial ones maintain constant positivity.

Humans complain.

Bots don’t.

Price Action: Organic Moves Breathe

Authentic meme coins don’t move in straight lines.

They surge, retrace, consolidate, then build again.

You’ll observe higher lows forming naturally. Pullbacks attract buyers. Support zones develop.

Artificial pumps look different:

Vertical candles

Minimal retracement

Immediate rejection at highs

Sharp collapses

Dead volume afterward

Organic charts look alive.

Artificial charts look scripted.

One of the strongest indicators is post-pump behavior. Real projects retain elevated baseline activity. Fake ones return to silence.

Momentum that evaporates is not momentum.

Developer Footprint and Transparency

In organic growth, builders show up.

They answer questions. They ship small updates. They adjust messaging based on feedback. They don’t vanish during volatility.

Artificial projects minimize exposure. Dev wallets go silent. Announcements are generic. Roadmaps are vague. Everything is future tense.

Watch for contract renouncement patterns, multisig transparency, and public accountability.

Real teams reduce control over time.

Fake teams retain it.

Attention Flow Mapping

Where is traffic coming from?

Organic meme coins grow laterally: Discord, Telegram, Twitter, Reddit, private groups, word of mouth.

Artificial growth relies vertically on a few amplification nodes: paid influencers, Telegram blast channels, coordinated raids.

If engagement originates primarily from large accounts with transactional relationships, growth is being rented.

If it spreads through small accounts and grassroots content, growth is being earned.

Follow the links.

Trace referral paths.

Attention leaves trails.

The Psychology Layer: What Organic Believers Do Differently

Organic holders behave differently from mercenary traders.

They:

Defend the project in comment sections

Create content without incentives

Hold through volatility

Invite friends

Participate in governance or meme creation

Artificial participants rotate capital quickly. They don’t emotionally attach. They don’t contribute creatively.

Communities that build culture outperform communities that chase candles.

Every time.

Composite Scoring: Building a Practical Detection Framework

Serious operators don’t rely on single indicators.

They aggregate.

A robust evaluation model weights:

Holder distribution entropy

Wallet age diversity

Liquidity decentralization

Volume irregularity

Social texture depth

Post-pump retention

Developer visibility

Each factor contributes to an overall authenticity score.

High scores predict survivability.

Low scores predict extraction.

This is how professionals filter thousands of launches into a handful of viable opportunities.

Not by vibes.

By structure.

Why This Matters More Than Ever

As tooling improves, artificial growth becomes more convincing.

Bots write better.

Wash trading becomes harder to spot.

Influencer marketing becomes more subtle.

But the fundamentals remain unchanged.

Human networks grow differently than engineered systems.

Decentralized interest cannot be perfectly simulated.

There will always be tells.

Your edge is learning to see them.

Retail chases narratives.

Professionals study behavior.

Meme coins reward those who understand crowd dynamics, not those who react fastest.

The market is a psychological machine wrapped in cryptography.

Once you internalize that, everything changes.

Final Perspective

Organic meme coin growth feels inefficient.

It’s slow at first.

It’s noisy.

It’s uncomfortable.

Artificial growth feels impressive.

It’s fast.

It’s clean.

It’s seductive.

But only one compounds.

The other extracts.

If you want longevity in this space, train yourself to ignore surface metrics and focus on underlying structure.

Price is lagging.

Distribution is leading.

Attention quality matters more than attention quantity.

Real communities always reveal themselves to those patient enough to look.