Most discussions about DeFi versus CeFi begin with ideology. Decentralization versus trust. Code versus institutions. Freedom versus control. These debates are emotionally compelling—but analytically weak. Finance does not evolve based on slogans. It evolves based on efficiency, resilience, scalability, and capital allocation performance.

The real question is not which system sounds better, but which system processes value more effectively under real-world constraints.

CeFi represents the culmination of centuries of financial engineering—risk departments, compliance frameworks, custodial guarantees, and liquidity provisioning. DeFi, by contrast, is a computational experiment: autonomous financial infrastructure enforced by cryptography rather than contracts, executed by software rather than intermediaries.

Both systems claim superiority. Only data can arbitrate that claim.

This article conducts a data-driven, first-principles comparison of DeFi and CeFi, examining liquidity efficiency, capital velocity, risk distribution, transparency, failure modes, regulatory friction, and long-term survivability. The goal is not to crown a winner, but to understand the economic truth beneath the narratives.

Defining the Systems Precisely (Without Marketing Language)

Before analysis, definitions must be exact.

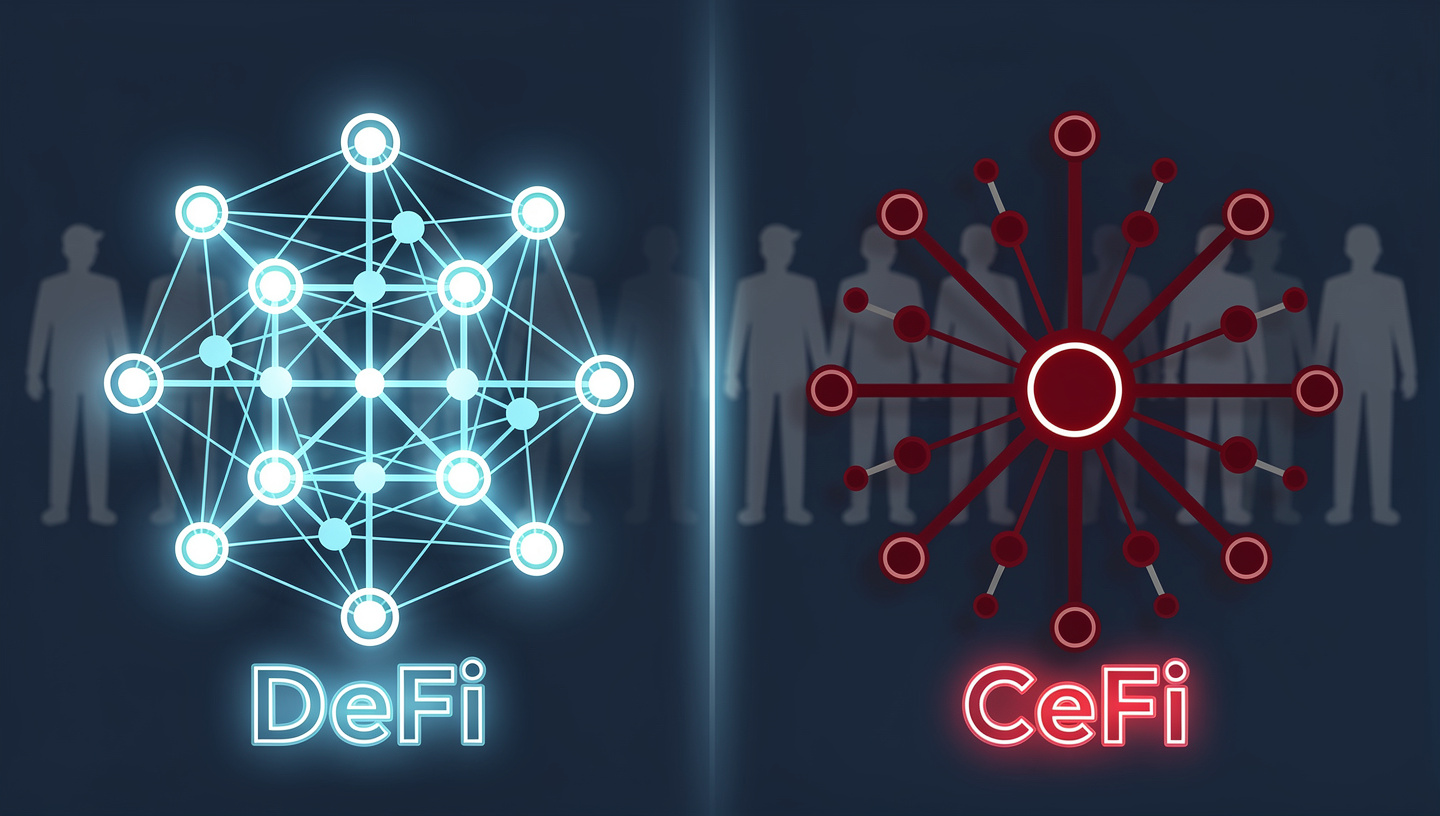

What CeFi Actually Is

Centralized Finance (CeFi) refers to financial services where custody, execution, and risk management are controlled by a centralized legal entity. This includes:

- Centralized exchanges (Binance, Coinbase, OKX)

- Crypto lending desks

- Custodial staking providers

- Prime brokers and OTC desks

The defining feature is not “centralization” as a vague concept, but institutional discretion. CeFi entities can:

- Freeze assets

- Reverse transactions

- Modify risk parameters

- Comply with legal directives

CeFi is finance with human override.

What DeFi Actually Is

Decentralized Finance (DeFi) consists of non-custodial financial protocols deployed on blockchains, where:

- Users retain control of private keys

- Transactions are executed via smart contracts

- Rules are enforced deterministically by code

Examples include:

- AMMs (Uniswap, Curve)

- Lending protocols (Aave, Compound)

- Derivatives (dYdX, GMX)

- Stablecoin systems (MakerDAO)

DeFi is finance with no discretionary layer. The system does exactly what the code specifies—nothing more, nothing less.

Liquidity: Depth, Efficiency, and Cost of Capital

Liquidity is the bloodstream of finance. Without it, all other metrics are irrelevant.

Absolute Liquidity: CeFi Still Dominates

From a raw volume perspective, CeFi remains dominant.

- Centralized exchanges routinely process 10–50x more daily volume than all DeFi DEXs combined during normal market conditions.

- Order-book depth in CeFi enables large block trades with minimal slippage, something most DeFi protocols cannot yet support natively.

This is not accidental. CeFi aggregates liquidity through:

- Market makers with balance sheets

- Off-chain netting

- Latency-optimized infrastructure

In pure size, CeFi wins.

Liquidity Efficiency: DeFi’s Silent Advantage

However, raw liquidity is not the same as liquidity efficiency.

DeFi protocols often exhibit:

- Higher capital utilization ratios

- Continuous liquidity provisioning (24/7, no market hours)

- No minimum account sizes

- Permissionless access to global capital

An Automated Market Maker does not need to attract counterparties simultaneously. It monetizes idle capital continuously.

Empirically, many DeFi pools generate higher fee yield per dollar of liquidity than centralized order books, especially during volatility spikes.

CeFi concentrates liquidity. DeFi recycles it.

Transparency: Information Symmetry vs. Information Privilege

CeFi: Opaque by Design

In CeFi, users operate under information asymmetry:

- Balance sheets are private

- Risk exposures are disclosed selectively

- Reserves are often unverifiable in real time

Even with proof-of-reserves initiatives, liabilities remain opaque. Users must trust management, auditors, and regulators.

This trust is not free—it is priced into spreads, fees, and systemic risk.

DeFi: Radical Transparency (With a Cost)

DeFi operates in a state of total observability:

- Every position is visible on-chain

- Liquidation thresholds are public

- Collateral ratios are auditable in real time

This transparency dramatically reduces hidden leverage and fraud risk. However, it introduces a new dynamic: reflexive risk.

Because everyone can see everything:

- Liquidations can cascade

- Arbitrageurs front-run distressed positions

- Markets react faster—but also more violently

DeFi replaces trust risk with execution risk.

Risk Models: Discretionary vs. Deterministic Failure

CeFi Risk: Human Judgment and Black Swans

CeFi risk is shaped by:

- Credit committees

- Risk officers

- Policy exceptions

- Emergency interventions

This allows flexibility—but also creates tail risk opacity.

Historically, most CeFi failures are not due to market volatility, but to:

- Excessive leverage

- Mismatched durations

- Undisclosed counterparty exposure

- Governance failure

When CeFi breaks, it breaks suddenly.

DeFi Risk: Mechanical, Predictable, Brutal

DeFi protocols fail differently.

Risks are:

- Smart contract bugs

- Oracle manipulation

- Liquidity exhaustion

- Economic exploits

The key distinction: DeFi failures are usually visible before they occur. The system does not lie. If parameters are fragile, the chain will reveal it.

DeFi does not hide risk. It prices it in real time.

Capital Velocity: How Fast Value Moves

Capital velocity measures how efficiently a system reallocates capital to productive use.

CeFi: Friction-Heavy but Stable

CeFi capital flow is constrained by:

- KYC/AML procedures

- Settlement delays

- Jurisdictional barriers

- Banking rails

These frictions slow velocity but increase predictability. Institutions value this stability.

DeFi: Near-Zero Friction, High Reflexivity

DeFi enables:

- Instant settlement

- Composability across protocols

- Atomic execution

- Global accessibility

Capital moves faster in DeFi than any financial system in history. However, speed amplifies reflexivity. Capital can leave just as quickly as it arrives.

Velocity without stability creates volatility.

Regulation: External Constraint vs. Embedded Rule Sets

CeFi: Regulation as a Structural Feature

CeFi operates within regulatory frameworks. Compliance is not optional—it is foundational.

This grants:

- Legal enforceability

- Consumer protection mechanisms

- Institutional legitimacy

But it also imposes:

- Geographic fragmentation

- Innovation latency

- Political risk

DeFi: Regulation by Architecture

DeFi does not reject rules—it embeds them in code.

Instead of:

- Regulators → institutions → users

DeFi uses:

- Protocol constraints → user behavior

This creates a parallel legal-economic system where compliance is enforced algorithmically, not bureaucratically.

Whether states tolerate this long-term remains an open question—but architecturally, DeFi does not need permission to function.

Cost Structures: Who Pays, and When

CeFi costs are:

- Explicit (fees, spreads)

- Implicit (counterparty risk, custody risk)

DeFi costs are:

- Gas fees

- Slippage

- Smart contract risk premiums

Over time, data shows:

- DeFi fees compress aggressively in competitive environments

- CeFi fees remain sticky due to regulatory moats

Cost minimization favors systems without intermediaries.

User Sovereignty vs. User Responsibility

CeFi optimizes for user convenience:

- Password resets

- Customer support

- Insurance programs

DeFi optimizes for user sovereignty:

- Self-custody

- No account recovery

- No protection from mistakes

Data indicates that most capital prefers convenience, but most innovation emerges from sovereignty-maximal systems.

This is not a moral statement. It is an economic observation.

The Data’s Verdict: Not DeFi or CeFi, but Layered Finance

The evidence does not support a zero-sum conclusion.

- CeFi excels at scale, compliance, and capital aggregation

- DeFi excels at transparency, efficiency, and innovation velocity

Historically, financial systems do not replace one another—they stack.

Just as:

- The internet did not eliminate enterprises

- Databases did not eliminate paper contracts

DeFi is not here to destroy CeFi. It is here to absorb its most inefficient components.

The future is hybrid:

- CeFi interfaces

- DeFi settlement layers

- On-chain transparency with off-chain governance

Finance evolves by subtraction of friction.

The Market Will Decide, Not Ideology

Decentralization is not a religion. Centralization is not evil. They are engineering trade-offs.

Markets do not reward narratives. They reward systems that:

- Allocate capital efficiently

- Survive stress

- Minimize trust assumptions

- Scale without fragility

DeFi is still young, volatile, and unforgiving. CeFi is mature, regulated, and strategically constrained.

The data suggests one conclusion with clarity:

Finance is migrating from discretion to determinism, from opacity to verifiability, from trust to computation.

Not because it is fashionable—but because it works.

In finance, what works eventually wins.