Crypto markets like to present themselves as brutally fair. Code is open. Ledgers are public. Anyone can buy, sell, or build. Yet beneath this rhetoric of neutrality lies a structural divide that quietly determines outcomes long before a token ever reaches a retail wallet: how the token is launched.

“Fair launch” and “VC-backed” are not just fundraising labels. They are economic architectures. They define who bears risk, who captures upside, how price discovery unfolds, and whether a network’s monetary credibility compounds over time or decays under hidden supply pressure. In traditional capital markets, these questions are handled through regulation and disclosure. In crypto, they are handled—often poorly—by Twitter threads, Discord rumors, and post-hoc outrage.

This article strips away ideology and sentiment. Using empirical patterns observed across multiple market cycles, it examines how fair-launched tokens and VC-backed tokens actually behave—in liquidity, volatility, drawdowns, survivorship, and long-term value capture. The goal is not to glorify one model or demonize the other, but to establish a clear-eyed, data-driven framework for investors who prefer reality over narrative.

Defining the Two Models Precisely (No Marketing Spin)

What “Fair Launch” Really Means

A fair launch, in its strict sense, implies:

- No pre-mine or negligible pre-allocation

- No preferential pricing for insiders

- No private or seed rounds with discounted tokens

- Public participation from genesis or near-genesis

- Transparent and predictable emission schedule

Bitcoin remains the canonical example. No early allocations. No VC cap table. No foundation quietly warehousing supply. Ethereum’s early sale complicates the definition, but its relatively broad initial distribution and lack of venture-style lockups place it closer to fair-launch economics than most modern tokens.

In practice, many projects claim fair launch while embedding subtle asymmetries: insider mining advantages, early access liquidity pools, or governance capture via non-token mechanisms. For analytical rigor, those hybrids are excluded here.

What “VC-Backed Token” Actually Entails

A VC-backed token typically includes:

- Seed, private, and strategic rounds at steep discounts

- Token allocations to funds, founders, and advisors

- Vesting schedules with cliffs and linear unlocks

- A public sale or exchange listing at a significantly higher implied valuation

From a corporate finance perspective, this resembles a pre-IPO company listing its equity on a public market—except without GAAP accounting, audited disclosures, or legal recourse for minority holders.

The defining characteristic is asymmetric entry price. Insiders buy at cents. The public buys at dollars. Everything else flows from that single fact.

Capital Formation vs Monetary Credibility

VC-backed advocates argue, with some justification, that capital accelerates development. Teams can hire faster, ship sooner, and pursue complex technical roadmaps. This is often true.

What is less discussed is the monetary cost of that acceleration.

A token is not merely a fundraising instrument; it is a monetary good within its own micro-economy. When large tranches are created at artificially low prices, the system embeds a latent sell pressure that persists for years. Vesting schedules do not eliminate this pressure; they merely delay it.

Fair launches invert this dynamic. Development is slower. Resources are scarcer. But the asset begins life without an overhang of discounted supply. Price discovery is harsher but cleaner. Volatility reflects genuine disagreement among market participants—not the mechanical unwind of private allocations.

Over long horizons, monetary credibility compounds. Once lost, it is rarely recovered.

Price Performance: What the Data Repeatedly Shows

Across the 2017, 2020–2021, and post-2022 cycles, several consistent patterns emerge.

Initial Returns: VC Tokens Win Early

In the first weeks to months after listing, VC-backed tokens often outperform. Aggressive market-making, coordinated announcements, and thin circulating supply create the illusion of explosive demand. Fully diluted valuations (FDV) expand rapidly, even as actual float remains minimal.

Retail participants interpret price appreciation as validation. In reality, they are often trading against artificially constrained supply.

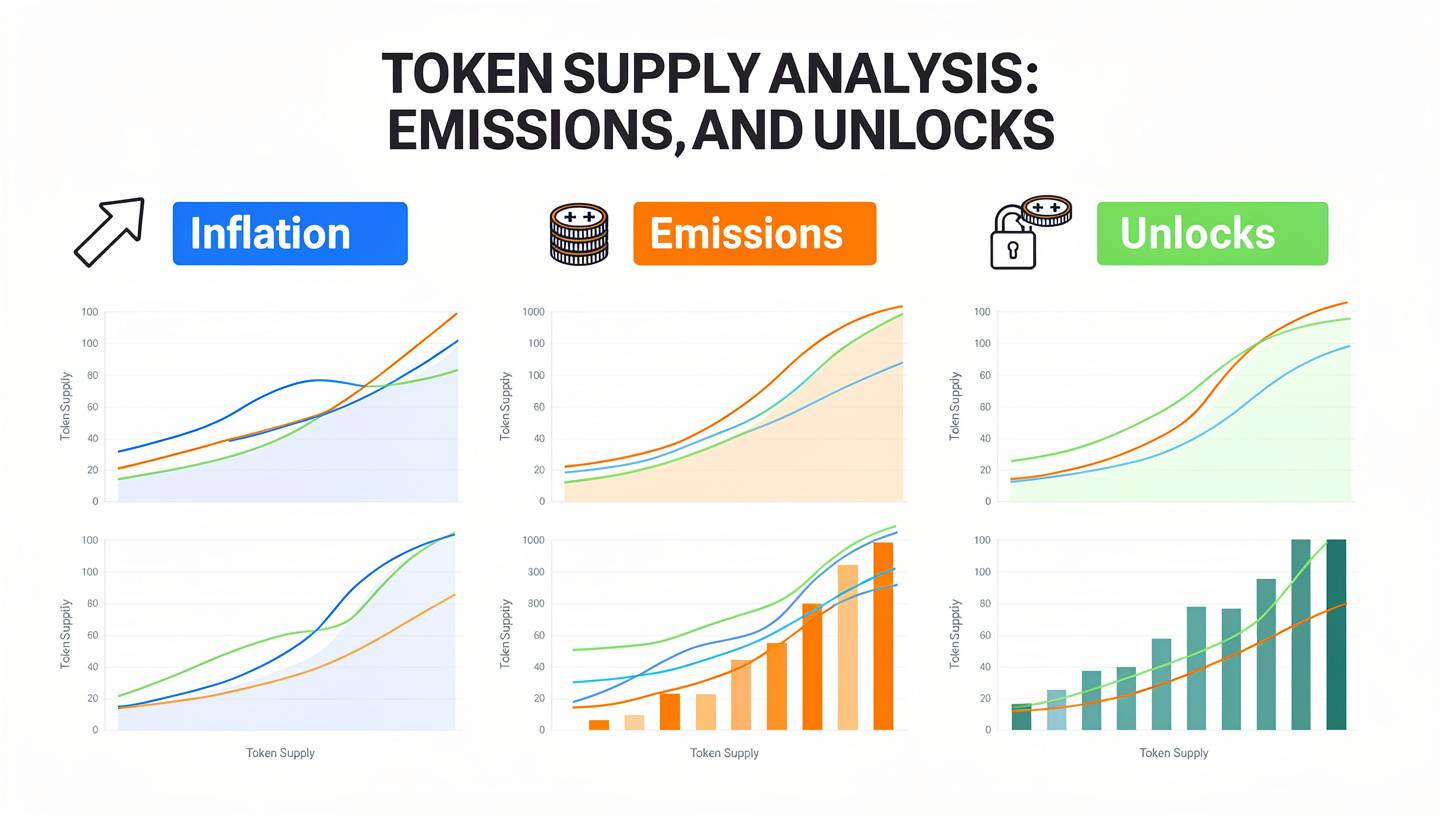

Medium-Term Reality: Unlocks Change the Regime

As vesting cliffs pass, market structure shifts. Circulating supply increases faster than organic demand. Volatility rises. Rallies are sold into. The asset enters a regime of persistent underperformance relative to its earlier peak.

Empirically, many VC-backed tokens experience:

- 70–95% drawdowns from all-time highs

- Multiple failed recovery attempts around unlock dates

- Long periods of price stagnation despite continued development

This is not a failure of technology. It is a failure of token economics.

Long-Term Survivorship: Fair Launches Dominate

When measured over multi-year horizons, a disproportionate share of surviving, high-market-cap crypto assets exhibit fair-launch or near-fair-launch characteristics. They attract long-term holders rather than transient liquidity. Their supply narratives are simple, legible, and credible.

Markets do not reward perfection. They reward trust minimization.

Liquidity, Volatility, and the Myth of Stability

VC-backed tokens often appear more “stable” early on. This stability is manufactured.

- Professional market makers smooth order books

- Foundations subsidize liquidity

- Volatility is suppressed until distribution objectives are met

Once these supports are withdrawn, true volatility asserts itself—often violently.

Fair-launched assets, by contrast, experience volatility immediately. There is no illusion of stability. Weak hands exit early. Strong hands accumulate. Over time, volatility declines organically as ownership concentrates among conviction holders.

This path is psychologically difficult but structurally sound.

Governance and the Illusion of Decentralization

On-chain governance tokens are frequently marketed as instruments of decentralization. Yet in VC-backed systems, voting power is often concentrated among the very entities that acquired tokens at the lowest cost.

This creates a paradox:

- Retail provides exit liquidity

- Insiders retain control

- Governance outcomes favor capital preservation over monetary integrity

Fair-launch systems are not immune to capture, but the cost of capture is materially higher. Accumulation must occur in the open market, at market prices, over time. This friction matters.

Decentralization is not a slogan. It is an economic property.

Incentive Alignment: Builders vs Holders

VC-backed models optimize for:

- Milestone-based fundraising

- Narrative-driven valuation expansion

- Exit opportunities tied to unlock schedules

Fair-launch models optimize for:

- Network usage

- Fee generation

- Long-term appreciation of a scarce asset

Neither guarantees success. But only one aligns builders with holders over decades rather than quarters.

A Framework for Rational Evaluation

Rather than choosing sides, sophisticated investors should ask:

- What percentage of supply was acquired below market price?

- What is the unlock schedule, and how does it compare to organic demand growth?

- Who controls governance today—and who will control it after full dilution?

- Does the token need perpetual narrative support, or does it derive value from usage and scarcity?

These questions matter more than whitepaper prose or venture brand names.

Conclusion: Markets Eventually Price Structure

Crypto is often described as immature. In truth, it is merely unforgiving. It exposes structural weaknesses faster and more brutally than traditional markets.

Fair launches sacrifice speed for credibility. VC-backed tokens sacrifice credibility for speed. Over short horizons, speed wins. Over long horizons, credibility compounds.

This is not ideology. It is capital markets logic applied to a new domain.

Invest accordingly.