In crypto, everyone talks about speed.

Fast block times.

Fast trades.

Fast money.

Fast exits.

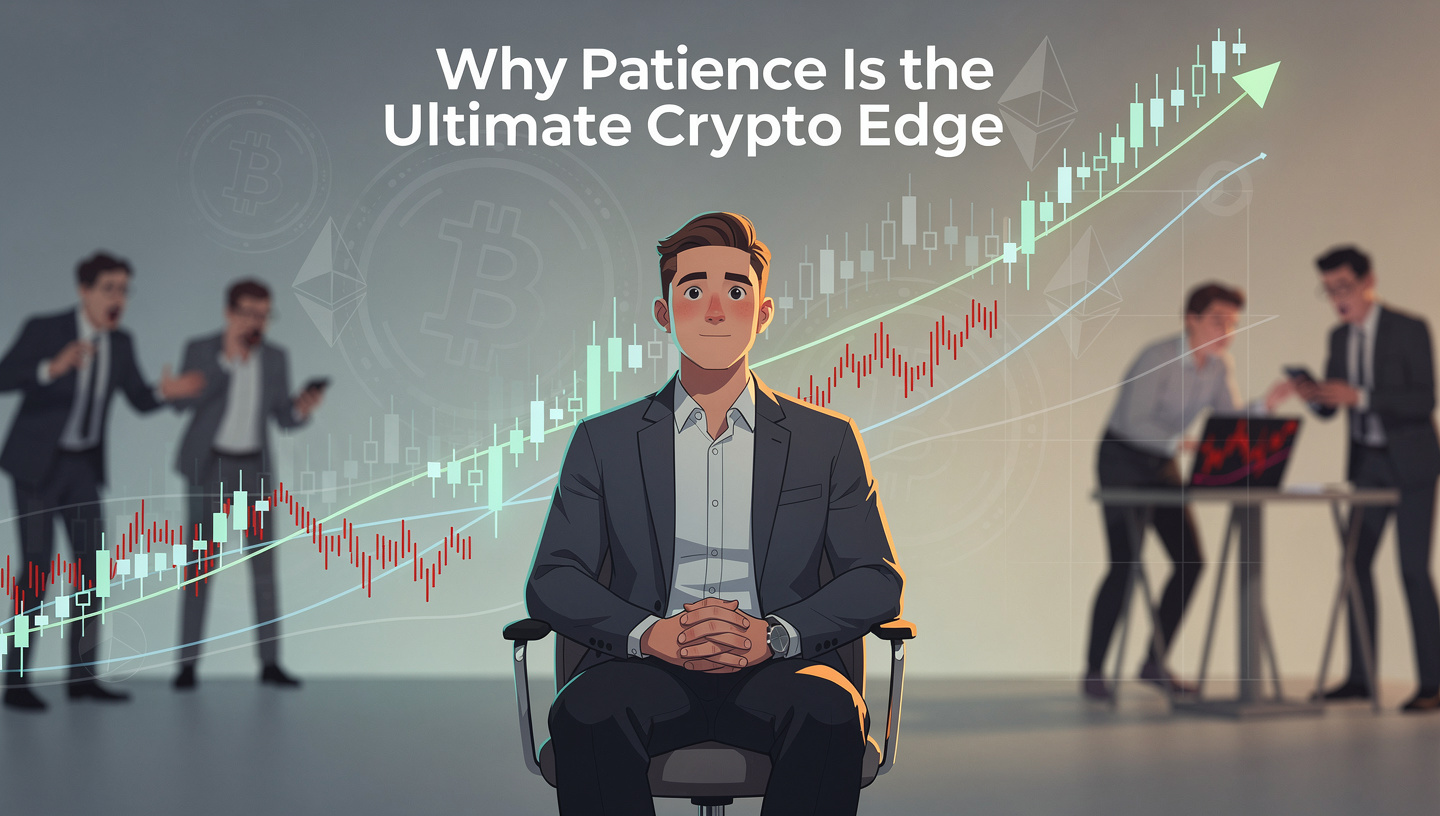

The culture celebrates the person who was “early,” the trader who “aped in,” the founder who “shipped fast and broke things.” Twitter rewards instant reactions. Discord rewards constant presence. Charts refresh every second, daring you to do something.

And yet—quietly, consistently, almost invisibly—the biggest winners in crypto tend to share one unsexy trait:

Patience.

Not patience as in laziness.

Not patience as in “do nothing forever.”

But patience as a deliberate, strategic advantage—one that compounds harder than leverage and survives longer than hype.

In a market obsessed with movement, patience is the rarest edge of all.

Crypto Is a Machine Designed to Steal Impatience

Crypto markets don’t just reward impatience.

They actively extract value from it.

Every element of the ecosystem is optimized for this:

- 24/7 trading with no cooldown

- Extreme volatility that triggers emotion

- Constant news cycles, narratives, and mini-crises

- Tokens that can move 30% in an hour

- Social feeds engineered to amplify FOMO and fear

Traditional markets close. Crypto never sleeps. That’s not a feature—it’s a psychological trap.

The impatient trader:

- Overtrades

- Chases pumps

- Panic sells dips

- Buys narratives at peak excitement

- Sells fundamentals at peak despair

Meanwhile, the patient participant often does something radical:

Nothing.

And somehow, over time, that “nothing” becomes everything.

Why Most People Lose Money Even When They’re Right

One of the cruelest truths in crypto is this:

You can be right about the asset and still lose money.

People called Bitcoin revolutionary in 2013… and sold in 2014.

They believed in Ethereum in 2017… and capitulated in 2018.

They understood DeFi in 2020… and round-tripped everything in 2021.

The problem wasn’t thesis.

The problem was time horizon.

Crypto rewards people who can sit through:

- Boredom

- Drawdowns

- Being ignored

- Being mocked

- Being “wrong” longer than feels reasonable

Impatience turns volatility into pain.

Patience turns volatility into opportunity.

The Market’s Favorite Trick: Forcing You to Act

Most bad crypto decisions aren’t made because of bad logic.

They’re made because of emotional urgency.

The chart is moving.

Your friend just made money.

Twitter says something is “about to explode.”

Your position is down 20%.

Your portfolio looks smaller than yesterday.

So you act—not because you should, but because doing nothing feels unbearable.

But markets don’t punish ignorance nearly as much as they punish compulsion.

Patience is the ability to say:

- “I don’t need to trade this.”

- “I don’t need to respond to every candle.”

- “I don’t need to monetize every idea immediately.”

That restraint alone puts you ahead of most participants.

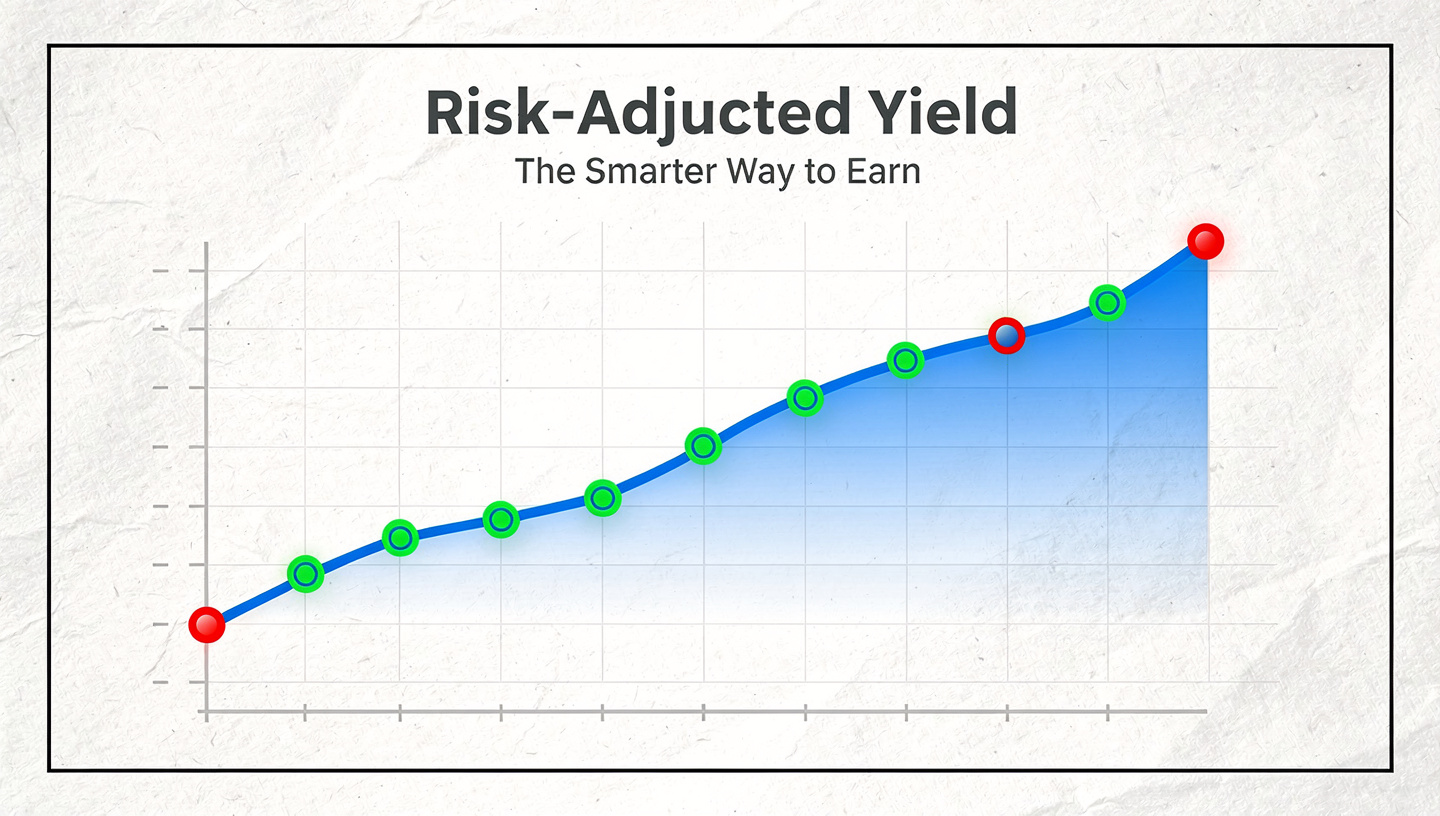

Time Is the Only True Asymmetric Advantage

In crypto, information spreads fast. Capital moves fast. Code forks instantly.

What doesn’t distribute evenly?

Time.

People underestimate how asymmetric time really is.

Someone who can hold a strong asset for:

- 3 years instead of 3 months

- 1 cycle instead of 1 narrative

- Multiple winters instead of one bull run

…is playing a fundamentally different game.

Time filters:

- Weak hands

- Overleveraged players

- Unsustainable projects

- Shallow narratives

Patience lets you benefit from survivorship—the quiet but powerful force that rewards whatever remains standing after chaos.

Builders Understand This Before Traders Do

The best builders in crypto don’t obsess over price.

They obsess over:

- Shipping

- Iteration

- Developer adoption

- Community trust

- Long-term incentives

They know something traders often forget:

Real value compounds slowly, then suddenly.

Infrastructure doesn’t explode overnight.

Protocols don’t mature in one cycle.

Trust doesn’t form in a week.

Patient builders survive long enough to look lucky.

And patient investors often win by simply aligning themselves with people who are willing to stay when others leave.

Why Bear Markets Are a Patience Stress Test

Bull markets reward activity.

Bear markets reward endurance.

During down-only periods:

- Volume disappears

- Attention vanishes

- Influencers go silent

- Prices grind sideways for months

This is where impatience gets punished the hardest.

People:

- Abandon solid projects because “nothing is happening”

- Sell near bottoms out of boredom

- Rotate endlessly, hoping something moves

- Quit entirely, promising to “come back later”

Patience during bears isn’t about optimism.

It’s about staying rational when stimulation is gone.

Those who remain don’t just survive—they gain:

- Better entry prices

- Deeper understanding

- Stronger conviction

- Less emotional baggage

The Hidden Cost of Constant Action

Every trade has a visible cost:

- Fees

- Slippage

- Taxes

But impatience has invisible costs:

- Mental fatigue

- Decision paralysis

- Loss of conviction

- Narrative hopping

- Burnout

Constant action fragments attention.

You stop learning deeply.

You stop thinking long-term.

You stop seeing the big picture.

Patience consolidates focus.

It allows you to:

- Study fundamentals

- Observe market cycles

- Learn from others’ mistakes

- Let probability work in your favor

Sometimes the most profitable move is protecting your mental capital.

Conviction Is Built Through Time, Not Tweets

Conviction doesn’t come from a thread with 10k likes.

It comes from:

- Reading docs repeatedly

- Watching teams ship quietly

- Seeing a protocol survive stress

- Understanding why something exists, not just what it does

This takes time.

Impatient participants outsource conviction to influencers.

Patient participants build it internally.

And when volatility hits, that difference is everything.

Patience Turns Luck Into Strategy

Plenty of people get lucky in crypto.

Very few keep it.

Patience is what converts:

- One good trade into a portfolio

- One cycle into generational wealth

- One insight into a long-term edge

It allows you to:

- Scale positions slowly

- Exit thoughtfully

- Avoid catastrophic mistakes

- Learn without blowing up

Luck fades.

Process endures.

Doing Less Is Not Doing Nothing

Patience isn’t passive.

It’s selective.

It means:

- Fewer trades, higher quality

- Fewer bets, deeper understanding

- Less noise, more signal

It means knowing when not to act.

In crypto, restraint is a form of intelligence.

The Quiet Superpower No One Brags About

No one tweets:

“I didn’t trade today and nothing bad happened.”

No one posts charts of positions they didn’t touch.

Patience doesn’t look impressive in real time.

It looks obvious in hindsight.

Years later, people say:

- “They were early.”

- “They got lucky.”

- “They had conviction.”

What they really had was the ability to wait.

Final Thought: The Market Can’t Take What You Don’t Give

Crypto will test you relentlessly:

- With volatility

- With temptation

- With fear

- With boredom

You don’t need to win every day.

You don’t need to react to everything.

You don’t need to prove you’re smart every hour.

The market can only extract value from you if you hand it over.