Cryptocurrency is fascinating. It is global, fast, open 24/7, and driven by breakthrough technology. It is also volatile, emotionally demanding, and unforgiving when mistakes happen.

Many people focus on how to make money in crypto.

Far fewer learn how to protect themselves from losing it.

Risk management is the foundation of long-term survival in any market — and cryptocurrency requires even greater discipline than traditional assets. Whether you follow prices out of curiosity, study the technology, or plan to invest in the future once you are legally able to do so, understanding risk management now will help you think like a professional.

This guide will walk through the key concepts.

1. Understand the Nature of Crypto Risk

Before talking about strategies, it is important to recognize what makes crypto uniquely risky.

1.1. Extreme price volatility

Prices can rise or fall 20–50% in days — sometimes hours. This level of volatility is exciting on the way up and emotionally painful on the way down.

Volatility means:

- Big gains are possible

- Big losses are equally possible

- Short-term predictions are unreliable

If you treat volatility like a game, the market will eventually teach you why it isn’t.

1.2. Technology and security risks

Cryptocurrency is software. Software can fail.

Common technology-related risks include:

- Bugs in smart contracts

- Protocol hacks or exploits

- Wallet mistakes (lost passwords, sending to the wrong address)

- Centralized services collapsing or being attacked

Unlike a bank, crypto typically has no customer support line that can reverse transactions.

1.3. Regulatory uncertainty

Governments are still working out how to regulate digital assets. Rules can change quickly. New laws can affect:

- Taxes

- Trading environments

- Which platforms are allowed to operate

- Whether certain tokens are considered securities

Uncertainty = risk.

1.4. Human psychology

Markets are driven by fear and greed. Social media hype, rumors, and “fear of missing out” pressure people to act impulsively.

Good risk management starts by assuming:

“I am not immune to emotional mistakes.”

2. Adopt the Right Mindset

Risk management is not about eliminating risk.

That is impossible.

It is about controlling exposure, staying rational, and protecting yourself from outcomes that could cause long-term harm.

Professional investors think in terms of:

- Probabilities

- Scenarios

- Consequences

- Time horizons

They ask:

“If I’m wrong, what happens to me?”

That question is the heart of risk management.

3. Never Risk Money You Cannot Afford to Lose

This is the most important rule in all of cryptocurrency.

Money that is needed for:

- Rent

- Food

- Education

- Healthcare

- Family responsibilities

should never be placed into speculative markets.

Crypto is optional. It is not necessary to live, study, or build your future.

Treat speculative capital as “risk capital” — and assume there is a real possibility that it can disappear.

4. Diversify Thoughtfully (But Not Blindly)

Diversification spreads risk across multiple assets. However, not all diversification is meaningful.

True diversification vs. fake diversification

Holding 20 tokens that all depend on the same narrative — for example, “gaming tokens” or “AI tokens” — is not real diversification. If that narrative fails, they may all decline together.

Stronger diversification considers different types of risk:

- Large, established assets vs. newer, experimental ones

- Different use-cases (payments, infrastructure, applications)

- Exposure across multiple blockchains and ecosystems

But diversification has limits. Owning too many assets becomes difficult to monitor and understand.

5. Position Sizing: The Quiet Superpower

Position sizing is deciding how much to allocate to any single asset.

Even excellent ideas can go wrong. Position sizing protects you when they do.

A disciplined approach might include thinking in tiers:

- Core positions: assets with stronger fundamentals and history — conservative allocations

- Satellite positions: higher-risk experiments — smaller allocations

The idea is simple:

A single bad decision should never threaten your entire portfolio.

6. Avoid Leverage and Highly Speculative Products

Leverage multiplies gains — and multiplies losses faster.

Many people discover this painfully.

In traditional markets, leverage is typically reserved for trained professionals. In crypto, it is marketed casually — which makes it dangerous.

Products like:

- High-leverage derivatives

- Complex yield schemes

- “Guaranteed” returns

carry risks that can wipe out accounts quickly. For young learners in particular, the safest approach is to avoid them entirely and focus on understanding the technology instead.

7. Plan Before You Act

Risk increases when decisions are impulsive.

Before entering any position (now or in the future), professionals write down:

- Why they are interested

- What would prove them wrong

- How long they plan to hold

- The level of loss they are willing to tolerate

This is often called a trading or investment plan.

A plan helps prevent emotional panicking during volatility because the rules are defined in advance.

8. Security Hygiene: Protecting Yourself from Theft

Many losses in crypto occur not from price drops but from security failures.

Key principles include:

- Be skeptical of links and messages promising rewards

- Avoid sharing private keys or recovery phrases with anyone

- Double-check addresses carefully before sending

- Prefer reputable, transparent platforms when interacting with services

- Back up recovery phrases offline and store them safely

The strongest technology cannot protect someone who clicks the wrong link.

Security is a personal responsibility.

9. Beware of Scams and Unrealistic Promises

If something sounds “risk-free” or “guaranteed,” it is almost always fraudulent.

Common red flags:

- Pressure to act immediately

- Secret strategies or “inside information”

- Promises of fixed high returns

- Requests for personal keys

- Celebrity endorsements with no substance

Healthy skepticism is part of risk management.

10. Control Emotions with Structure

Markets will test your patience, confidence, and discipline.

Tools that help:

- Predefined plans and limits

- Slower decision-making — avoid acting instantly

- Journaling trades and lessons learned

- Limiting how often you check prices

You cannot remove emotion, but you can reduce the damage it causes.

11. Think Long Term

Short-term speculation is largely luck.

Long-term thinking emphasizes:

- Understanding technology trends

- Studying real adoption

- Observing developer activity

- Assessing whether a project solves meaningful problems

Time is one of the most powerful risk-management tools when paired with strong fundamentals.

12. Learn Before You Risk Anything

Education reduces avoidable mistakes.

Areas worth studying:

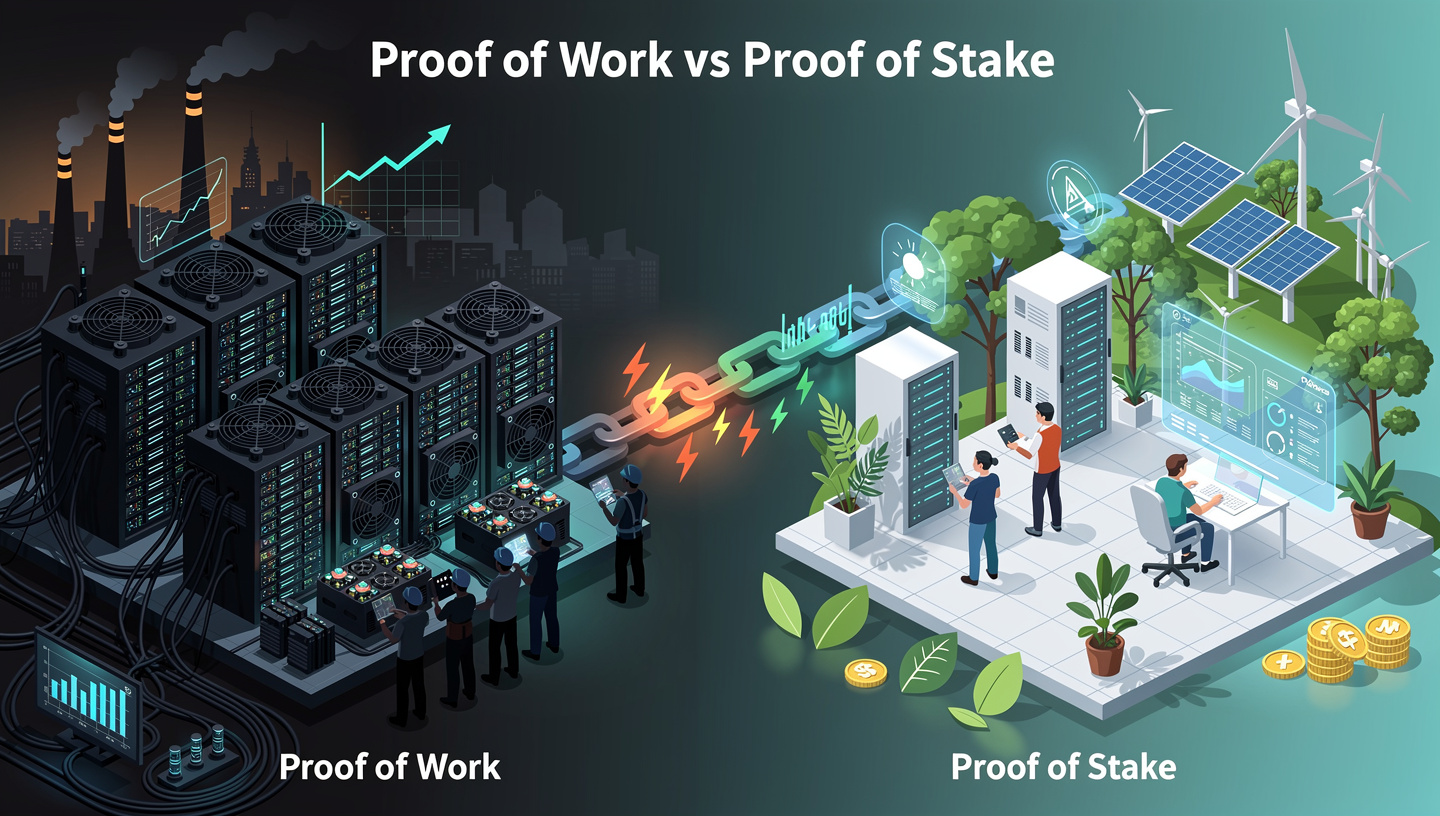

- How blockchains work

- Wallets and keys

- Basic economics of supply and demand

- How scams operate

- Tax and legal frameworks in your country (when you are of legal age)

The more you understand, the less likely you are to be surprised.

13. Accept That Losses Are Part of the Journey

Even the best investors experience losing trades.

Risk management does not prevent losses.

It ensures losses are:

- Manageable

- Expected

- Part of the process — not catastrophic events

If a single mistake can ruin everything, the strategy is flawed.

14. A Simple Framework for Thinking About Risk

When evaluating any cryptocurrency opportunity, ask:

- What problem does this project solve?

- Who is building it and what is their track record?

- How could this fail? (technical, regulatory, market reasons)

- What happens if I’m wrong?

- Does this fit within my overall allocation?

If you cannot answer these questions clearly, risk is higher than it appears.

Final Thoughts

Cryptocurrency offers innovation, experimentation, and opportunity — but it demands maturity and caution. Risk management is not optional. It is the discipline that separates temporary speculation from sustainable participation.

If you treat risk with respect — learn patiently, think in probabilities, protect yourself from avoidable mistakes — you will approach the crypto ecosystem with a professional mindset, even before you ever place a single trade.