Cryptocurrency was supposed to make money move freely — fast, global, and inexpensive. So, if blockchain is “decentralized” and there is no bank in the middle, why do you still have to pay fees every time you send crypto, mint an NFT, or interact with a smart contract?

Those fees have a name: gas.

Gas fees are one of the most misunderstood parts of crypto. People complain about them, joke about them, rage-quit projects because of them — and yet gas is essential to how blockchains stay secure, fair, and operational.

In this article, we’ll unpack gas from the ground up:

- What gas actually is (and what it is not)

- How miners/validators earn gas

- Why fees rise and fall

- Why different blockchains charge different amounts

- How wallets estimate gas

- How to avoid overpaying

- And what the future of gas might look like

By the end, gas will feel far less mysterious — and much more logical.

What “gas” really means

Let’s start with a simple truth:

Gas is not a product. Gas is a pricing mechanism.

You are not “buying” gas like fuel for a car. Instead, gas is the unit used to measure the computational work required to process your transaction on a blockchain.

Every action requires work:

- Sending ETH

- Swapping tokens

- Minting NFTs

- Running a DeFi trade

- Executing a smart contract function

Blockchains like Ethereum track that work using small units — called gas units.

Think of it like paying for electricity. Electricity companies bill based on kilowatt-hours. You are paying for the usage of the network’s resources.

On a blockchain, you pay gas for using:

- Validator/miner computation

- Storage capacity

- Network bandwidth

Without fees, people could spam the network endlessly. The blockchain would slow to a crawl, become unusable, and ultimately vulnerable to attack.

Gas exists to prevent that.

Who receives gas fees?

Contrary to popular belief:

You do not pay gas “to Ethereum” or “to Bitcoin.”

You pay gas to the network participants who process and validate transactions.

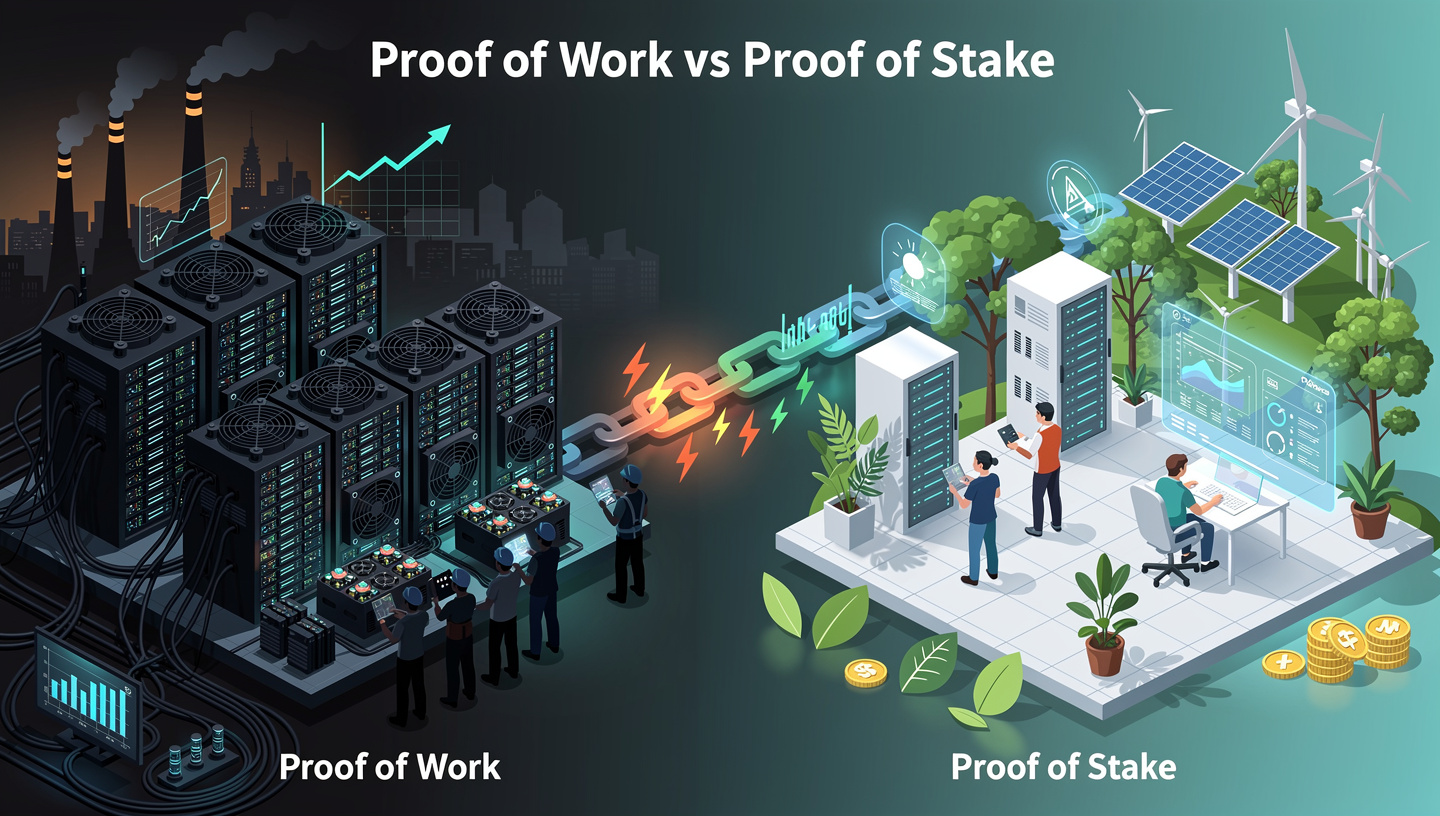

Depending on the blockchain model, that could be:

- Miners (Proof of Work)

- Validators (Proof of Stake)

They:

- Take pending transactions from the mempool

- Verify them

- Order and include them in a block

- Add that block to the blockchain

This is not charity. It is economic incentive.

Validators secure the network because they are compensated. Gas ensures:

- Security

- Fairness

- Incentive alignment

- Resource allocation

Without compensation, there would be no reason to operate expensive infrastructure.

Gas on Ethereum: base fee + priority fee

Ethereum popularized the term “gas,” so let’s look at its model.

Every Ethereum transaction requires two core components:

1. Gas units (how much work is needed)

This is determined by what your transaction is doing.

Examples:

- Simple transfer of ETH: ~21,000 gas

- Approving a token: often 40k–60k gas

- Swapping on Uniswap: 120k–200k+ gas

- Complex smart contract interactions: sometimes 300k+ gas

More complexity = more instructions = more gas units.

2. Gas price (how much you pay per unit)

Gas price is usually measured in gwei, which is a tiny fraction of ETH.

1 ETH = 1,000,000,000 gwei.

You multiply:

gas units × gas price = total fee

For example:

- 21,000 gas

- 30 gwei

21,000 × 30 gwei = 630,000 gwei

Convert to ETH:

630,000 gwei = 0.00063 ETH

If ETH is $3,000:

0.00063 ETH ≈ $1.89

That’s your fee.

Why gas spikes during busy times

Blockchains operate like highways.

When nobody is driving: smooth, cheap, fast.

When millions rush in: congestion, slowdowns, and rising costs.

Validators can only fit a limited number of transactions into each block.

When demand exceeds supply:

- Users compete

- They raise their gas price

- Validators prioritize higher-paying transactions

- Fees increase sharply

This is economics, not malfunction.

Gas becomes more expensive whenever the network is crowded:

- NFT launches

- Meme coin hype

- DeFi farming seasons

- Big price crashes

- Bull market mania

Blockchain does exactly what it was designed to do:

prioritize the transactions that users value most.

Smart contracts cost more than simple transfers

A simple transfer is only verifying ownership and updating two balances.

Smart contracts are different.

They might:

- Check multiple conditions

- Pull price data from oracles

- Interact with multiple protocols

- Trigger multiple internal calls

- Update on-chain storage repeatedly

Each operation is an instruction. Instructions require computation. Computation requires gas.

This is why:

- Swapping on Uniswap costs more than sending ETH.

- Minting NFTs costs more than receiving them.

- Deploying a contract costs far more than using one.

The blockchain is not punishing you. It is charging proportionally to resource consumption — similar to cloud computing.

Gas helps stop spam and attacks

Imagine if blockchain was free.

Anyone could:

- Send billions of junk transactions

- Flood the mempool

- Overwhelm validators

- Prevent legitimate transactions from processing

This is known as a Denial-of-Service (DoS) attack.

Gas fees act like a security shield.

If attackers want to spam, it becomes:

- Expensive

- Unsustainable

- Economically irrational

To attack, they must burn money continuously.

That is powerful economic defense.

Why different blockchains have different gas fees

Not all blockchains are built the same way.

Fees depend on:

- Architecture

- Consensus mechanism

- Block size

- Base demand

- Throughput capability

Let’s compare a few broad categories.

High-security, decentralized networks (e.g., Ethereum mainnet)

Pros:

- Strong decentralization

- High security guarantees

- Large validator base

Cons:

- Limited capacity

- Higher fees during peak demand

High-throughput chains (e.g., Solana, BSC, Avalanche, etc.)

Pros:

- Faster transaction speeds

- Typically lower fees

- High usability

Trade-offs:

- Often higher hardware requirements

- Possible centralization risks

- Different security models

Neither model is “best”.

Each chain optimizes around different goals.

Users choose based on what they value most:

- Maximum security

- Lower cost

- Speed

- Ecosystem size

There is no single perfect answer.

How wallets estimate gas — and why they are sometimes wrong

When you press “Send,” your wallet estimates how much gas is required.

Wallets rely on:

- Network history

- Current mempool activity

- Smart contract complexity

- Gas usage averages

This is probabilistic, not guaranteed.

Sometimes:

- The estimate is too low → transaction fails but still costs gas.

- The estimate is too high → you pay more than needed but succeed.

A failure still costs gas because validators still executed part of the transaction before it reverted.

That work must still be paid for.

Can gas fees ever go to zero?

Realistically? No.

Zero-fee networks usually either:

- Hide costs somewhere else (inflation, token dilution), or

- Accept spam risk and instability, or

- Centralize control so an operator silently subsidizes usage.

Blockchains that remain:

- Secure

- Public

- Permissionless

must charge something.

The goal is not zero.

The goal is:

- Predictable

- Reasonable

- Efficient

- Fairly distributed fees

Ways users can reduce gas costs (without hacks or tricks)

There is no magic. But there are strategies.

1. Use the network during low activity times

Fees vary by time zone and global habits. Off-peak windows are cheaper.

2. Use Layer-2 scaling networks

Layer-2 solutions process transactions off-chain, then settle to the main chain.

Examples include optimistic rollups and zk-rollups. They can reduce costs dramatically while keeping strong security guarantees.

3. Avoid unnecessary on-chain actions

Batch operations when possible. Think before minting, swapping repeatedly, or approving multiple times.

4. Use fee controls in wallets

Set maximum gas you are willing to pay. Some wallets allow dynamic strategies to balance cost versus speed.

The future of gas: cheaper, smarter, more efficient

Developers across ecosystems are working to make gas:

- More predictable

- Lower on average

- Less painful for users

Efforts include:

- Layer-2 scaling

- Better mempool design

- Optimized smart contracts

- Alternative fee markets

- Protocol upgrades

The direction is clear: maintain security, reduce friction.

Gas will likely never disappear — but it will feel less like a barrier and more like infrastructure cost.

Final perspective: gas is the price of decentralization

Gas fees frustrate people because they highlight a fundamental reality:

Decentralization is not free.

Running:

- Thousands of nodes

- Constant validation

- Cryptographic verification

- Open participation

- Global consensus

requires real resources. Those resources must be paid for by someone. In decentralized systems, that “someone” is the user.

When you pay gas, you are not just paying for a transaction.

You are paying for:

- Security

- Neutrality

- Censorship resistance

- Global accessibility

- A financial system that nobody controls alone

And that, ultimately, is the value proposition of blockchain itself.