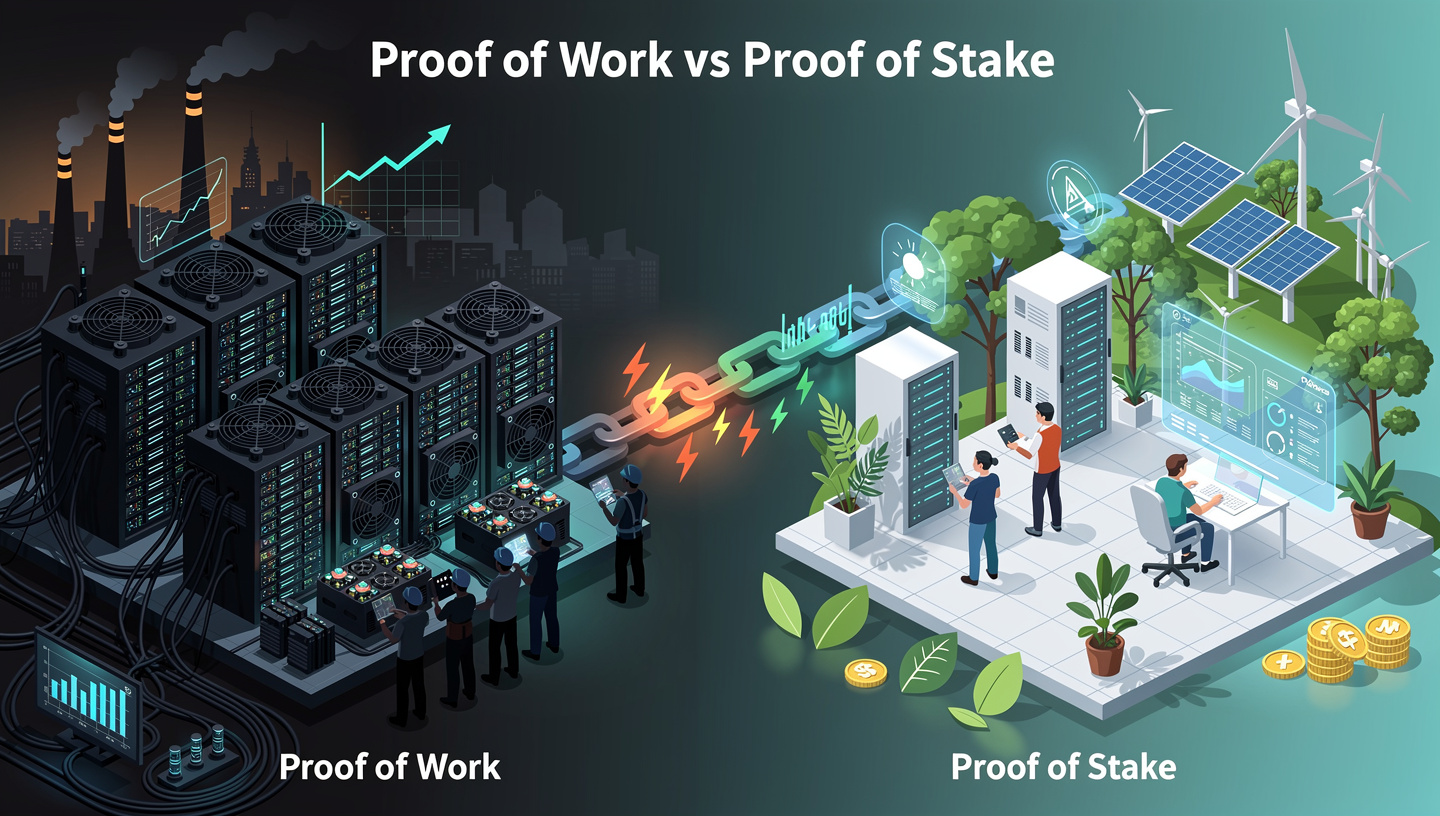

If blockchain is the engine behind cryptocurrencies, then consensus mechanisms are the laws of physics that keep that engine running. They determine who gets to add new blocks, how transactions are validated, and how the network protects itself from fraud.

Two models dominate today’s conversation:

- Proof of Work (PoW) — pioneered by Bitcoin

- Proof of Stake (PoS) — popularized by Ethereum’s major upgrade in 2022 and widely adopted by newer chains

Both systems aim to achieve the same thing:

A decentralized network where strangers can agree on what is true — without banks, governments, or centralized servers.

Yet they do so in radically different ways.

This article breaks down — clearly and realistically — how each works, where each excels, where each fails, and what the future likely holds.

1. Why Consensus Matters in the First Place

Without consensus rules, blockchain becomes chaos.

Imagine thousands of computers worldwide all keeping copies of the same ledger. At any time:

- Someone could try to spend the same coins twice

- Someone could try to rewrite history

- Someone could spam the network with fake transactions

Consensus mechanisms prevent this by enforcing:

- Order

- Fairness

- Security

They determine:

- Who proposes the next block

- How that block is verified

- What happens if someone cheats

This is where Proof of Work and Proof of Stake take different paths.

2. Proof of Work: Security Through Computation

How Proof of Work Actually Works

Proof of Work turns security into a math race.

Miners compete to solve cryptographic puzzles using specialized hardware. The puzzle is intentionally difficult, requiring significant electricity and computational power.

Steps simplified:

- Transactions are broadcast.

- Miners group them into a candidate block.

- Miners repeatedly guess numbers (nonces) until the block hash meets strict criteria.

- The first miner who solves it broadcasts the block.

- Other nodes verify the solution.

- The miner receives a block reward + transaction fees.

Why this matters:

- Cheating becomes extremely expensive.

- Rewriting history requires enormous computational power.

Advantages of Proof of Work

1. Battle-tested security

Bitcoin has run for more than a decade without compromise at the protocol level. The reason is simple:

To attack PoW, you must control more than 50% of global mining power — which costs billions.

2. Simple, transparent economics

Anyone can verify:

- Hash rate

- Difficulty

- Mining rewards

- Network security levels

The rules are predictable and public.

3. High resistance to manipulation

Because validators are tied to physical resources (hardware + electricity), control is harder to centralize through governance politics.

Disadvantages of Proof of Work

1. Energy consumption

PoW consumes large amounts of electricity. Supporters argue much of it is renewable or otherwise wasted energy. Critics argue that it scales poorly and creates environmental strain.

Both arguments have truth.

2. Slower transaction throughput

Because blocks take time to mine, PoW networks typically:

- Process fewer transactions per second

- Experience higher latency during congestion

3. Mining centralization risk

Over time:

- Industrial mining farms gained dominance

- Specialized ASIC hardware priced out hobbyists

PoW is decentralized in governance — but operationally, mining tends to cluster.

3. Proof of Stake: Security Through Ownership

How Proof of Stake Works

Proof of Stake removes mining entirely.

Instead of burning electricity, validators lock up tokens (stake). The protocol randomly selects validators to propose and validate blocks based on:

- Amount staked

- Randomization logic

- Network rules

If a validator behaves maliciously:

- Their stake can be slashed

- They lose rewards

- They may be expelled from the network

Advantages of Proof of Stake

1. Massive energy efficiency

PoS reduces energy usage by over 99% compared to PoW. No heavy hardware. No industrial mining farms.

2. Faster and more scalable

PoS networks tend to support:

- Higher transaction throughput

- Faster confirmations

- Lower fees (especially during normal usage)

3. Easier participation

Anyone with enough tokens (or through staking pools) can help secure the network. That democratizes earning opportunities — at least in theory.

Disadvantages of Proof of Stake

1. “The rich get richer”

Rewards are often proportional to stake. Large holders receive more rewards, compounding their control.

Without careful governance, PoS risks drifting toward oligopoly dynamics.

2. Attacks look different — and subtler

In PoS, power is not tied to machines — it is tied to wealth.

Potential risks include:

- Cartel behavior among large validators

- Governance capture

- Collusion to censor transactions

- Liquidity concentration through staking services

3. Slashing complexity and user risk

Staking incorrectly, choosing a bad validator, or failing uptime requirements can cause losses. The system is secure, but operational mistakes carry consequences.

4. Security: PoW vs. PoS — A Direct Comparison

| Dimension | Proof of Work | Proof of Stake |

|---|---|---|

| Primary security anchor | Physical resources (hardware + electricity) | Financial collateral (tokens) |

| Cost of attack | Enormous capital + ongoing operational cost | Large capital acquisition |

| Reversibility of attacks | Difficult, visible, expensive | Potentially easier if governance captured |

| Real-world track record | Over a decade of proven resilience | Newer, evolving, still maturing |

Neither is perfect. Each chooses different tradeoffs:

- PoW: Hard, costly, slow — but extremely robust

- PoS: Efficient, flexible — but dependent on incentives and governance

5. Decentralization: Who Really Controls the Network?

In Proof of Work

Control tends to concentrate where:

- Electricity is cheapest

- Hardware capital is high

- Industrial mining pools dominate

Yet miners cannot easily rewrite rules without full-node consensus.

In Proof of Stake

Control tends to concentrate where:

- Large token holders aggregate

- Staking pools dominate

- Custodial platforms stake on behalf of millions of users

This means PoS sometimes functions closer to financial governance than hardware-based governance.

6. Environmental Debate: Beyond Simplistic Narratives

It is easy to say:

- “PoW destroys the planet”

- “PoS is magically perfect”

Reality is far more nuanced.

PoW often uses:

- Stranded hydro

- Excess wind and solar

- Flared natural gas that would otherwise burn uselessly

PoS undeniably reduces consumption, but pushes risk into centralized staking infrastructure and complex governance mechanisms.

Both models are evolving to address weaknesses.

7. Which Is Better — PoW or PoS?

The honest answer:

It depends on what you value.

Choose Proof of Work if your priorities are:

- Maximum neutrality

- Censorship resistance

- Long-term, conservative security

Choose Proof of Stake if your priorities are:

- Efficiency

- Speed

- Lower environmental footprint

- Easier participation

Many analysts expect a world where:

- Bitcoin continues representing hard, conservative digital money

- PoS chains dominate smart contracts, DeFi, NFTs, and high-speed applications

Different tools, different jobs.

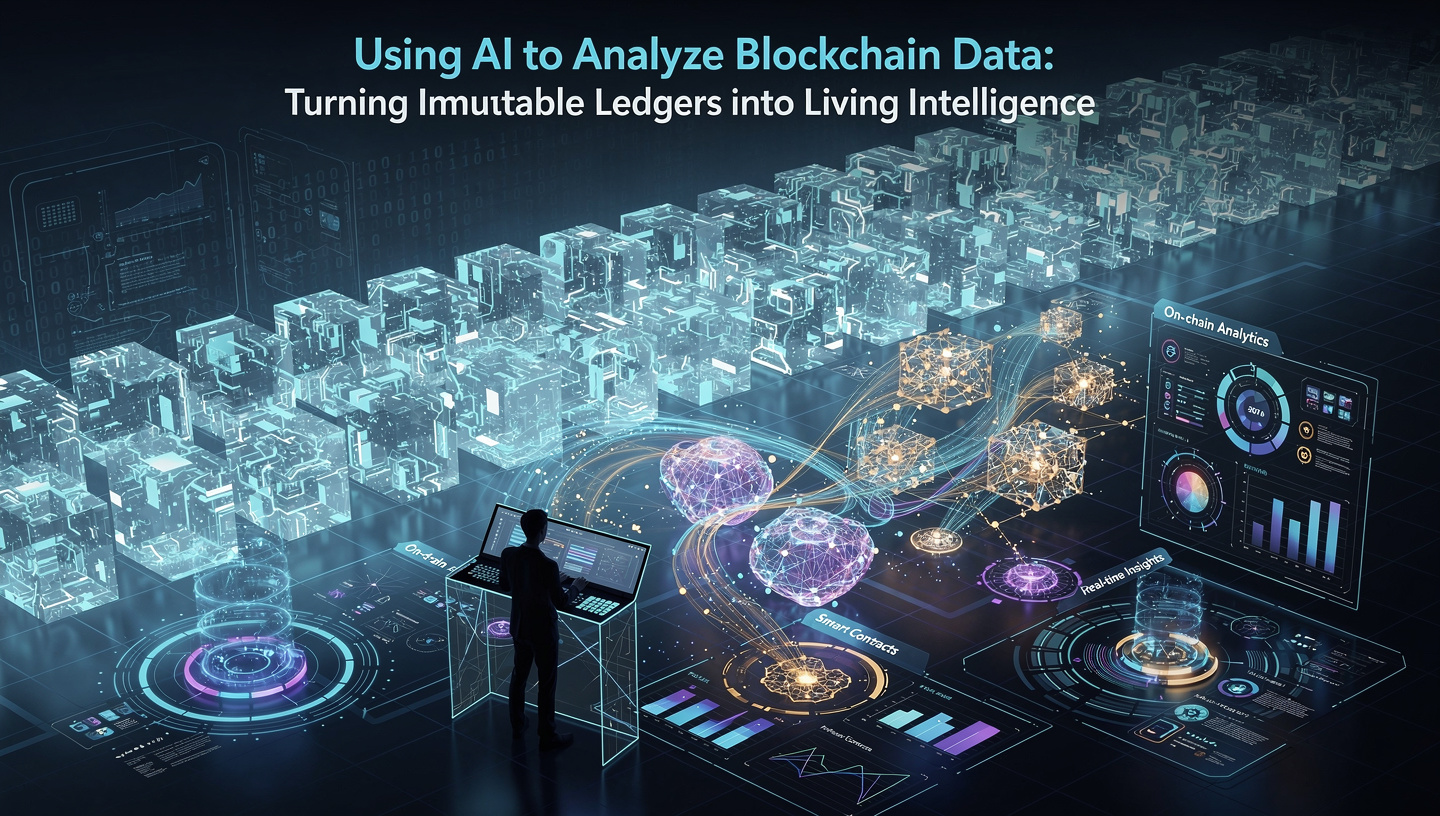

8. The Future: Hybrid and Adaptive Consensus Models

Innovation is accelerating. We are already seeing:

- Hybrid PoW/PoS systems

- Checkpointing models

- Restaking and shared security

- Rollups and modular chains layered over base networks

Consensus is no longer a binary conversation. It is becoming a portfolio of mechanisms, optimized for different use cases.

Final Thought

Proof of Work and Proof of Stake each embody a philosophy.

- PoW: Security anchored in the physical world.

- PoS: Security anchored in aligned economic incentives.

Neither is inherently “right” or “wrong.” The real challenge — and opportunity — lies in understanding the tradeoffs and deploying the right architecture for the right mission.